- Ceylon Graphite Corp. (CYL) has closed a private placement for gross proceeds of $3,500,000

- The company issued 21,875,000 units priced at $0.16 per unit

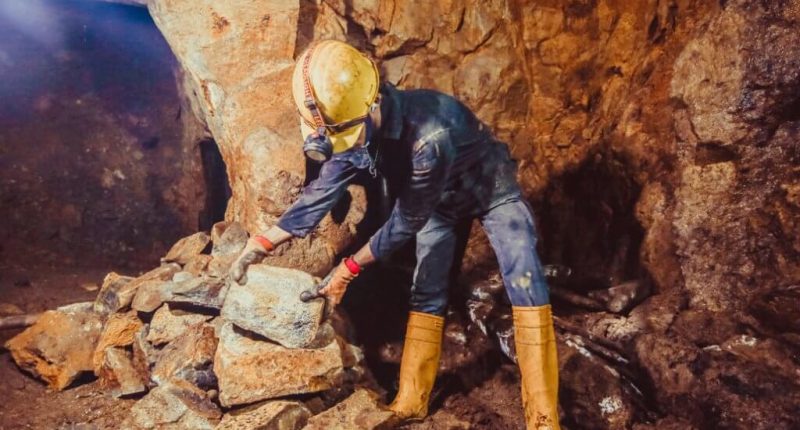

- Net proceeds will be used to advance the company’s K1 and M1 mines to commercial production

- Ceylon Graphite is in the business of developing and commercializing innovative graphene and graphite applications and products

- Ceylon Graphite Corp. (CYL) opened trading at C$0.135 per share

Ceylon Graphite Corp. (CYL) has closed its previously announced private placement for gross proceeds of $3,500,000.

The company issued 21,875,000 units priced at $0.16 per unit. Each unit consists of one common share and one common share purchase warrant. Each warrant entitles the holder to acquire one additional common share at a price of $0.25 until May 10, 2025.

Net proceeds will be used to advance the company’s K1 and M1 mines to commercial production.

Ceylon CEO, Don Baxter commented on the capital raise.

“I am extremely grateful for the support our strategic shareholders. I am looking forward to getting two mines producing graphite in the very near term. In the meantime, we continue our conversations with OEMs regarding their battery graphite supply requirements. We are witnessing a sea of change in attitudes from OEMs as they realize need for the supply of critical input materials to feed the battery factories they are announcing.”

All securities issued are subject to a statutory four-month hold period. PowerOne Capital Markets Limited and Primary Capital Inc. acted as finders and were paid a finder’s fee consisting of cash and warrants.

Ceylon Graphite is in the business of developing and commercializing innovative graphene and graphite applications and products.

Ceylon Graphite Corp. (CYL) opened trading at C$0.135 per share.