- Ethos Gold Corp. (ECC) has announced a non-brokered private placement financing for gross proceeds of up to $3,000,000

- The company will issue a combination of non-flow-through units priced at $0.60 and flow-through shares priced at $0.72

- The private placement is expected to close on or about March 31, 2022

- The company intends to use the net proceeds for exploration expenses and for general working capital purposes

- Ethos Gold is a Canada-based exploration company

- Ethos Gold Corp. (ECC) opened trading at C$0.24 per share

Ethos Gold Corp. (ECC) has announced a non-brokered private placement financing for gross proceeds of up to $3,000,000.

The company will issue a combination of non-flow-through units priced at $0.60 and flow-through shares priced at $0.72.

Each unit will consist of one common share and one-half of one share purchase warrant. Each warrant may be exercised to acquire one share at a price of $0.90 for a period of 24 months from the closing of the offering.

Warrants are subject to an acceleration clause.

The company intends to use the net proceeds for exploration expenses and for general working capital purposes.

All securities issued will be subject to a statutory four-month hold period.

The private placement is expected to close on or about March 31, 2022.

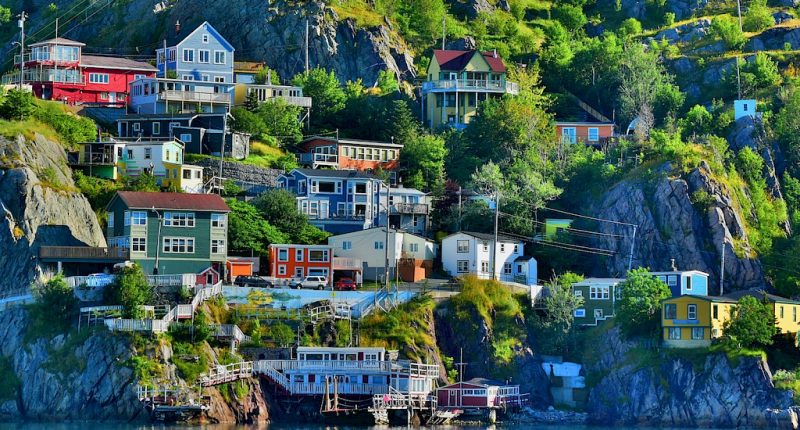

Ethos Gold is a Canada-based exploration company with a portfolio of district-scale projects in British Columbia, Ontario, Quebec, and Newfoundland that have large-scale discovery potential.

Ethos Gold Corp. (ECC) opened trading at C$0.24 per share.