- Silvercorp Metals (SVM) has doubled its gold sales in its latest quarterly report of the year

- In the three months leading up to September 30, the company sold 2,200 ounces of gold, a 98 per cent increase on the previous corresponding quarter

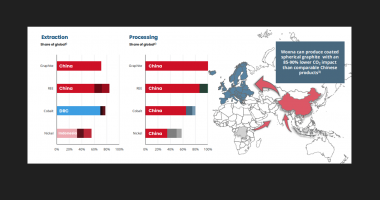

- The influx of gold sales came from the company’s BYP mine in China, which managed to sell its stockpiled assets before being place on care on maintenance

- Meanwhile, zinc sales hit 7.4 million pounds, an 11 per cent increase on the same quarter last year, but silver and lead sales dropped eight and three percent, respectively

- Silvercorp Metals (SVM) is currently up 4.33 per cent and is trading at C$10.36 per share

Silvercorp Metals (SVM) has doubled its gold sales in its latest quarterly report of the year.

In the three months leading up to September 30, the company sold 2,200 ounces of gold, a 98 per cent increase on the previous corresponding quarter. The influx of gold sales came from the company’s BYP mine in China, which managed to sell its stockpiled assets before being place on care on maintenance.

Meanwhile, zinc sales hit and 7.4 million pounds of zinc, an 11 per cent increase on the same quarter last year, but silver and lead sales dropped eight and three percent respectively.

Despite the increase in sales, silver, gold, and lead production from the company’s operations dropped by eight per cent, six per cent and three per cent, respectively. That said, zinc production rose by a slight two per cent to 7.1 million pounds.

As a result of the consistent performance, the company’s operations in the Ying Mining District, as well as its GC Mine, are expected to meet their annual guidance estimates.

Investors have responded well to this morning’s news, adding to the company’s impressive share price performance this year to date. After dropping a staggering 60 per cent at the onset of the COVID-19 pandemic, the company’s share price quickly recovered with the help of the recent strong precious metal prices.

When compared to its 52-week low of just under three dollars a share in March, the company’s current share price has risen more than 250 per cent in the following six months to now be valued at over 10 dollars a share.

Silvercorp Metals (SVM) is currently up 4.33 per cent and is trading at $10.36 per share at 10:53 pm EDT.