- Common shares of Tuga Innovations (TUGA) are now eligible for electronic clearing and settlement through the DTC in the U.S

- DTC eligibility reduces costs and accelerates the settlement process for investors and brokers

- TUGA Innovations’ common shares will continue to trade on the CSE under the symbol TUGA

- TUGA Innovations is a development-stage EV company undertaking the conception, design, and production of specialized EVs

- Shares of Tuga Innovations Inc. (TUGA) opened trading at C$0.21

Common shares of Tuga Innovations (TUGA) are now eligible for electronic clearing and settlement through the DTC in the U.S.

DTC eligibility reduces costs and accelerates the settlement process for investors and brokers allowing its common shares to be traded over a wider selection of brokerage firms.

Existing investors benefit from potentially greater liquidity and faster execution speeds. This also opens the door to new investors that may have been previously restricted from purchasing the company’s common shares and simplifies the process of trading them in the United States.

TUGA Innovations’ common shares will continue to trade on the CSE under the symbol TUGA.

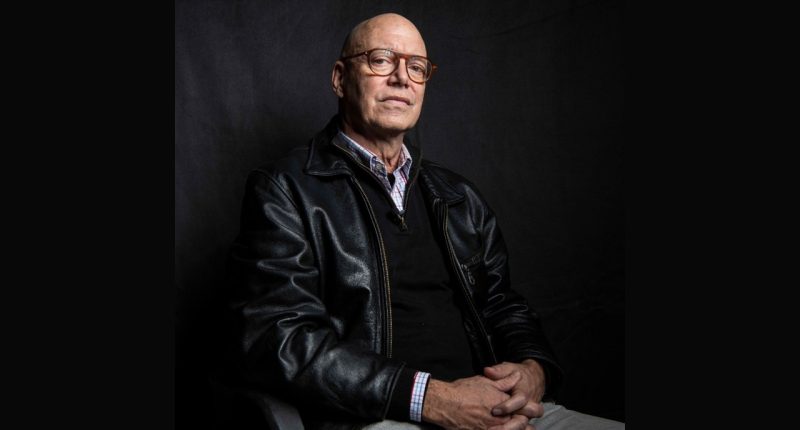

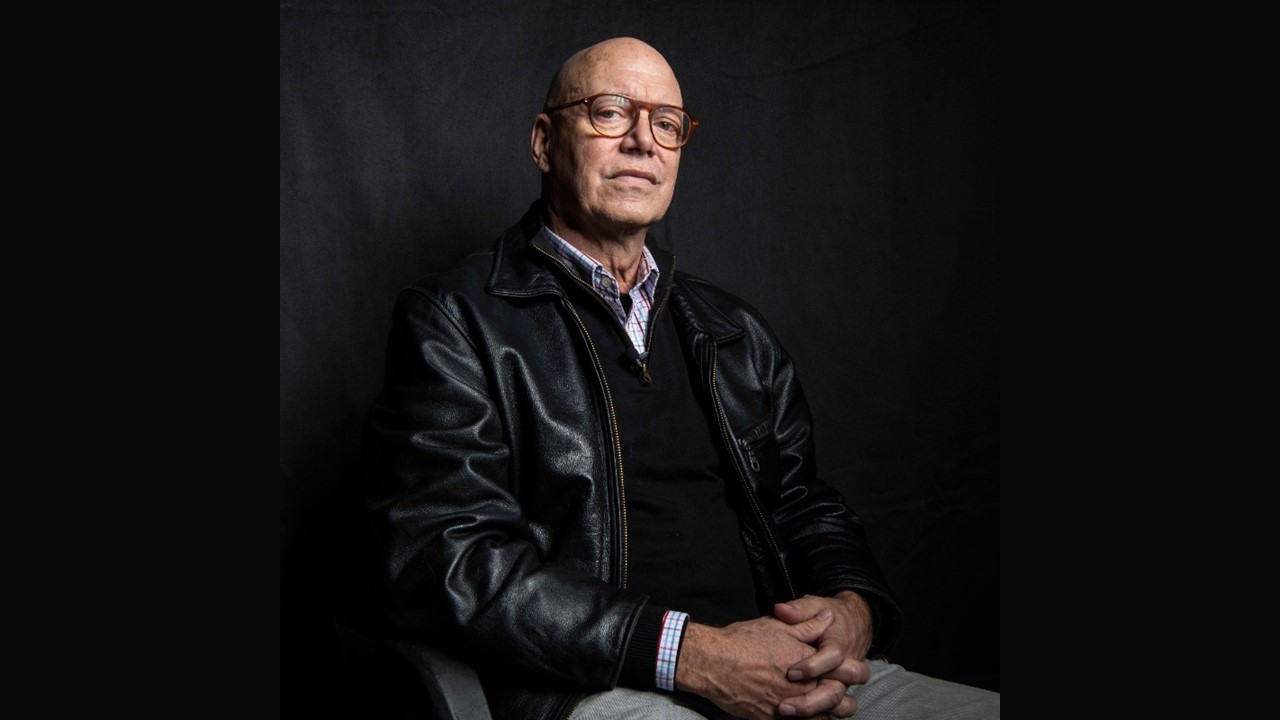

Company CEO John Hagie commented on the news.

“Today’s news is a vital milestone towards extending our market presence across the United States to engage with this large and important shareholder audience. DTC eligibility allows Tuga’s current and prospective shareholders a cost-efficient and timely method for the clearing and settlement of our common shares. Today’s news positions Tuga to engage with confidence, purpose, and consideration with current and future investors across the USA.”

TUGA Innovations is a development-stage EV company undertaking the conception, design, and production of specialized EVs to improve the urban mobility experience.

Shares of Tuga Innovations Inc. (TUGA) opened trading at C$0.21.