- Stifel GMP has agreed to buy on a bought deal basis 24,000,000 common shares

- Under the underwriting arrangement, Yamana Gold Inc. has agreed to purchase all of the shares under the offering

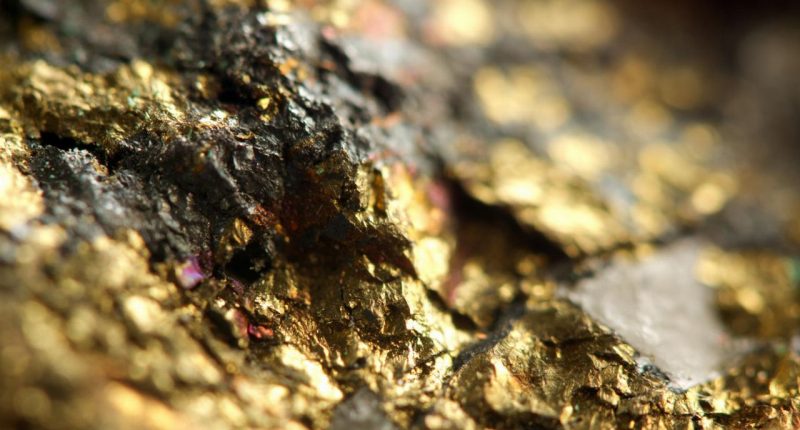

- Proceeds will be used to fund the construction of Ascot’s Premier Gold Project in British Columbia

- The offering is expected to close on or about April 20, 2021

- Ascot is a Canadian-based exploration and development company

- Ascot Resources (AOT) opened trading at $0.88 per share

Ascot Resources (AOT) has entered into an agreement with Stifel GMP in connection with private placement financing.

Stifel GMP has agreed to buy on a bought deal basis 24,000,000 common shares at an issue price of $0.86 per share for proceeds of C$20,640,000.

Under the underwriting arrangement, Yamana Gold Inc. has agreed to be the substitute purchaser and will purchase all of the shares from the offering. Yamana is purchasing the shares for investment purposes and will hold approximately 6.4 per cent of the company’s outstanding shares.

Derek White, President and CEO, commented,

“The bought deal private placement and investment by Yamana arose subsequent to the bought deal financing which closed last Friday. This additional funding will facilitate the company’s ability to accelerate its surface and underground exploration during construction. We are delighted with having Yamana as a shareholder.”

Proceeds will be used to fund the construction of the Premier Gold Project in British Columbia and for working capital and general corporate purposes.

The offering will be conducted on a “bought deal” private placement basis subject to a formal underwriting agreement. An application will be made to list the shares on the Toronto Stock Exchange.

The offering is expected to close on or about April 20, 2021.

Ascot is a Canadian-based exploration and development company focused on re-starting the past-producing historic Premier gold mine, located in British Columbia’s Golden Triangle.

Ascot Resources (AOT) opened trading at $0.88 per share.