- AMPD Ventures (AMPD) has signed an agreement to supply Variational AI with machine learning infrastructure.

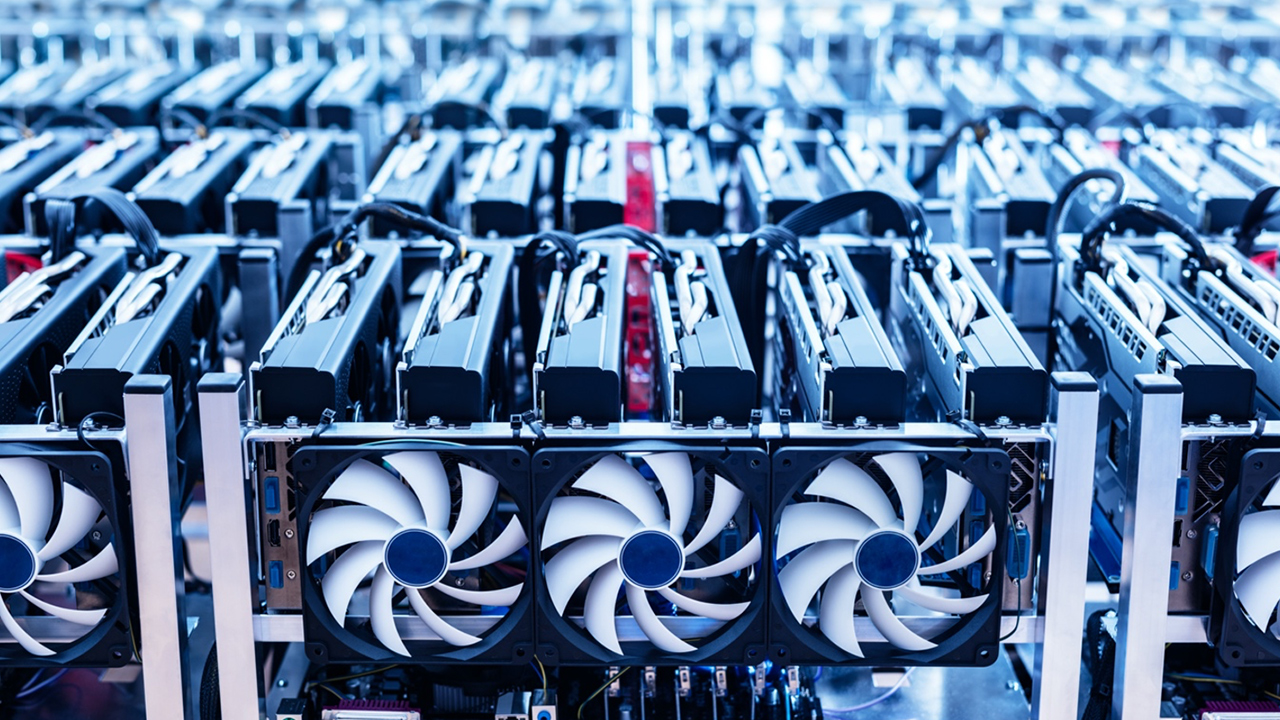

- AMPD’s DC1 data centre will house Variational’s GPU system, a component of Variational’s artificial intelligence technologies.

- Variational’s artificial intelligence and machine learning technologies are used to discover molecules that may be developed into new drugs.

- AMPD’s compensation for their services has not yet been disclosed.

- AMPD’s share price is down by 1.43 per cent, with shares trading at $0.34 apiece.

AMPD Ventures (AMPD) has announced a deal in which AMPD will provide machine learning infrastructure to Variational AI.

AMPD’s DC1 sustainable data centre in Vancouver will play host to Variational’s GPU system.

Variational AI uses specialised electric circuits called GPU’s (Graphics Processing Units) to perform complex calculations that help discover molecules, which may be developed into new pharmaceutical drugs.

Handol Kim, Co-founder and CEO of Variational AI, spoke about the deal. “We are starting off with a 16 GPU system hosted at AMPD’s DC1 data centre, and we expect to grow to 128 GPU’s during the rest of 2020. AMPD was able to meet our needs today and for the foreseeable future with their scalable platform and understanding of how GPU’s are used for artificial intelligence applications.”

According to AMPD CEO Anthony Brown, “Canada has been emerging as a global hub for artificial intelligence technologies, with over 150 AI/machine learning start-ups based in Vancouver alone, working across a range of application areas.”

It has not yet been disclosed what the deal dictates AMPD will receive in return for their services to Variation AI.

AMPD’s share price is down by 1.43 per cent, with shares trading at $0.34 apiece.