- Rio2 Limited (RIO) has closed its public offering and private placement for combined gross proceeds of C$35,144,122

- A total of 44,275,000 shares were issued in the public offering for gross proceeds of C$28,778,750

- 9,792,880 common shares were issued to Wheaton pursuant to the private placement for gross proceeds of $6,365,372

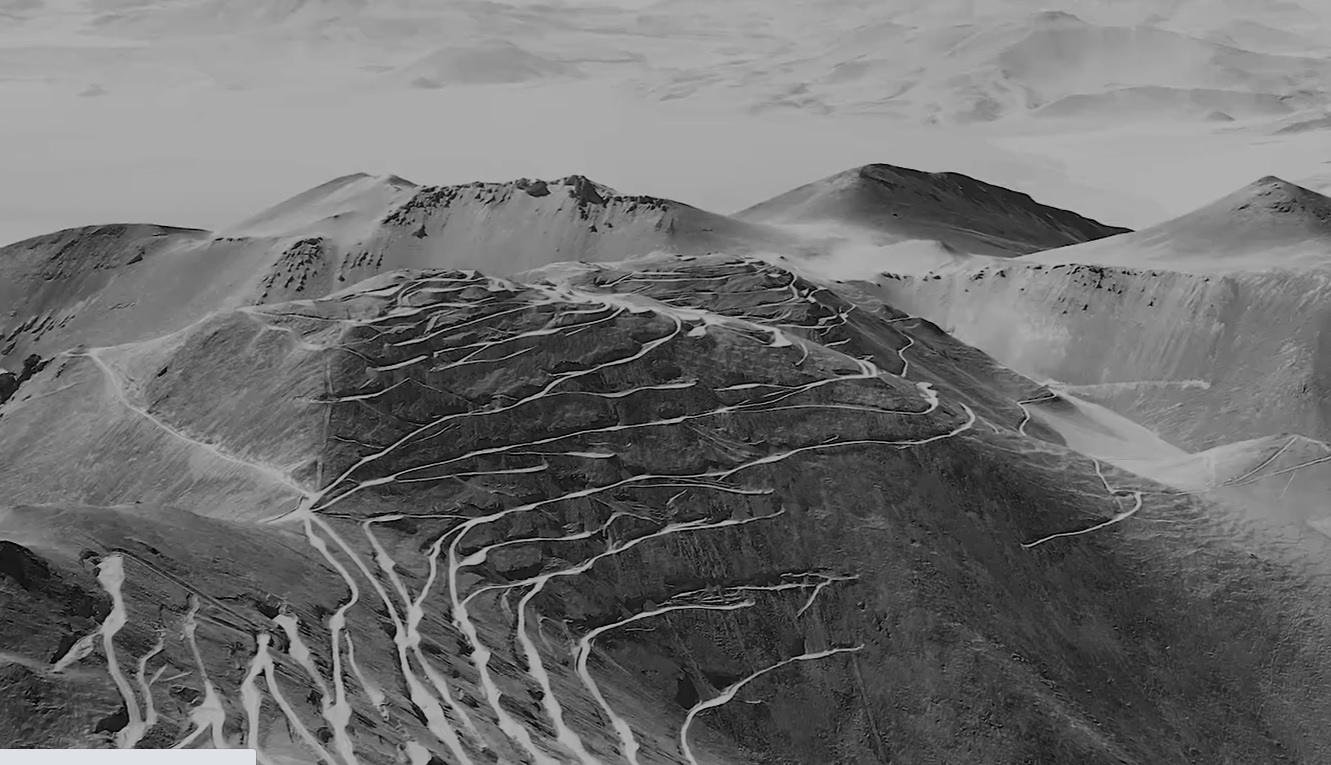

- The bulk of the combined proceeds will be used to fund the development of the company’s Fenix Gold Project in Chile

- Rio2 is a mining company focused on taking its Fenix Gold Project to production

- Rio2 Limited (RIO) is trading at $0.63 per share at 11:50 am ET

Rio2 Limited (RIO) has closed its public offering and private placement to Wheaton Precious Metals Corp. for combined gross proceeds of C$35,144,122.

A total of 44,275,000 shares were issued in the public offering at the price of $0.65 per share, including the full exercise of the over-allotment option for gross proceeds of C$28,778,750.

Scotiabank, CIBC Capital Markets and Raymond James, as joint bookrunners and co-lead underwriters, along with Cantor Fitzgerald Canada Corporation, Sprott Capital Partners LP, and Cormark Securities Inc. acted as the underwriters for the public offering.

A total of 9,792,880 common shares were issued to Wheaton pursuant to the private placement for gross proceeds of $6,365,372.

The bulk of the combined proceeds will be used to fund the development of the company’s Fenix Gold Project. The remaining proceeds will be used for general working capital purposes.

Shares issued are subject to a hold period of four months plus one day. Final acceptance by the TSXV is subject to the completion of customary post-closing filings.

DLA Piper (Canada) LLP acted as legal counsel to Rio2 and Borden Ladner Gervais LLP (BLG) acted as legal counsel to the underwriters.

Rio2 is a mining company focused on taking its Fenix Gold Project to production. In addition to the Fenix Gold Project, Rio2 Limited continues to pursue additional strategic acquisitions.

Rio2 Limited (RIO) is trading at $0.63 per share at 11:50 am ET.