- Major Precious Metals raised gross proceeds of $8.5 million

- Net proceeds will be used to support a large diamond drilling campaign on its Skaergaard Project in eastern Greenland

- Finder’s fees of $340,851 cash and 949,860 warrants were paid to qualified agents

- Major Precious Metals is a Canadian junior mining company whose flagship project is the Skaergaard Project

- Major Precious Metals Corp. (SIZE) opened trading at C$0.37 per share

Major Precious Metals (SIZE) has closed a non-brokered private placement of 24,285,715 units for gross proceeds of $8.5 million.

Each unit consists of one common share and one-half of one transferable common share purchase warrant. Each whole warrant entitles the holder to purchase one additional common share at a price of $0.70 for a period of two years from closing.

In the event that the shares have a closing price on the CSE of $1.20 or higher for a period of ten consecutive trading days at any time, the company may accelerate the expiry date of the warrants by giving notice to the holders via a news release. Warrants would expire 30 days after the date of such notice.

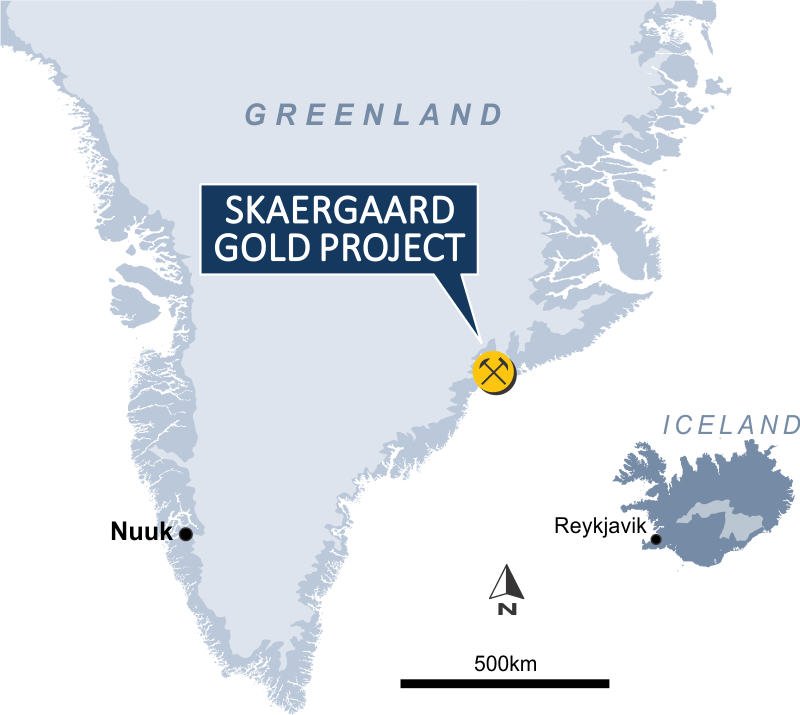

Net proceeds will be used to support a large diamond drilling campaign already underway on its Skaergaard Project in eastern Greenland. The drilling program is expected to begin within the next few weeks. Drilling crew, equipment and logistical support are in place.

Finder’s fees of $340,851 cash and 949,860 warrants have been paid in connection with the private placement.

All securities issued are subject to a statutory four-month hold period.

Major Precious Metals is a Canadian junior mining company. The company’s flagship project is the Skaergaard Project in Greenland containing one of the world’s largest palladium and gold deposits.

Major Precious Metals Corp. (SIZE) opened trading at C$0.37 per share.