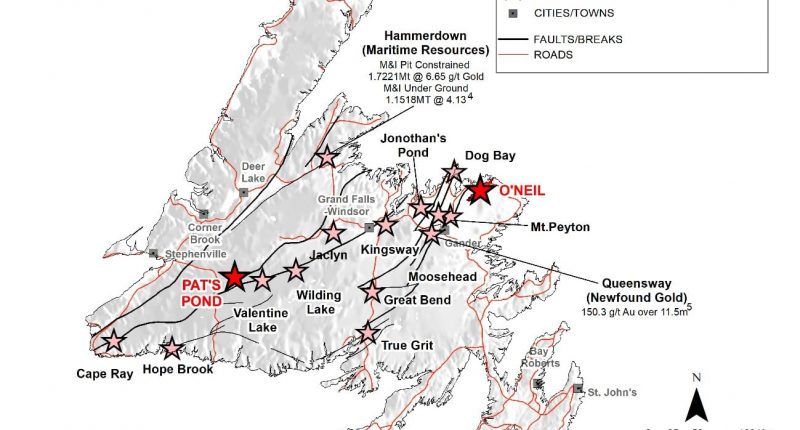

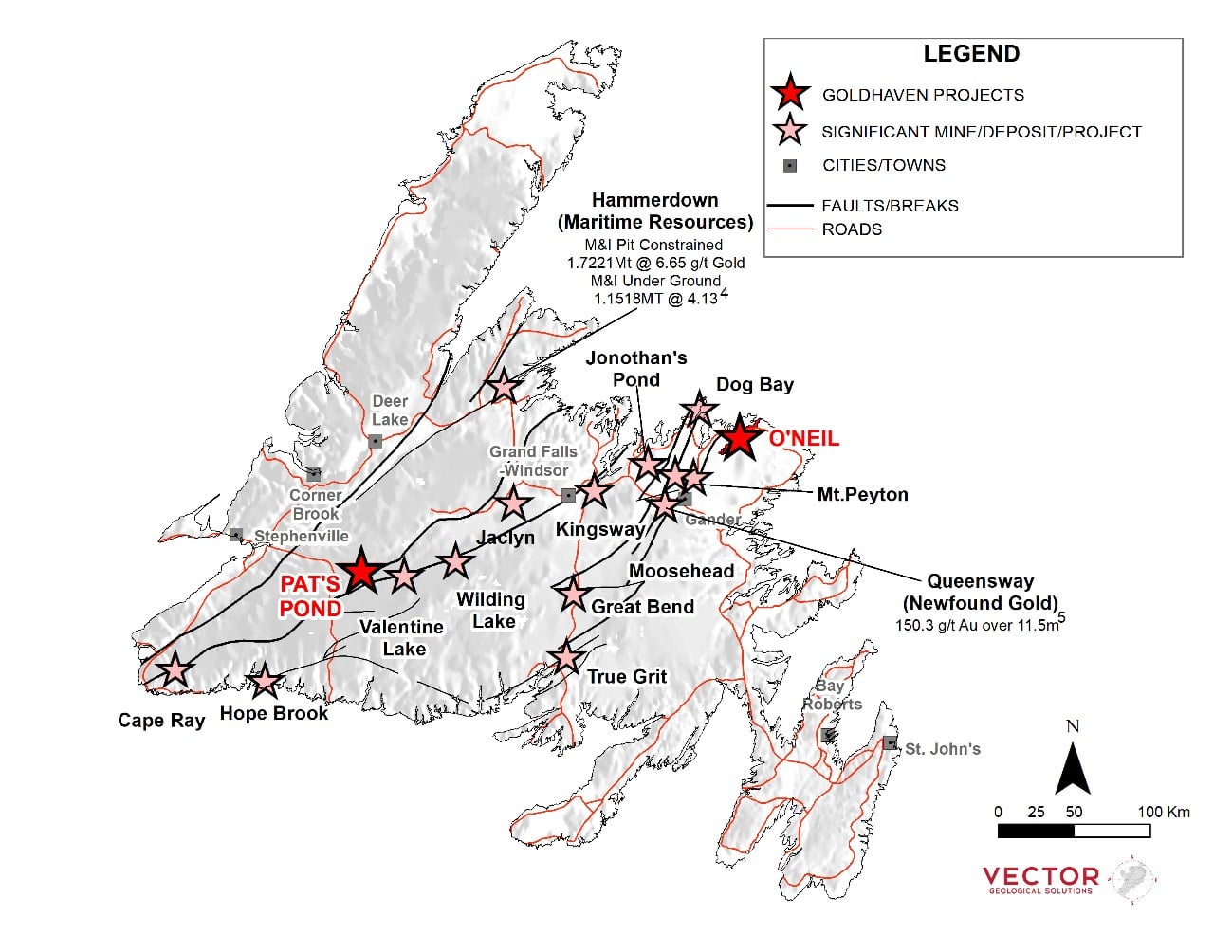

- GoldHaven (GOH) has acquired a major land position in the Central Newfoundland Gold Belt

- The company entered into an earn-in agreement under which it may earn a 100 per cent interest in the Pat’s Pond and O’Neill projects

- Pat’s Pond consists of 327 claims covering 8,175 hectares, while O’Neill consists of 525 claims covering 13,145 hectares

- Both projects are considered prospective for volcanogenic massive sulphides and epithermal gold deposits

- GoldHaven Resources is a Canadian junior exploration company active in the Maricunga Gold Belt of northern Chile

- GoldHaven (GOH) is unchanged trading at $0.53 per share

GoldHaven (GOH) has acquired a major land position in the Central Newfoundland Gold Belt.

The company entered into an earn-in agreement under which it may earn a 100 per cent interest in the Pat’s Pond and O’Neill projects.

Pat’s Pond Project

Pat’s Pond consists of 327 claims covering 8,175 hectares and is considered prospective for volcanogenic massive sulphides and epithermal gold deposits. Precious and base metal mineralization occurs in three historical mineral occurrences.

In July 2008, North Range Exploration identified mineralization in outcrop that returned 119.9 g/t silver, 6.20 per cent lead and 4 per cent zinc.

In 2010, Puddle Pond Resources drilled three holes at the Horn-Mesher occurrence that intersected pyritic, silica-chlorite-carbonate altered metavolcanic rocks associated with elevated gold, silver, lead and zinc. A 2 m sample (102.40 m depth) in hole HM-04-10 returned 2.1 g/t gold.

The Pat’s Pond #2 occurrence contains a float sample that returned 18.66 g/t gold, 36.7 oz/ton silver, 7.5 per cent lead and 1.1 per cent zinc, while a diamond drill hole returned 1.4 m of 0.31 g/t gold, 3.2 oz/t silver, 0.78 per cent lead and 1.1 per cent zinc.

O’Neill Project

O’Neill consists of 525 claims covering 13,145 hectares and is also considered prospective for volcanogenic massive sulphides and epithermal gold deposits.

Deal summary

GoldHaven shall issue 7,100,000 common shares on or before five business days after the effective date.

For Pat’s Pond, the company shall issue 1,200,000 shares on the first anniversary of the effective date and 800,000 shares on the second anniversary.

The vendors retain a 2 per cent NSR royalty with the right to re-purchase 1 per cent at any time for C$1 million.

Future prospecting

The company completed phase 1 and is preparing its phase 2 drill campaigns in the Maricunga Gold Belt.

GoldHaven is also preparing two projects for exploration in the Central Newfoundland Gold Belt.

Daniel Schieber, GoldHaven’s CEO, commented,

“Newfoundland has become one of the best places to explore in Canada. These acquisitions supplement our core strategy to expand our ownership of highly prospective projects next to major discoveries. GOH is now very well positioned to unlock value from our 213 km2 Newfoundland portfolio.”

GoldHaven Resources is a Canadian junior exploration company active in the Maricunga Gold Belt of northern Chile.

GoldHaven (GOH) is unchanged trading at $0.53 per share as of 9:38 am ET.