- good natured Products (GDNP) announced its audited financial results Q4 2021 and FY2021

- Revenues for Q4 2021 increased 329 per cent to a record $22.9 million

- Revenue for FY2021 increased to $61.1 million compared to $16.7 million for FY2020

- The company incurred a net loss of $4.2 million in Q4 2021 and $12.7 million for FY2021

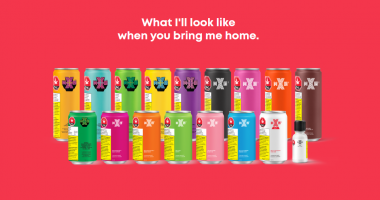

- good natured Products is focused on becoming North America’s leading earth-friendly plant-based products company

- good natured (GDNP) is up 6.67 per cent, trading at C$0.48 per share at 10:30 am ET

good natured Products (GDNP) announced its audited financial results for Q4 2021 and FY2021.

FY2021 was another transformational year for the company, with 266 per cent revenue growth driven by acquisitions and strong organic growth. Organic revenue growth was approximately 45 per cent, up from 22 per cent in the prior year, driven by a 300 per cent increase in active B2B customer accounts. The company also achieved its goal to improve adjusted EBITDA, and delivered positive adjusted EBITDA for the fourth quarter.

Revenue growth was also achieved through the addition of a commercial agreement with a national U.S. food producer, increases in average selling price per unit, along with the noted increase in B2B customers to over 1,200 active accounts on December 31, 2021, compared to 400 at December 31, 2020.

“Despite challenging macro economic conditions that required consistent and disciplined management of a changing business environment and global supply chain disruptions, good natured® again delivered record revenue performance in Q4 2021 and improved gross margins when compared to the third quarter,” stated Paul Antoniadis, CEO of good natured®.

“We’re off to a strong start in 2022, with our first quarter preliminary results indicating over 200% year-over-year revenue growth and gross margins near the high end of the targeted range. With robust end market demand driven in part by significant reshoring activity, combined with our investments in high-speed robotic machinery, I have never been more excited about what the future holds for good natured®and our owners!”

Key highlights:·

- Revenues for Q4 2021 increased 329 per cent to a record $22.9 million compared to $5.3 million for the three months ended December 31, 2020. Revenue for FY2021 increased 266 per cent to $61.1 million compared to $16.7 million for FY2020.

- Variable gross profit for Q4 2021 increased 262 per cent to $7.0 million and 30.5 per cent of sales, compared to $1.9 million and 36.2 per cent of sales for Q4 2020. Variable gross profit for FY2021 increased 207 per cent to $19.7 million and 32.2 per cent of sales, compared to $6.4 million and 38.4 per cent of sales for FY2020.

- Gross profit increased 205 per cent to $5.3 million for Q4 2021 and 151 per cent to $15.6 million for FY2021. Gross margin for Q4 2021 and FY2021 was 23.3 per cent and 25.6 per cent respectively.

- The company’s Adjusted EBITDA for Q4 2021 and FY2021 showed a gain of $0.5 million and a loss of $0.1 million, compared to a loss of $0.8 million and $1.5 million for Q4 2020 and FY2020 respectively.

- In Q4 2021, the company incurred a net loss of $4.2 million compared to a net loss of $3.2 million in Q4 2020. Net loss for FY2021 was $12.7 million compared to a net loss of $7.2 million for FY2020.

- Net working capital increased to $20.6 million as of December 31, 2021, compared to $5.6 million on December 31, 2020, an increase of 271 per cent.

good natured Products is focused on becoming North America’s leading earth-friendly plant-based products company.

good natured (GDNP) is up 6.67 per cent, trading at C$0.48 per share at 10:30 am ET.