- The final tranche consisted of 790,000 non-flow-through units and 250,000 flow-through units for proceeds of $88,200

- Proceeds from the sale of FT units will be used for exploration programs on the company’s Ontario and Saskatchewan gold and nickel properties

- Proceeds from the sale of NFT units will be used for general working capital

- Finder’s fees for the second tranche consisting of $1,750 cash and 17,500 finder’s warrants were paid to Industrial Alliance Securities Inc.

- ALX Resources Corp is engaged in the acquisition, exploration, and development of mineral properties

- ALX Resources Corp. (AL) opened trading at C$0.08 per share

ALX Resources (AL) has closed the final tranche of a non-brokered private placement.

The final tranche consisted of 790,000 non-flow-through units and 250,000 flow-through units for proceeds of $88,200. A total of 15,591,250 NFT units and 2,940,000 FT units were sold in two tranches for gross proceeds of $1,541,300.

The NFT units were sold for $0.08 per unit, consisting of one common share and one common share purchase warrant. The FT units were sold for $0.10 per unit consisting of one flow-through common share and one non-flow-through common share purchase warrant.

The securities issued in the first and tranches of the offering are subject to a hold period of four months plus one day from the closing date.

Proceeds from the sale of FT units will be used for exploration programs on the company’s Ontario and Saskatchewan gold and nickel properties, and the proceeds from the sale of NFT units will be used for general working capital.

Finder’s fees for the second tranche consisting of $1,750 cash and 17,500 finder’s warrants were paid to Industrial Alliance Securities Inc.

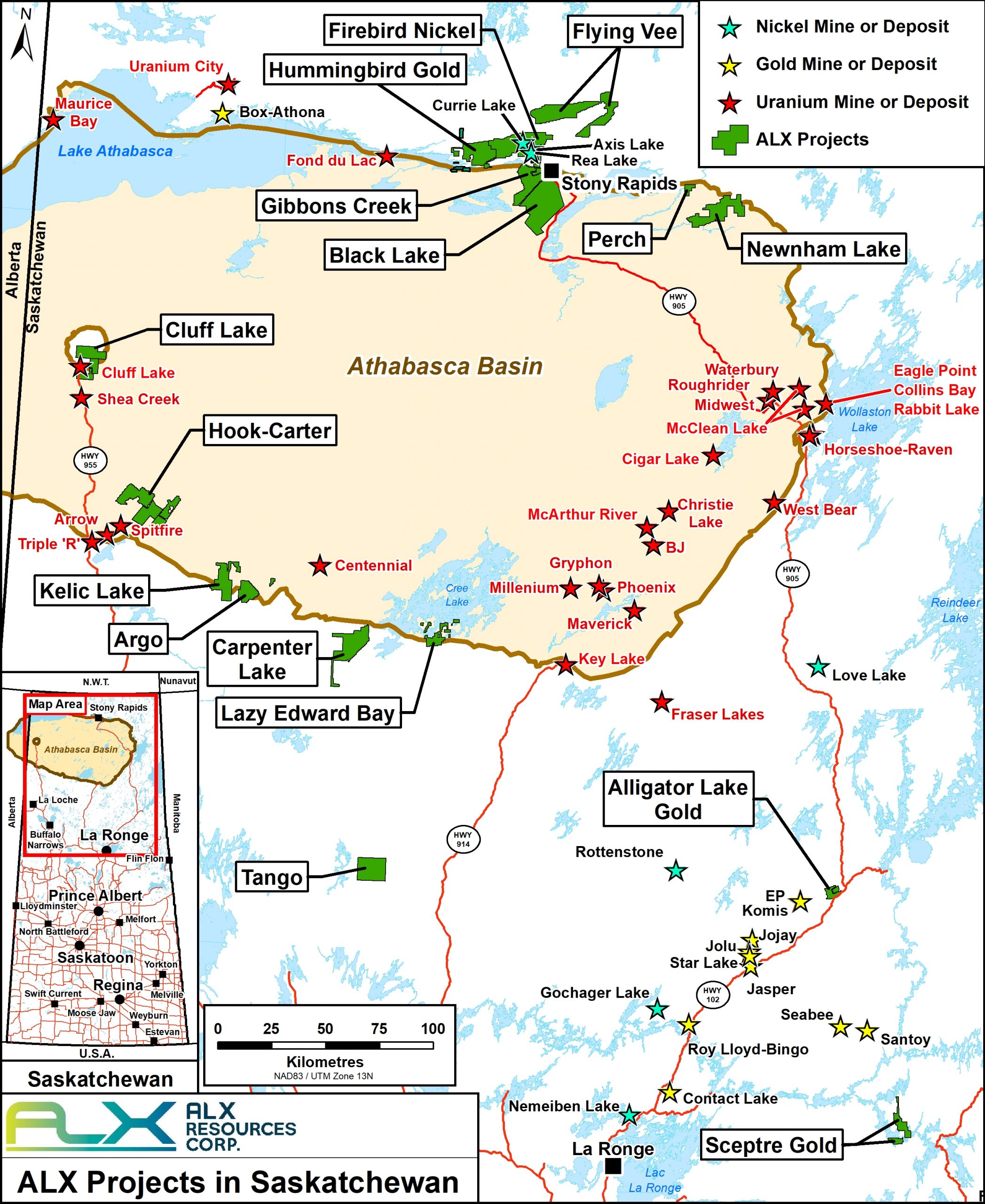

ALX Resources’ mandate is to provide shareholders with multiple opportunities for discovery by exploring a portfolio of prospective mineral properties, which include gold, nickel, copper, and uranium projects. The company uses the latest exploration technologies and holds interests in over 200,000 hectares of prospective lands in Saskatchewan and Ontario.

ALX owns 100% interests in the Firebird Nickel Project, the Flying Vee Nickel/Gold and Sceptre Gold projects, and can earn up to 80% interest in the Alligator Lake Gold Project in northern Saskatchewan, Canada.

ALX owns or can earn, up to 100% interests in the Vixen Gold Project, the Electra Nickel Project and the Cannon Copper Project located in historic mining districts of Ontario, Canada, and in the Draco VMS Project in Norway.

ALX holds interests in several uranium exploration properties in northern Saskatchewan, including a 20% interest in the Hook-Carter Uranium Project, located within the prolific Patterson Lake Corridor, with Denison Mines Corp. (80% interest) operating exploration since 2016, a 40% interest in the Black Lake Uranium Project (a joint venture with UEX Corporation and Orano Canada Inc.), and a 100% interest in the Gibbons Creek Uranium Project.

ALX Resources Corp. (AL) opened trading at C$0.08 per share.