- Fremont issued 20,732,833 units at a price of $0.03 per unit for gross proceeds of $621,985

- Net proceeds will be used primarily for ongoing exploration work at Cobb Creek

- Officers and directors of the company subscribed for a total of 3,133,334 units

- Fremont Gold Ltd is a Canadian exploration company engaged in the acquisition and exploration of mineral properties

- Fremont Gold Ltd. (FRE) opened trading at C$0.03 per share

Fremont Gold (FRE) has closed its non-brokered private placement for gross proceeds of $621,985.

The company issued 20,732,833 units at a price of $0.03 per unit.

Net proceeds will be used for ongoing work at Cobb Creek, evaluation of mineral opportunities and general working capital.

Dennis Moore, President and CEO of Fremont commented on the financing.

“We are pleased that nearly all of the subscribers are existing shareholders that have supported the company over the past few years. The funds raised will be used for exploration work defining new drill targets at Cobb Creek as well as evaluation of new mineral opportunities identified by Fremont management.

Each unit includes a common share and one share purchase warrant. Each share purchase warrant can be redeemed for one common share at a purchase price of $0.05 for a period of 24 months.

Fremont issued 280,000 share purchase warrants to finders.

Officers and directors of the company subscribed for a total of 3,133,334 units for proceeds of $94,000.

All securities issued are subject to a statutory four-month hold period, expiring on November 28, 2021.

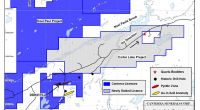

Fremont Gold has assembled a portfolio of quality gold projects located in Nevada’s most prolific gold trends. The company’s property portfolio includes Cobb Creek, which hosts a historic resource, Griffon, a past-producing gold mine, North Carlin, a new discovery opportunity, and Hurricane, which has returned significant gold intercepts from surface in past drilling.

Fremont Gold Ltd. (FRE) opened trading at C$0.03 per share.