- The Very Good Food Company (VERY) has announced the signing of a C$70 million credit facility with Waygar Capital and Ninepoint Partners

- The credit facility consists of a C$20 million revolving line of credit and a C$50 million term loan

- VERY GOOD will use the credit facility for working capital and the term loan to purchase equipment

- All amounts drawn under the credit facility will pay interest at a rate of 9.95 per cent per annum on the unpaid principal amount of outstanding advances and will be repaid in full upon maturity

- The Very Good Food Company Inc. (VERY) is down 1.33 per cent and is trading at C$4.46 at 11:27 am ET

The Very Good Food Company (VERY) has entered into a loan agreement with Waygar Capital Inc., as agent for Ninepoint Canadian Senior Debt Master Fund L.P.

The senior secured credit facility consists of a C$20 million revolving line of credit and a C$50 million term loan.

VERY GOOD will use the credit facility for working capital and the term loan to purchase equipment for its production facilities.

“The closing of this credit facility is a key milestone and a testament of our ability to access favorable financing while diversifying our capital structure and we are very pleased to have the Waygar Capital team as a partner as we execute on our growth strategy”, said Mitchell Scott, CEO.

“We are very pleased to be in a position to support VERY GOOD’s strategic priorities and future success”, said Wayne R. Ehgoetz, President and CEO of Waygar Capital.

“We look forward to our partnership with VERY GOOD’s exceptional management team as they execute their exciting growth and M&A strategy,” added Ehgoetz.

All amounts drawn under the credit facility will pay interest at a rate of 9.95 per cent per annum and will be repaid in full upon maturity. The credit facility is secured by a first-priority security interest on substantially all of its assets.

The credit facility will become due on June 7, 2023, subject to VERY GOOD’s option to extend the maturity date for an additional 12 months on terms and conditions to be mutually agreed to between the company and the lender.

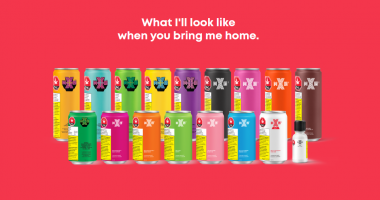

The Very Good Food Company Inc. is an emerging plant-based food technology company that produces plant-based meat and other food products that are delicious while maintaining a wholesome nutritional profile.

The Very Good Food Company Inc. (VERY) is down 1.33 per cent and is trading at C$4.46 at 11:27 am ET.