- Pure Gold Mining (PGM) has closed the final tranche of a non-brokered private placement for total gross proceeds of C$31,086,144

- During the second tranche, Pure Gold issued a total of 22,168,000 units, priced at C$0.15 per unit, for gross proceeds of $3,325,200

- Between the first and second Tranches, Pure Gold issued a total of 207,240,960 units

- Proceeds will be used to ramp up production at the PureGold Mine

- PureGold is a Canadian gold mining company, located in Red Lake, Ontario

- Pure Gold Mining Inc. (PGM) is up 2.63 per cent, trading at $0.195 per share at 3 pm ET

Pure Gold Mining (PGM) has closed the final tranche of a non-brokered private placement for total gross proceeds of C$31,086,144.

During the second tranche of the previously announced offering, Pure Gold issued 22,168,000 units, priced at C$0.15 per unit, for gross proceeds of $3,325,200. Each unit consists of one common share and one common share purchase warrant. Each warrant will entitle the holder to acquire one additional common share for six months from the closing date of the offering.

Between the first and second Tranches, Pure Gold issued a total of 207,240,960 units at a price of $0.15 per unit.

Pure Gold has issued 20,922,914 units to creditors to settle $3,138,437.10 in outstanding debt. Between this security for debt transaction and the private placement, the company has issued 228,163,874 units.

Mark O’Dea, Interim President & CEO of PureGold commented on the capital raise.

“On behalf of the Executive Team, I would like to thank our long-term shareholders for their continuing support and welcome all of our new shareholders to Pure Gold. This financing is intended to give the company the runway to bring stability to our operation and establish a profitable mining business in Canada. We are excited and committed to driving Pure Gold forward with a large, high-grade resource base, a strong and improving geological understanding of the deposit, significant opportunity for growth, and a talented new operating team at the helm.”

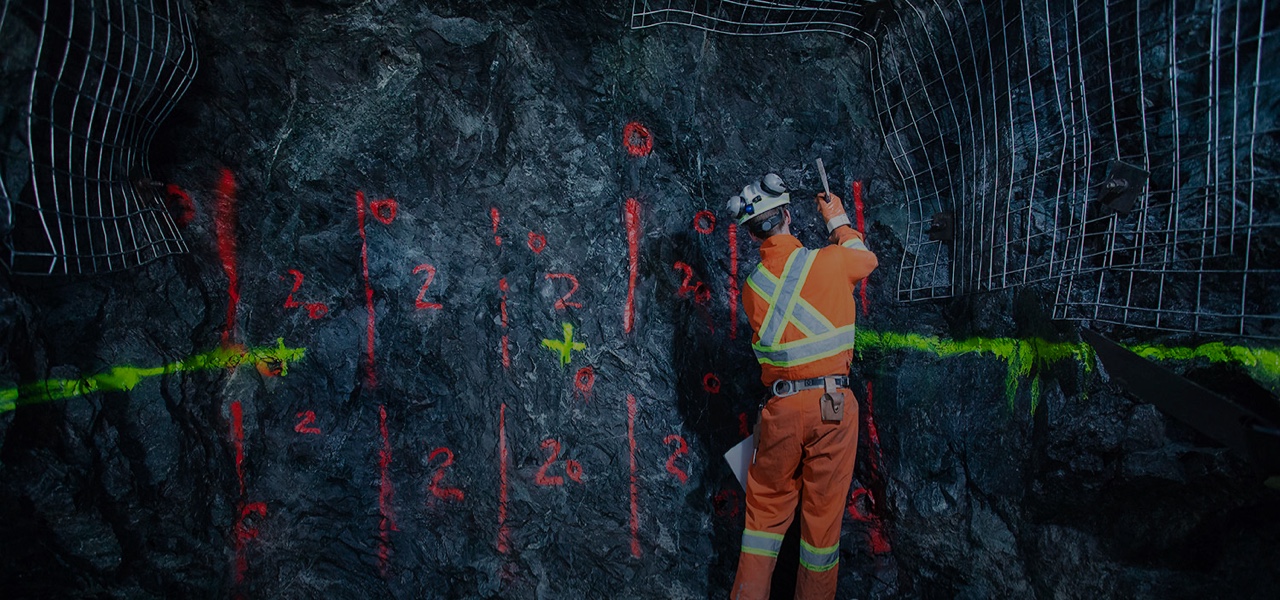

Proceeds will be used to ramp up production at the Pure Gold Mine to 800 TPD by Q3 2022, reducing operating and sustaining capital costs in Q2 2022 and for general corporate purposes. Pure Gold is a Canadian gold mining company located in Red Lake, Ontario. The company owns and operates the Pure Gold Mine, which entered commercial production in 2021.

PureGold is a Canadian gold mining company, located in Red Lake, Ontario. The company owns and operates the PureGold Mine, which entered commercial production in 2021.

Pure Gold Mining Inc. (PGM) is up 2.63 per cent, trading at $0.195 per share at 3 pm ET.