- Palamina Corp. (PA) paid US$4,000 to acquire 100 per cent of a 2 sq. km. titled internal concession at the Usicayos Gold Project & now holds 100 per cent title interest to 140 sq. km.

- Palamina is in process of completing the modification of its declaration to drill additional gold zones

- Palamina Corp. (PA) is trading at C$0.16

Palamina Corp. (PA) paid US$4,000 to acquire 100 per cent of a 200 hectare titled internal concession at the Usicayos Gold Project.

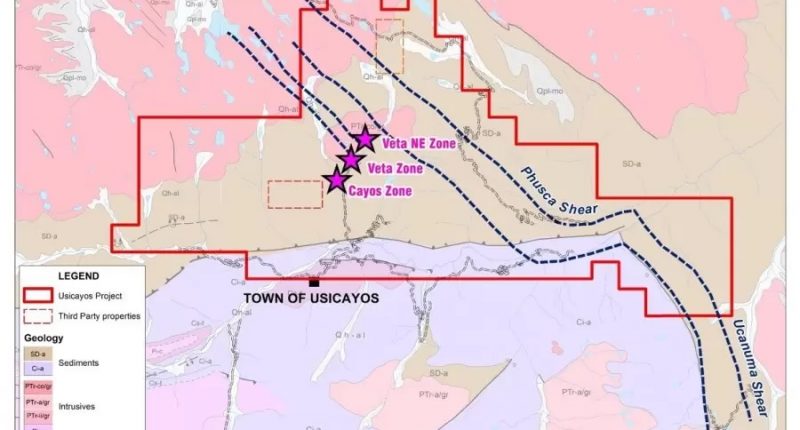

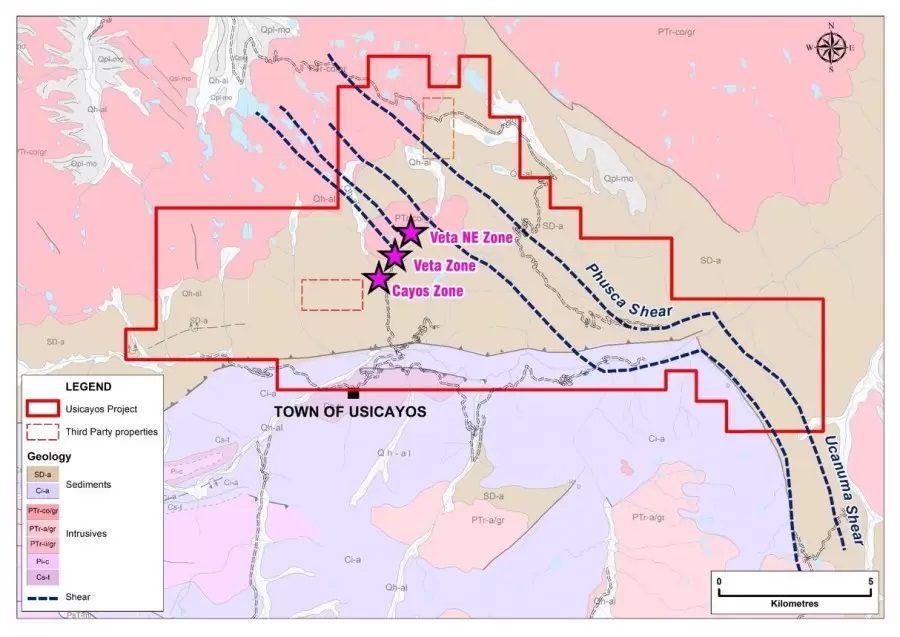

Palamina now holds 100 per cent title interest to 140 sq. km. (14,012 hectares) at Usicayos.

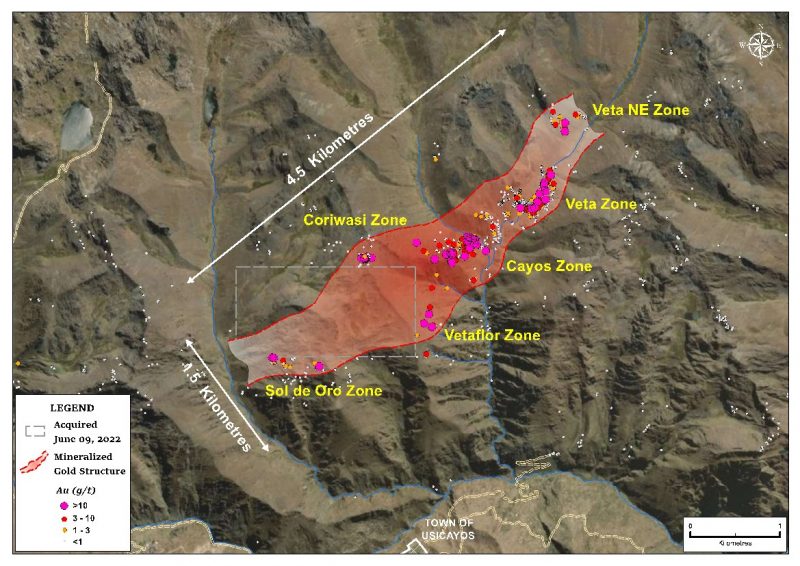

Andrew Thomson, President of Palamina explained that following the latest acquisition, Palamina now holds 100% title interest to the 1.5 km. wide by 4.5 km. long NE trending cluster of gold-bearing structures defined to date at Usicayos.

“Newly announced gold zones Sol de Oro, Veta Flor and Coriwasi host numerous small historic adits and gold mine sites formerly operated by informal miners seeking free gold within the NE trending shear zone structures. Drill pads will be allocated to all zones under Palamina’s existing drill permit. Palamina has completed VE-05-22 and VE-06-22 in the Veta Zone and submitted the drill core sections of interest from both holes to the assay lab and we are awaiting results.”

In May of 2022, Palamina resumed drilling and has completed those drill holes in order to test the last 200 metres at the north east end of the 800 metre mineralized gold strike length defined at surface.

Palamina is in process of completing the modification of its DIA (Declaración de Impacto Ambiental) in order to drill additional gold zones southwest of the Veta Zone.

Palamina has the first-mover advantage on 4 district-scale gold projects in southeastern Peru in the Puno Orogenic Gold Belt (POGB). A maiden drill program is underway at its flagship Usicayos Gold Project.

Palamina Corp. (PA) is trading at C$0.16.