- Gowest Gold (GWA) is making progress towards initial gold production from its wholly owned Bradshaw Gold Deposit in Ontario

- The company has received all environmental permits required to bring the mine into production, excluding the Mine Production Closure Plan

- An ore-sorter has now been started, which will organise stockpiled mixed development ore for trucking to Northern Sun’s Redstone Mill

- Additional funding is required to meet operational objectives, and the company is currently in discussions with a number of interested financing parties

- Gowest Gold (GWA) is currently steady and is trading at C$0.35 per share

Gowest Gold (GWA) is making progress towards initial gold production from its wholly owned Bradshaw Gold Deposit in Ontario.

The deposit sits within the company’s Frankfield property, which is located approximately 32 kilometres north-northeast of Timmins and includes eight mining leases over 842 hectares.

Gowest Gold has now received all the necessary environmental permits required to bring the proposed mine into commercial production. This excludes the Mine Production Closure Plan, which has now been submitted to Ontario’s Ministry of Energy, Northern Development and Mines for review.

According to the Ontario Mining Act, the regulatory body has 45 days to issue its decision.

The company has also initiated the start-up of an ore-sorter, which will organise stockpiled surface material before being trucked to Northern Sun’s Redstone Mill for processing.

Operators of the mill have advised Gowest Gold that the necessary upgrades are now being finalised and that the circuit will be ready in the next few weeks.

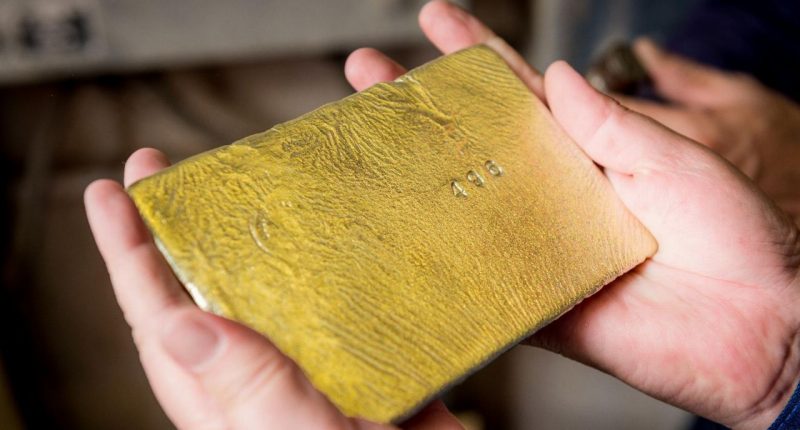

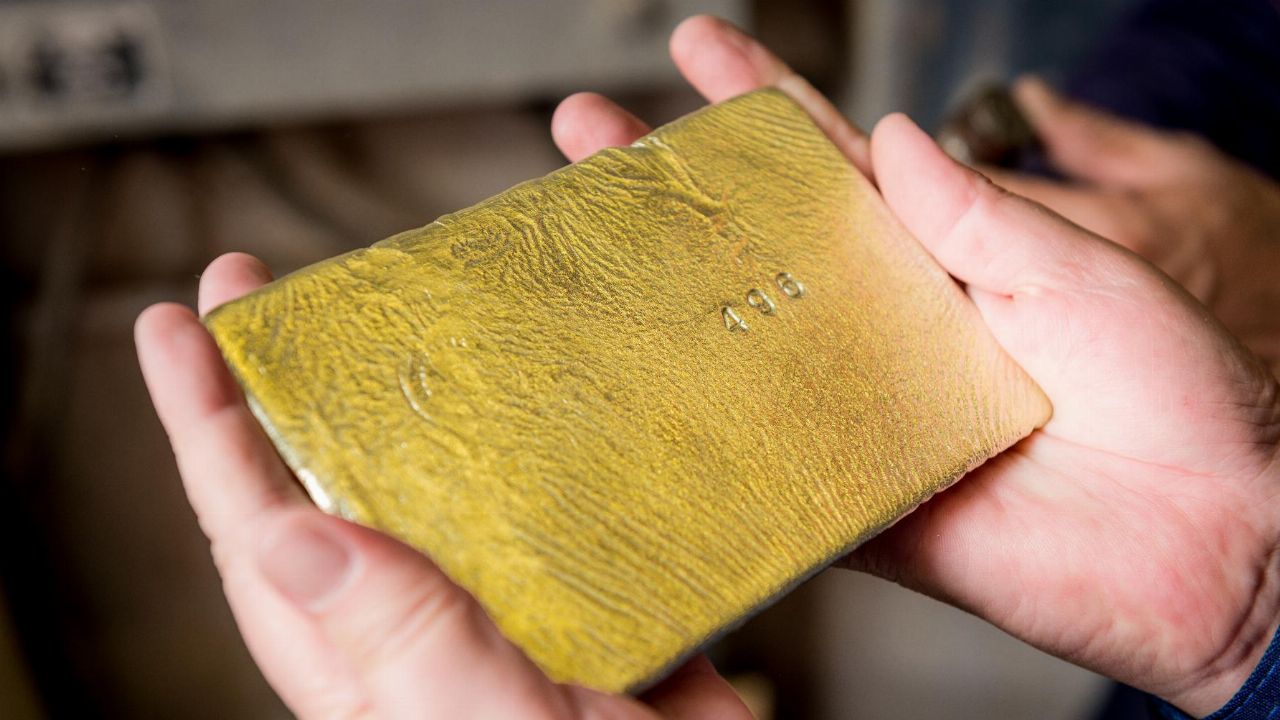

Roughly 28,000 tonnes of gold-bearing ore is currently stockpiled on site, most of which came from Gowest Gold’s advanced exploration bulk sample program.

While operational developments appear to be continuing as planned, the company says it still requires additional funding in order to meet its objectives. Gowest Gold is currently in discussion with a number of interested parties with a view to completing at least one round of financing, which will be needed to successfully bring the Bradshaw Deposit to production.

Greg Romain, President of Gowest Gold, said he looks forward to providing shareholders with regular updates over the coming weeks and months.

“We are more confident than ever that we are on the verge of seeing the Bradshaw gold deposit as a new gold mine in the Timmins camp within the coming year,” he added.

Gowest Gold (GWA) is currently steady at C$0.35 per share, as of 10:47am EDT.