- Ascot Resources Ltd. (AOT) slows down the development, financing, and exploration of the Premier Gold Project

- Ascot stated the project’s construction has been advanced in key areas but still needs to secure full alternative funding

- It is hoping to do so before the end of this month’s construction

- Ascot is working with potential financing partners including project lenders

- First gold pour will be delayed until between late 2023 and early 2024

- Ascot Resources Ltd. (AOT) is down 20.17 per cent trading at $0.45 per share as of 4:22 p.m. ET.

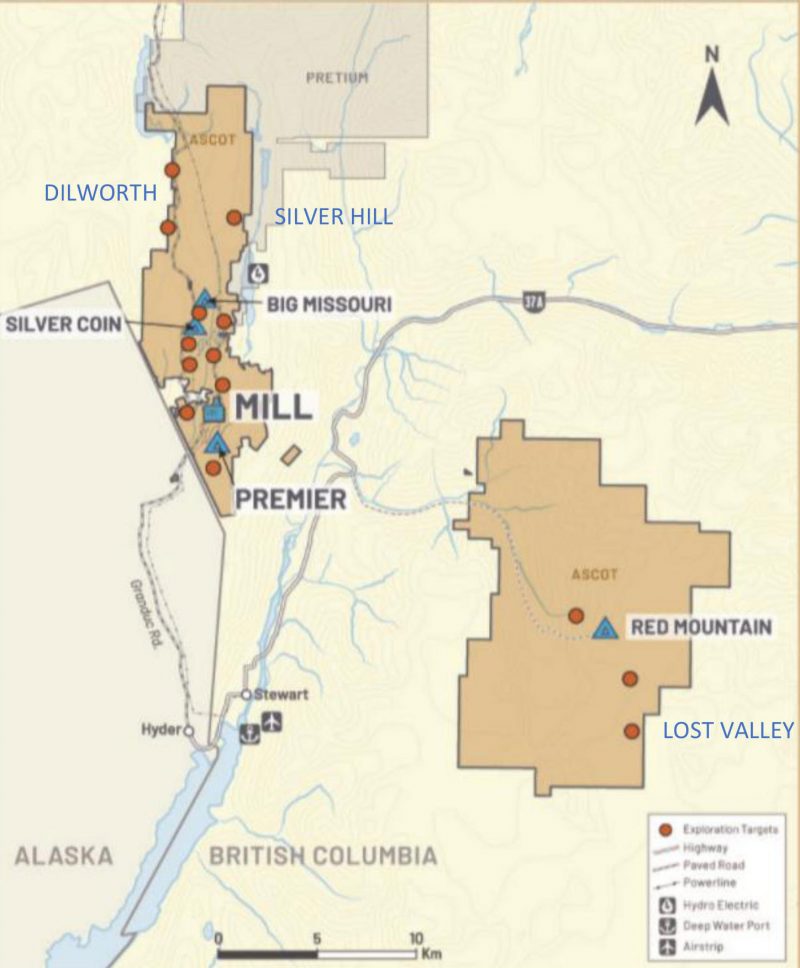

Ascot Resources (AOT) has slowed the development, financing, and exploration of the Premier Gold Project located on Nisga’a Nation Treaty Lands in B.C.

Ascot stated the project’s construction has been advanced in key areas but still needs to secure full alternative funding in order to avoid putting certain work packages on hold. It is hoping to do so before the end of this month’s construction of the tailings dam and new water treatment plant as these activities are limited to summer construction.

The company has been working with a growing number of potential financing partners including project lenders and streaming-royalty companies.

Ascot’s discussions are ongoing, and it believes a financing solution can be achieved in the foreseeable future. Until this funding is secured, Ascot will begin slowing construction activities and placing specific work packages on hold.

However, the underground mine development work and exploration program will remain on track. The deceleration of project construction will provide more time for mine plan and sequencing optimization. It will enable exploration drilling to determine the size, extent and high-grade continuity of the emerging Sebakwe Zone at the Premier deposit.

Given the company’s delays in construction areas, the target for first gold pour will be delayed from the first quarter of 2023 until between late 2023 and early 2024. Ascot stated it will be developing a more detailed construction timeline and will continue to assess any potential cost implications associated with this delay.

Ascot Resources Ltd. (AOT) is down 20.17 per cent trading at $0.45 per share as of 4:22 p.m. ET.