- Macarthur Minerals (MMS) has successfully expanded the mineral resource estimate of the magnetite deposits at its Lake Giles Iron Project in Western Australia

- The deposits’ indicated resource is now estimated to be 218.7 million tonnes at 27.5 per cent iron head grade and 66.1 per cent iron DTR concentrate grade

- The measured resource now stands at 53.9 million tonnes at 30.8 per cent iron head grade and 66.0 per cent iron DTR concentrate grade

- The expanded estimate has also significantly bumped the site’s inferred resource, which now sits at 997 million tonnes at 28.4 per cent iron head grade and 64.6 per cent iron DTR grade concentrate grade

- With the expanded estimate now complete, the company has sufficient categorised resource to support the site’s current feasibility study

- Macarthur Minerals (MMS) is holding steady and is currently trading at C$0.23 per share

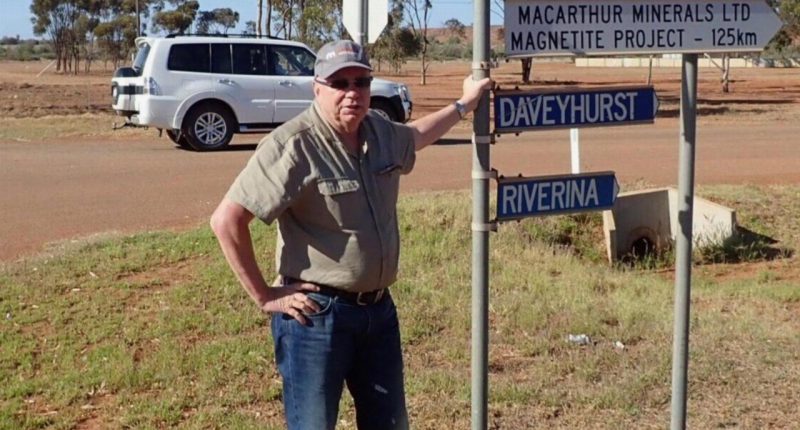

Macarthur Minerals (MMS) has successfully expanded the mineral resource estimate of the magnetite deposits at its Lake Giles Iron Project in Western Australia.

Over the course of last year, Macarthur Minerals performed an extensive infill drilling program across the site’s Moonshine deposits, with aim of expanding the known resource beyond inferred to include the indicated and measured categories.

The program’s findings have now been incorporated into the existing data, substantially expanding the previous resource estimate, which was initially released in 2009 and then first updated last year.

The deposits’ measured resource now stands at 53.9 million tonnes at 30.8 per cent iron head grade and 66.0 per cent iron DTR concentrate grade. A further 218.7 million tonnes of indicated resource has also been recorded at 27.5 per cent iron head grade and 66.1 per cent iron DTR concentrate grade.

The expanded estimate has significantly bumped the deposits’ inferred resource, which now sits at 997 million tonnes at 28.4 per cent iron head grade and 64.6 per cent iron DTR concentrate grade.

With the expanded estimate now complete, the company has sufficient categorised resource to support its current feasibility study for the project and can turn its focus to establishing the site’s road-to-market network.

Cameron McCall, President and Executive Chairman of Macarthur Minerals, said completing the updated mineral resource was a major milestone for the company’s ongoing feasibility work.

“The company’s board and management are singularly focused on progressing through the key gateways to deliver the project to maximise the opportunities presented in the current commodity cycle.

“With our focus now on the many more successes which need to follow, we have committed to a pathway of responsible, respectful and sustainable development. These are the principles and points of difference upon which the company will focus as an emerging Australian iron ore producer. This is a great outcome for Macarthur and its shareholders,” he said.

This news follows a series of developments the company has made in recent months, including the appointment of RCR Mining Technologies to design the project’s transport solutions.

Macarthur Minerals (MMS) is holding steady and is currently trading at C$0.23 per share at 2:11pm EDT.