- American Aires (WIFI) has closed the first tranche of a non-brokered private placement for aggregate gross proceeds of $75,000

- The company issued 750,000 units at a price of $0.10 per unit

- The net proceeds of the offering will be used for working capital and for other general and administrative costs

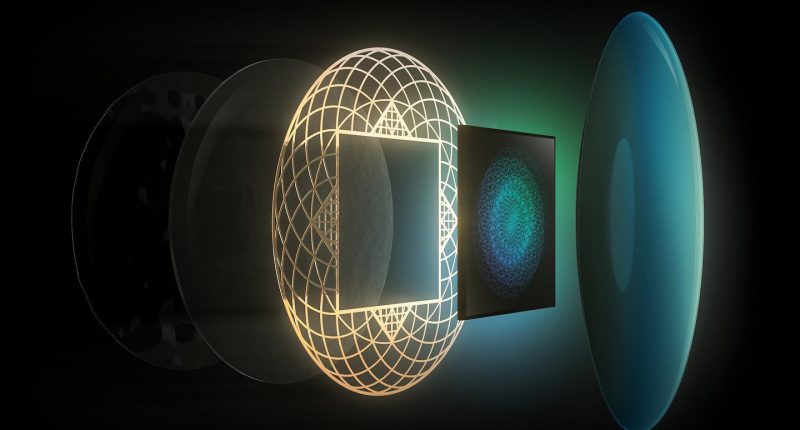

- American Aires is a nanotechnology company that develops silicon-based microprocessors that reduce the harmful effects of electromagnetic radiation

- American Aires (WIFI) opened trading at C$0.09 per share

American Aires (WIFI) has closed the first tranche of a non-brokered private placement for aggregate gross proceeds of $75,000.

The company issued 750,000 units at a price of $0.10 per unit. Each unit consists of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional share at a price of $0.10 for a period of thirty-six months from the closing of the offering. The warrants are subject to an acceleration clause.

American Aires issued 60,000 broker warrants to eligible finders.

The net proceeds of the offering will be used for working capital and for other general and administrative costs.

All securities issued under the offering are subject to a four-month hold period.

American Aires is a nanotechnology company that develops silicon-based microprocessors that reduce the harmful effects of electromagnetic radiation.

American Aires (WIFI) opened trading at C$0.09 per share.