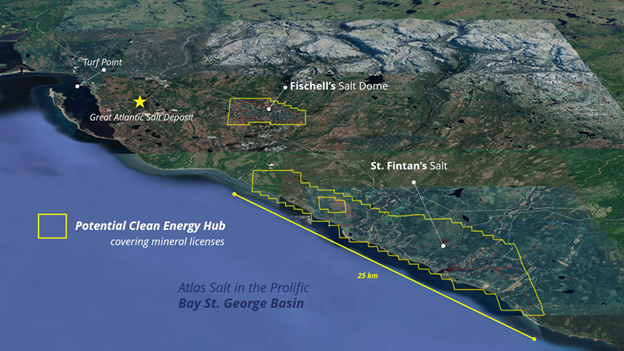

- Atlas Salt’s (SALT) recent survey on the Fichell’s Brooke Salt Dome suggest there is a second salt dome nearby

- The survey showed a second anomaly three kilometres east of Fichell’s Brooke

- It has the potential to be a large sized salt deposit

- Atlas said it is planning a spinout company to work on parts of the surrounding land

- The company is currently preparing an application to list its spinout

- Atlas Salt (SALT) is up 0.47 per cent and is trading at $2.13 per share as of 2:25 p.m. ET

Atlas Salt (SALT) has announced results from a recent survey on the Fichell’s Brooke Salt Dome.

According to Atlas, the survey showed a second anomaly three kilometres east of the currently established salt dome, which has yet to see any drilling. The company believes the signature of this new anomaly could be substantial in size.

“It is rare to see such an advantaged salt asset as Great Atlantic – massive and relatively shallow, high-grade, homogeneous and immediately next to a deep-water port… see what’s unfolding to the south in the Fischell’s Brook area, and how these salt domes could help anchor a potential clean energy hub,” Rowland Howe, President of Atlas, said.

The eastern anomaly signature is consistent with the district-scale salt potential of Atlas’ Newfoundland land package, parts of which will form a strategic near-term “spinout” aimed at unlocking additional shareholder value.

Atlas plans to “unlock the value” of its salt assets by creating a spinout company led by a separate management team with expertise in the clean energy space. This plan will progress alongside completing a feasibility study for its flagship Great Atlantic Project.

Currently, the company is preparing an application to list its spinout, NEWCO, on a Canadian stock exchange. Further details are pending.

Atlas Salt (SALT) is up 0.47 per cent and is trading at $2.13 per share as of 2:25 p.m. ET.