- Chatham Rock Phosphate Limited (NZP) reports an update on the French Polynesian legislation relevant to the granting of mining concessions

- Chatham’s wholly-owned subsidiary SAS Avenir Makatea can now request a public enquiry into the grant of the mining concession on Makatea

- A request for a public enquiry will be lodged in November

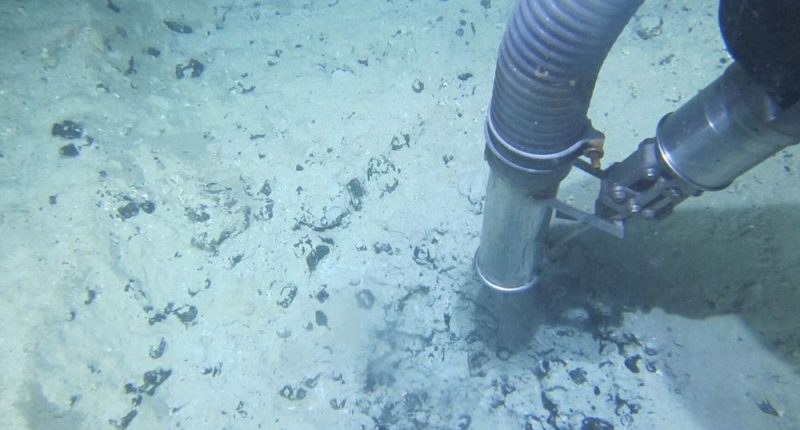

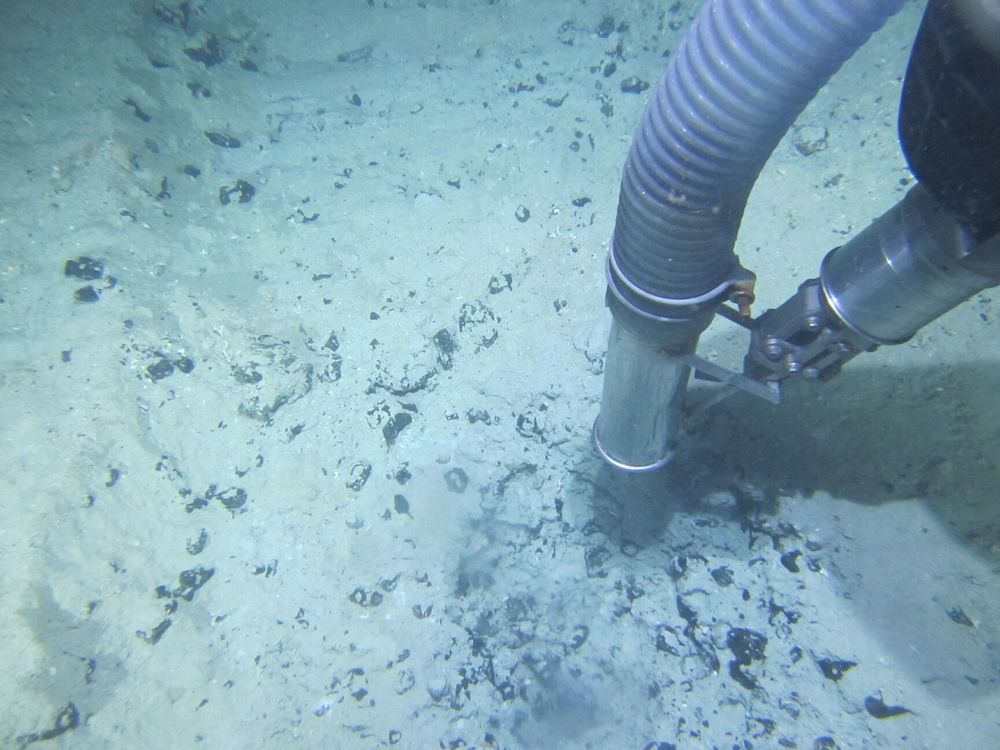

- Chatham Rock Phosphate Ltd is a mineral exploration company

- Chatham Rock Phosphate Limited (NZP) opened trading at C$0.12 per share

Chatham Rock Phosphate Limited (NZP) reports that French Polynesian government has updated legislation regarding the granting of mining concessions.

Chatham’s wholly-owned subsidiary SAS Avenir Makatea is now able to request a public enquiry into the granting of a mining concession on Makatea.

The request for the public enquiry will be lodged in November.

The French Polynesian government has spent the last three years working on the now adopted modern legislative framework.

The final legislative change to harmonize the current Environment Code with the new Mining Code was adopted by the French Polynesian Assembly on 21 October 2021.

The new Mining Code was approved in February 2020 while the new Fiscal Code for Extractive Industries was adopted by the Assembly in December 2019.

Chatham Rock Phosphate Ltd is a mineral exploration company engaged in the development and exploration of the offshore Chatham Rise rock phosphate deposit in New Zealand.

Chatham Rock Phosphate Limited (NZP) opened trading at C$0.12 per share.