- Omai Gold Mines Corp. (OMG) is pleased to announce a non-brokered private placement for aggregate gross proceeds of up to C$3,000,000

- Silvercorp Metals Inc. has indicated its intention to subscribe for approximately C$455,000 of the offering

- Proceeds from the offering will be used to fund additional drilling under the Wenot deposit and to advance new high-priority exploration targets at Omai

- Omai Gold Mines Corp is a mineral exploration company

- Omai Gold Mines Corp. (OMG) opened trading at C$0.185 per share

Omai Gold Mines Corp. (OMG) is pleased to announce a non-brokered private placement for aggregate gross proceeds of up to C$3,000,000.

Units will be priced at C$0.17. Each unit will consist of one common share and one-half of a common share purchase warrant. Each warrant entitles the holder to acquire one common share at a price of C$0.23 for a period of 36 months from the closing date of the offering.

Silvercorp Metals Inc., an existing shareholder, has indicated its intention to subscribe for approximately C$455,000 of the offering.

Mario Stifano, Chief Executive Officer of Omai Gold Mines, commented,

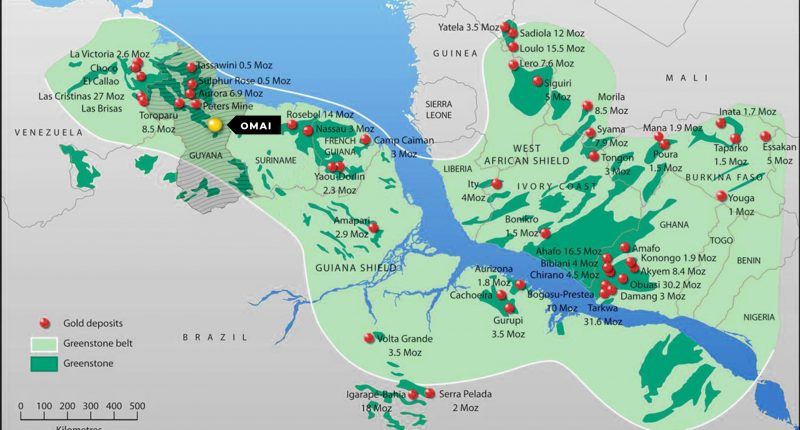

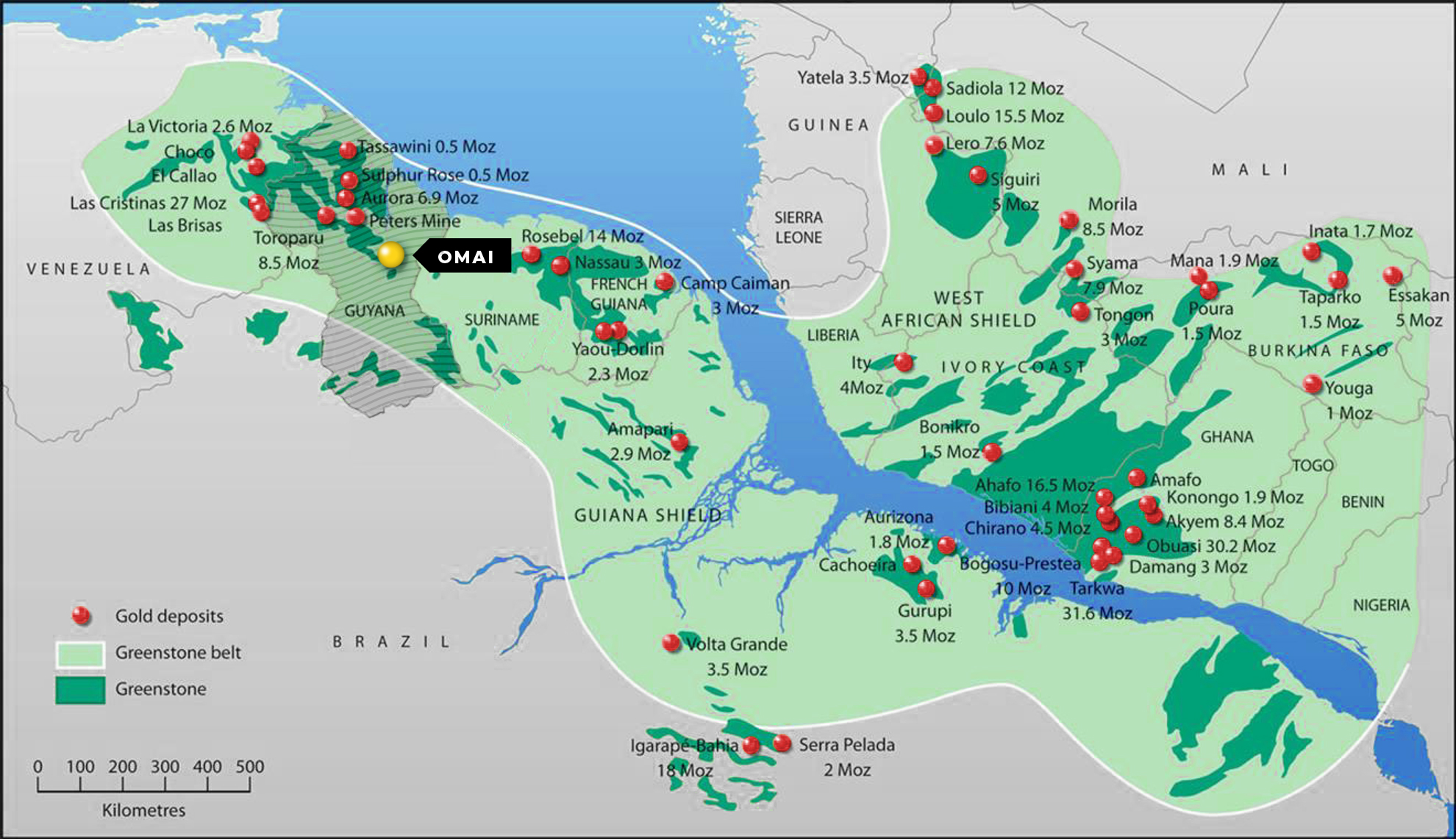

“We are delighted that Silvercorp is maintaining its pro rata ownership in Omai Gold Mines. The positive results from the ongoing drilling and assaying program at the Wenot target that we previously announced – including 16.0 meters of 9.0 grams per tonne (g/t) gold, 32.1 meters of 3.6 g/t gold, and 14 meters of 9.1 g/t gold, indicates the potential to significantly expand the open-pit mineralization at Wenot while it remains open at depth and on strike. Given the location on the prospective Guiana Shield that is home to other major gold discoveries, Omai exhibits excellent potential to host near surface as well as high-grade gold mineralization such as hole OMU-28 which drilled 101 meters of 34.91 g/t gold at the Fennell deep target.”

Proceeds from the offering will be used to fund additional drilling under the Wenot deposit, the preparation of the company’s inaugural 43-101 resource estimate for Wenot, and to advance new high-priority exploration targets at Omai, including Broccoli Hill.

The company may pay a finder’s fee of 7% cash as well as 7% broker warrants for units sold to certain investors. Broker warrants can be redeemed for one common share at a price of $0.17 for a period of 36 months from the date of issuance.

Omai Gold Mines Corp is a mineral exploration company. Its Omai gold mine is located in Guyana, on the North coast of South America. The mine has two open pits: the Fennell pit and the Wenot pit.

Omai Gold Mines Corp. (OMG) opened trading at C$0.185 per share.