- Silver Hammer Mining (HAMR) has reported previously unreleased drill intercepts from 2002 drilling at the Silver Strand project

- This additional information compliments Silver Hammer’s 2021 drill program and gives the company more information for drill targeting in 2022

- Highlights from this previously unreported data include 2,071 AgEq over 1.0 metre

- Silver Hammer Mining is engaged in the exploration of mineral properties in North America

- Shares in Silver Hammer Mining (HAMR) are down 4.29 per cent, trading at $0.67 per share

Silver Hammer Mining (HAMR) has reported previously unreleased drill intercepts from 2002 drilling at the Silver Strand project.

The 2002 drill program was conducted by New Jersey Mining, who provided Silver Hammer with both the physical drill core and original assay certificates, making the data eligible to be included in an NI 43-101 compliant resource estimate.

Silver Hammer has commenced an initial drill program at Silver Strand that will test for silver and gold mineralization immediately below the mine’s lowest level, extending only 90 metres below surface.

This additional information compliments Silver Hammer’s 2021 drill program and gives the company more information to add to the geological model that will be used for drill targeting in 2022.

Highlights from this previously unreported data include:

- 1,005 g/t silver equivalent (AgEq) over 2.2 metres;

- 1,219 g/t AgEq over 3.3 metres;

- 1,876 g/t AgEq over 1.6 metres; and

- 1,609 g/t AgEq over 1.5 metres, including 2,071 AgEq over 1.0 metre and 2,439 AgEq over 0.6 metre.

Morgan Lekstorm, Silver Hammer’s president and CEO, commented on the 2002 results.

“These newly acquired results, combined with our initial 2021 drill campaign, demonstrate consistent high-grade gold and silver values immediately beneath the existing mine workings,” he said.

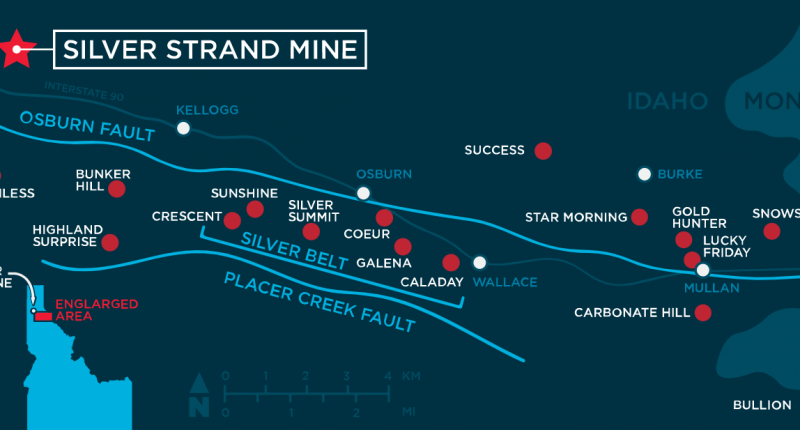

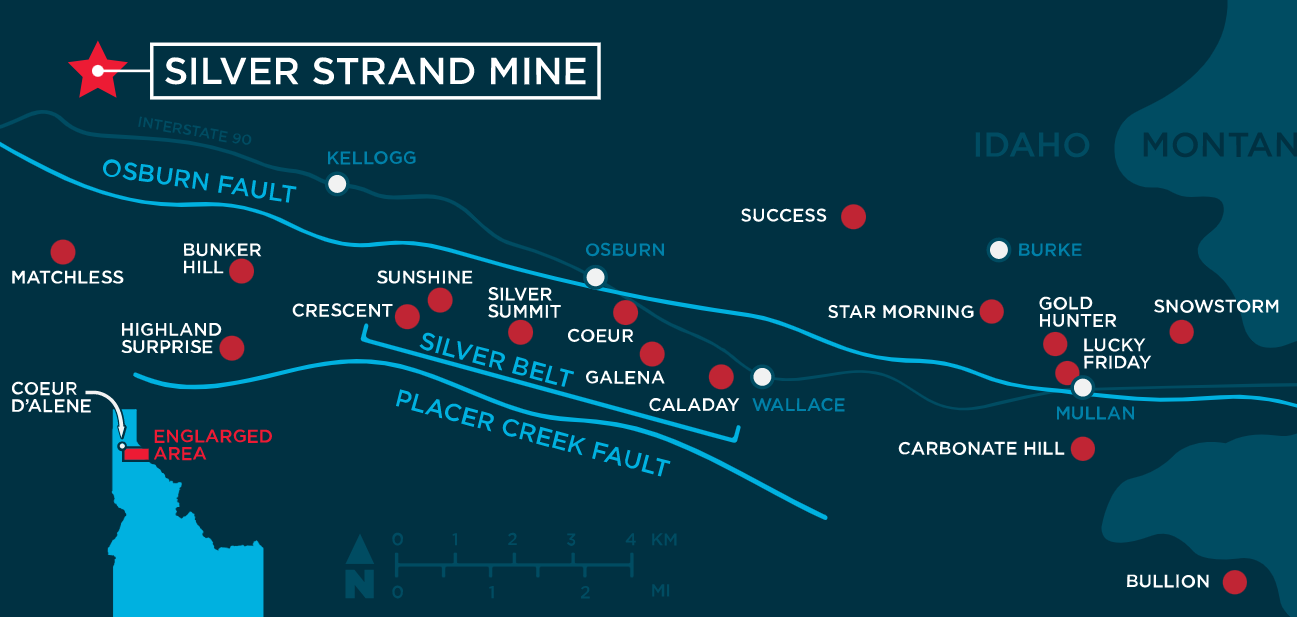

“Based on an independent report,” added Mr. Lekstorm, “we now know that the nearby Lucky Friday Mine, located 63.5 kilometres west of Silver Strand, known for its significant, ongoing silver production, was once Idaho’s largest gold producer, so it’s not surprising to us that we are seeing such strong gold mineralization in these near-surface drill holes.”

Silver Hammer Mining is engaged in the exploration of mineral properties in North America, including The Silver Strand Mine in Idaho, the Eliza Silver and Silverton Silver Mine in Nevada, and the Lacy Gold Project in British Columbia.

Shares in Silver Hammer Mining (HAMR) are down 4.29 per cent, trading at $0.67 per share as of 3:41 pm EST.