- Ivanhoe Mines (IVN) is progressing the development of its Kamoa-Kakula Project with the joining of the main northern and southern access tunnels

- The tunnels provide access to the Kakula Mine, which is the first of several high-grade underground copper mines planned at the project

- Average copper grades at the Kakula Mine, which is expected to begin production in July 2021, are thought to exceed 8 per cent

- The Kamoa-Kakula Project is held under a joint venture between Ivanhoe, Zijin Mining Group, Crystal River Global and the DRC Government

- Ivanhoe Mines is currently up 0.35 per cent to C$5.75 per share

Ivanhoe Mines (IVN) is progressing the development of its Kamoa-Kakula Project with the joining of the main northern and southern access tunnels.

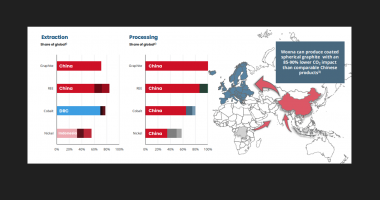

Located in the Democratic Republic of Congo (DRC), the project covers 400 square kilometres and is held under a joint venture between Ivanhoe and Zijin Mining Group, which both own a 39.6 per cent stake. Crystal River Global also holds a 0.8 per cent interest, while the DRC Government owns the remaining 20 per cent.

The tunnels provide access to the Kakula Copper Mine, located on the eastern portion of the Kakula deposit, which is the first of several underground copper mines that have been planned on the project’s mining license.

With the tunnels now connected, two high-grade, drift-and-fill mining blocks have been opened up, totalling 10.6 million tonnes at an average grade of 6.78 per cent copper.

“Now that we have initiated development of Kakula’s first two high-grade ore blocks, it is important to note that these two areas alone contain more than 700,000 tonnes of in- situ copper, and approximately 600,000 tonnes of recoverable copper,” said Robert Friedland, Chairman of Ivanhoe Mines.

“With copper trading at approximately US$7,000 [C$9,144] a tonne, the saleable value of the copper concentrate produced from these initial two blocks exceeds the estimated capital cost to develop both the first and second phases of production at Kamoa-Kakula,” he added.

With Phase One copper concentrate production scheduled to begin in July next year, the Kakula Mine is projected to be the world’s highest-grade major copper mine, with an estimated initial mining rate of 3.8 million tonnes per annum and a life of approximately 21 years.

Ivanhoe Mines is currently up 0.35 per cent to C$5.75 per share at 2:31pm EST.