- Waterloo Brewing (TSX:WBR) has reported C$60.3 million in revenue for the year ending January 31, 2020, a 16 per cent increase over the year before

- Gross profit margins were marginally up from 29.1 per cent to 29.6 per cent

- The company reported record annual EBITDA of $12 million

- Waterloo cited consistent increases in both sales volumes and margins as the main growth factors

- At the close of trading yesterday, Waterloo Brewing (WBR) was steady at $2.94 per share, with a market cap of $103.55 million

Waterloo Brewing (TSX:WBR) has reported C$60.3 million in revenue for the year ending January 31, 2020, up 16 per cent on last year.

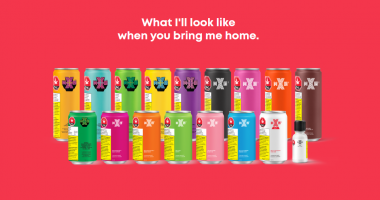

Founded in 1984, the company is Ontario’s largest Canadian-owned brewery. With a substantial portfolio of craft beers, Waterloo also provides an array of contract manufacturing services for beer, coolers and ciders.

Over the past fiscal year, improvements were seen in both the operating and market performance of the business.

In addition to the increase in revenue, Waterloo also reported a record 19 per cent increase in EBITDA to $12 million, compared to $10.1 million the year before.

The company cited consistent growth over the last four quarters in both sales volumes and margins as the primary factors behind the improved financials.

Gross profit margins for the year were marginally up from 29.1 per cent to 29.6 per cent.

However, selling, marketing and administration expenses also increased to $11.8 million, compared to $9.6 million in the preceding 12 months.

George Croft, President and CEO of Waterloo Brewing, noted steady volume gains across its premium portfolio of 24 per cent.

“Landshark Lager was a tremendous success story driven by the in-case promotions delivering volume in excess of 30,000 hectolitres and growth of 33 per cent.

“Our flagship Laker brand delivered an astonishing 20 per cent growth versus 2019 thanks to a growing, loyal following of beer drinkers and our Seagram business grew 58 per cent with the launch of our new Island Time Anytime ready-to-drink cocktail,” he said.

George added that continued investments in Waterloo’s operational capabilities in 2019 landed new copeck agreements, which are expected to generate a further $40 million in revenue over the next three years.

At the close of trading yesterday, Waterloo Brewing (WBR) was steady at $2.94 per share, with a market cap of $103.55 million.