- Galiano Gold Inc. (GAU) has updated metallurgical test work and plant recoveries at its Asanko Gold Mine in Ghana, West Africa

- During Q2 2022, 16 diamond drill holes were completed, and the resulting 2,221 metre increments were tested as a preliminary recovery assessment, yielding encouraging results

- The company expects to release its full Q2 financial and operational results on August 11th, 2022

- Results of the independent laboratory testing are expected late in Q3 2022

- Shares of Galiano Gold Inc. were trading steady at $0.50 as of 4:20 pm ET

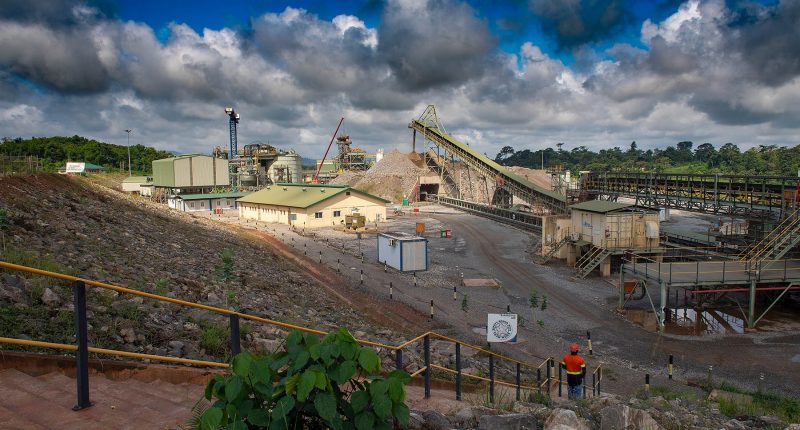

Galiano Gold (GAU) has updated metallurgical test work and plant recoveries at its Asanko Gold Mine.

During Q2 2022, 16 diamond drill holes were completed, and the resulting 2,221 metre increments were tested as a preliminary recovery assessment, yielding encouraging results. Significant work took place during this time to optimize the mine’s plant performance.

The mine is a 50/50 joint venture with Gold Fields Ltd. (NYSE:GFI) which is managed and operated by Galiano.

Galiano’s President and Chief Executive Officer, Matt Badylak explained that the team was encouraged by the strong performance in the plant during the quarter which resulted in preliminary production of 92,300 ounces for the first half of 2022.

“On the back of improving recoveries and robust production in H1, we expect to provide an update to full year guidance in our upcoming Q2 disclosures.”

The company expects to release its full Q2 financial and operational results after the market closes on August 11th, 2022. Results of the independent laboratory testing are expected late in Q3 2022.

Galiano’s Asanko Gold Mine is a multi-deposit complex, with two main deposits, the Obotan Project and the Esaase Project, both located in the Amansie West District of the Republic of Ghana, West Africa.

Shares of Galiano Gold Inc. were trading steady at $0.50 as of 4:20 pm ET.