- Rio2 Limited (RIO) closed the sale of Anocarire mining concessions with Andex Minerals Chile SpA

- The total consideration received by Rio2 are cash payments totalling US$6.4 million and a 1.5 per cent net-smelter return royalty

- The net-smelter return royalty is made up of US$5 million received at closing and US$1.4 million received in partial payments

- Also included is a 1.5 per cent net smelter return royalty in respect of all mining products extracted from the start of commercial production for a period of one hundred years

- Rio2 Limited (RIO) is unchanged trading at $0.64 per share as of 1:03 p.m. EST

Rio2 Limited (RIO) has closed the sale of Anocarire mining concessions with Andex Minerals Chile SpA.

This follows the completion of Andex’s purchase option.

The Anocarire mining concessions were one of the non-core assets resulting from Rio2’s business combination with Atacama Pacific Corporation.

The total consideration received by Rio2 includes cash payments totalling US$6.4 million and a 1.5 per cent net-smelter return royalty.

The net-smelter return royalty is made up of US$5 million received at closing and US$1.4 million received in partial payments over the past three years.

Also included is a 1.5 per cent net smelter return royalty in respect of all mining products extracted from the start of commercial production for a period of one hundred years.

Jose Luis Martinez, Rio2’s Executive Vice President and Chief Strategy Officer, stated,

“The sale of this non-core asset adds an additional US$5 million of available funding to support Rio2’s strategic business initiatives other than the construction of the Fenix Gold Project which has its project financing arranged to production.”

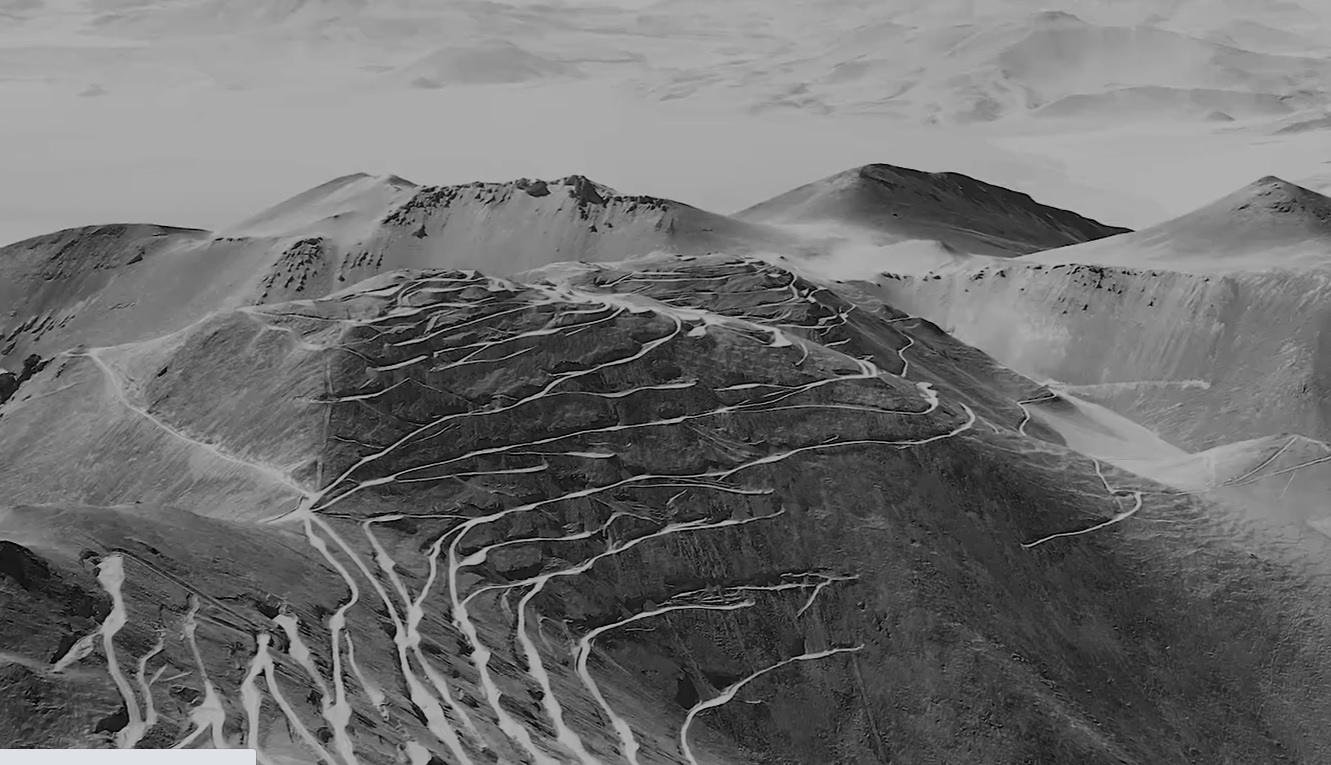

The concessions are in the district of Putre, Chile, approximately 120 kilometres east of Arica.

There are no development synergies between the future Fenix Gold Mine and the Anocarire concessions.

Rio2 is focused on taking its Fenix Gold Project in Chile to production in the shortest possible timeframe based on a staged development strategy.

In addition to the Fenix Gold Project in development in Chile, Rio2 Limited continues to pursue additional strategic acquisitions.

Rio2 Limited (RIO) is unchanged trading at $0.64 per share as of 1:03 p.m. EST.