- Kerr Mines (KER) has revealed an increase in its bought deal offering with Haywood Securities to an aggregate of C$5 million

- Under the terms of the financing, Haywood Securities has agreed to purchase a total of 35.7 million units at a price of 14 cents each

- Each unit will be comprised of one common share and half of one common share purchase warrant

- The proceeds raised under the offering will be used to fund drilling and engineering activities at the company’s Copperstone gold project

- Kerr Mines (KER) is currently down 3.03 per cent and is trading at $0.16 per share

Kerr Mines (KER) has revealed an increase in its bought deal offering with Haywood Securities to an aggregate of C$5 million.

Under the terms of the original offering, announced on July 13, 2020, Haywood Securities had agreed to purchase a total of 21.5 million units at a price of $0.14 each for gross proceeds of $3.01 million

However, this has now been increased to a total of 35.7 million units. These units will be comprised of one common share in Kerr Mines and half of one common share purchase warrant.

Each whole purchase warrant will entitle the holder to acquire an additional common share at a price of $0.22 per share for a period of 24 months from the date of closing, which is expected to be around August 4 this year.

The proceeds raised under the offering will be used to undertake a targeted drill program at Kerr Mines’ high-grade Copperstone gold project, which is hoped to expand resource and reserve estimated while also testing for further deposits within the 50-square-kilometre property.

In addition, the financing will enable the company to further advance in-depth engineering and project optimisation activities ahead of a proposed re-start of the Copperstone gold project.

Located in LaPaz County, western Arizona, the project was acquired by Kerr Mines in 2014, and is is fully permitted with substantial mining infrastructure, mineral resources and processing infrastructure already in place.

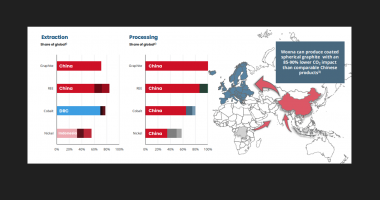

Arizona has long been considered a mining-friendly jurisdiction with a rich history of resource extraction accounting for 65 per cent of copper production in the United States.

Kerr Mines (KER) is down 3.03 per cent and is trading at 16 cents per share at 3:11pm EDT.