- ValOre Metals Corp.’s (VO) recent drilling at its Angilak Project intersected multiple shallow zones of radioactivity in seven holes

- Multiple zones of near-surface radioactivity intersected in seven holes

- Completed drilling expanded the prospective structure, doubling the historical trend

- 2022 drilling will follow-up the high-grade uranium oxide core intercepts from 2015

- Extended soil sampling will assess the uranium potential of the regional target

- ValOre Metals Corp. (VO) is up 2.44 per cent and is trading at $0.42 per share as of 2:58 p.m. ET.

Recent drilling at ValOre Metals’ (VO) Angilak Project intersected multiple shallow zones of radioactivity in seven holes.

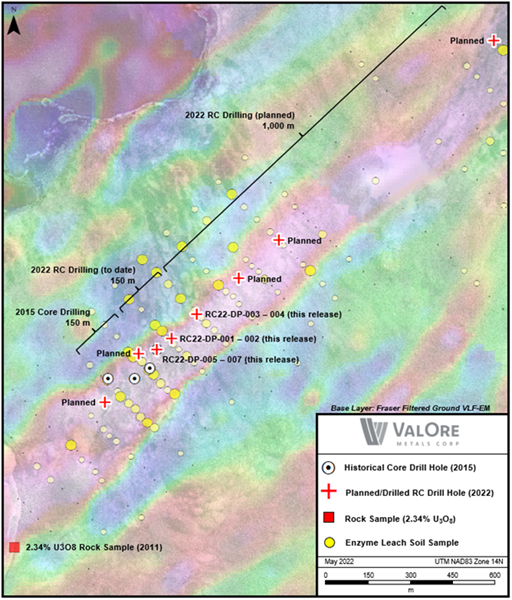

Multiple zones of near-surface radioactivity intersected in seven holes all of which returned high scintillometer counts per second (CPS) measurements with a maximum of 65,535 CPS in drill hole RC22-DP-005. A total of 43 samples have been taken.

The seven drill holes are from three drill sites at the Dipole Trend (shown above) out of a planned 16 holes. Completed drilling expanded the prospective structure along strike to the northeast, doubling the historical trend in length and wide open in both directions, and at depth. Significant intercepts to be followed-up in the summer core drilling program.

Exploration drilling at Dipole this year will follow up on the high-grade uranium oxide core intercepts from 2015, which outlined a 25- to the 48-metre-wide zone of multiple mineralized intervals hosted in a sequence of structurally weak volcanic rock horizons.

Furthermore, strong uranium anomalies are condensed on both ends of the grid, with the target conductor extending for approximately nine kilometres. Extended soil sampling will assess the uranium potential of this regional target.

If favourable results continue, an expansion to the 2022 drilling program at Dipole will be reviewed and considered.

ValOre Metals Corp. (VO) is up 2.44 per cent and is trading at $0.42 per share as of 2:58 p.m. ET.