- Mining company, Class 1 Nickel and Technologies (NICO) will begin trading on the Canadian Securities Exchange (CSE) today

- The company’s focus is on developing nickel-copper-cobalt sulphide deposits at projects in Ontario and Quebec

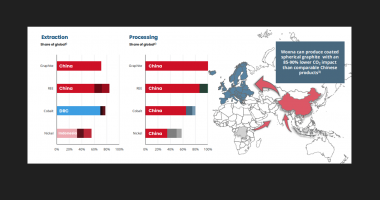

- Class 1 Nickel considers its CSE debut to be timely, in light of growing demand for nickel and cobalt sulphides

- The company’s common shares will trade on the CSE under the ticker code NICO

- Class 1 Nickel and Technologies (NICO) will begin listing later today

Mining company, Class 1 Nickel and Technologies (NICO) will begin trading on the Canadian Securities Exchange (CSE) today.

Class 1 Nickel is a mineral resources company, focused on developing nickel-copper-cobalt sulphide deposits. The company has already consolidated two komatiite-hosted nickel-copper-cobalt sulphide projects into one land package.

The 20 square kilometre land package, known as the Alexo-Dundonald Project, is located near Timmins in Ontario. It is 100 per cent owned by Class 1 Nickel, and includes a past producing mine that remains open at depth and along strike.

In addition to having favourable geology and good exploration potential, the Project is located close to suitable infrastructure, within a safe and reliable nickel jurisdiction. In order to determine and realise the Project’s full potential for discovering mineralisation, Class 1 Nickel has retained several geologists specialising in nickel.

While the Alexo-Dundonald Project is its main focus, the company also holds an option to acquire the Somanike nickel-copper sulphide project. The project, located in La Motte, Quebec, is currently owned by Quebec Precious Metals (TSXV:QPM).

Class 1 Nickel’s President and CEO, Benjamin H Cooper, commented on the company’s debut on the CSE, which he believes is well-timed.

“We are pleased to be trading publicly on the CSE, and expect to systematically explore our nickel sulphide properties.

“The timing is perfect for our company, as management believes world markets are beginning to understand the value of magmatic nickel and cobalt sulphide to battery, automotive, and technology sectors.

“We welcome all new investors to the company, and remain earnestly committed to exploring our projects with short lead-times, towards the goal of nickel-cobalt production,” he said.

The company’s common shares will begin trading on the CSE today, under the ticker code NICO.

Class 1 Nickel and Technologies (NICO) will begin listing later today.