- Delta Resources Limited (DLTA) has closed the sale of its Bellechasse-Timmins Gold Deposit to Yorkton Ventures for $1,700,000

- Delta retains a 1 per cent Net Smelter Return (NSR) royalty

- Delta Resources Limited is a Canadian mineral exploration company

- Delta Resources Limited (DLTA) opened trading at C$0.195 per share

Delta Resources Limited (DLTA) has closed the sale of its Bellechasse-Timmins Gold Deposit to Yorkton Ventures (YVI) for $1,700,000.

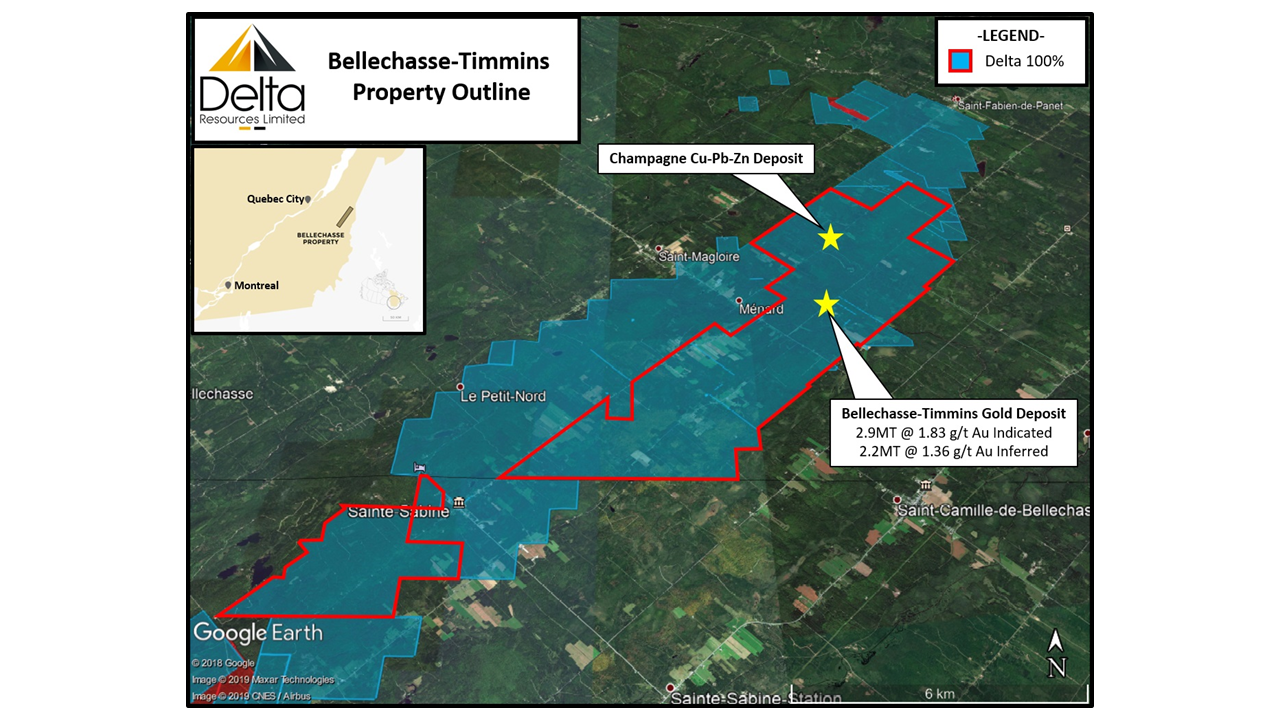

The Bellechasse-Timmins Gold Deposit is located in southeastern Quebec.

Andre Tessier, President of Delta Resources commented on the transaction.

“We are very pleased to conclude this transaction with Yorkton Ventures. Throughout this process, Yorkton has been transparent and in constant communication allowing for an efficient process to unfold despite some unavoidable delays. We wish Yorkton well in developing the property in the very amenable mining jurisdiction of Quebec.”

Andrew Lee Smith, Yorkton’s CEO added,

“Yorkton’s Board and management are pleased to have concluded this transaction with Delta. The company is looking forward to actively engaging the Bellechasse-Timmins Gold Project and the opportunity it represents to enhance shareholder value. The transaction proved to be a challenging process during the time of the pandemic, and on behalf of the Board I would like to thank Delta for their patience and support while completing the transaction.”

Delta retains a 1 per cent Net Smelter Return (NSR) royalty on any and all commercial production. Yorkton may re-purchase 0.5 per cent of the NSR for $1 million at any time.

Delta Resources Limited is a Canadian mineral exploration company focused on the exploration of high-potential gold and base metal projects in Canada.

Delta Resources Limited (DLTA) opened trading at C$0.195 per share.