- Vendetta Mining (VTT) has closed the second tranche of its non-brokered private placement

- The company has raised total gross proceeds of $928,272 from the two tranches

- Each unit, priced at $0.05, includes common share and one half of one common share purchase warrant

- Net proceeds from the private placement will be used to advance the development of the Pegmont Lead-Zinc project

- Vendetta Mining is a Canadian junior exploration company

- Vendetta Mining Corp. (VTT) opened trading at C$0.055 per share

Vendetta Mining (VTT) has closed the second tranche of its previously announced non-brokered private placement.

Combined with the first tranche of the private placement, a total of 18,565,440 units were issued at a price of $0.05 per unit for gross proceeds of $928,272. Each unit includes one common share and one-half of one common share purchase warrant exercisable at a price of $0.07.

All securities issued are subject to a four-month hold period.

Net proceeds from the private placement will be used to advance the development of the Pegmont Lead-Zinc project and general working capital.

Finders fees of $16,295 were paid in association with the first and second tranches of the private placement.

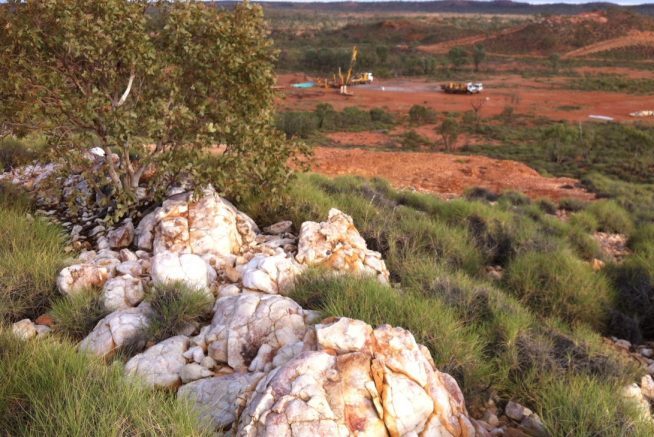

Vendetta Mining is a Canadian junior exploration company engaged in acquiring, exploring, and developing mineral properties, emphasizing lead and zinc. It is currently focused on advancing the Pegmont Lead-Zinc project in Australia.

Vendetta Mining Corp. (VTT) opened trading at C$0.055 per share.