- Record quarterly gold production of 59,723 ounces and gold sales of 59,783 ounces

- 37 per cent increase in gold production compared to Q2 2021

- Cash of $92.3 million at June 30, 2022, or C$0.27 per share – an increase of $15 million from March 31, 2022 and no debt

- Bonanza Grade Drill Results from Panteon North within the Limon Complex

- Calibre Mining Corp. (CXB) is up 5.88 per cent trading at $0.90 per share at 2:27 pm EDT.

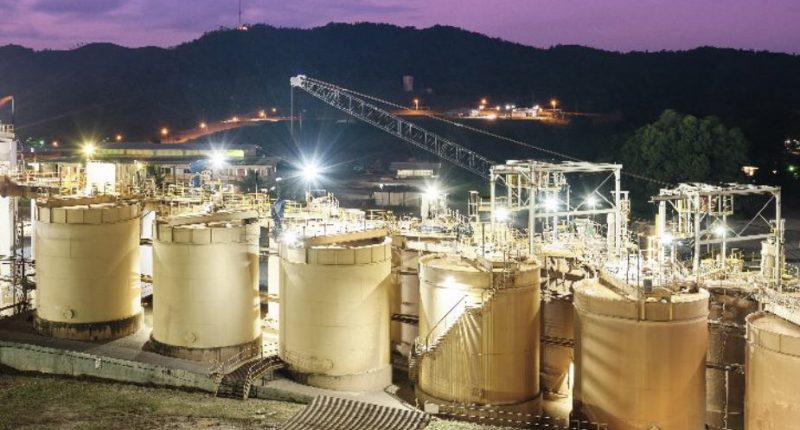

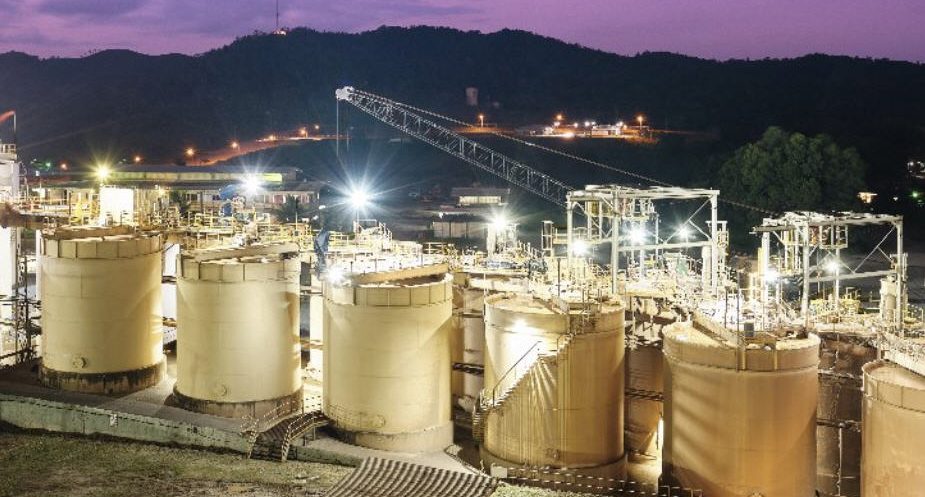

Calibre Mining Corp. (CXB) has announced operating results for the three and six months ended June 30, 2022.

The company also reported cash on hand at quarter-end (all amounts in U.S. dollars).

Q2 and Year to Date (YTD) 2022 production overview:

- Record consolidated quarterly gold production of 59,723 ounces and gold sales of 59,783 ounces

- 37% increase in gold production compared to Q2 2021 (43,506 ounces)

- Nicaragua gold production of 48,810 ounces and Nevada gold production of 10,913 ounces

- Consolidated year-to-date (YTD) gold production of 111,621 ounces, gold sales of 112,270 ounces and on track to deliver full-year guidance of 220,000 to 235,000 ounces

Q2 2022 highlights:

- Cash of $92.3 million on June 30, 2022 or C$0.27 per share – an increase of $15 million from March 31, 2022 and no debt

- Announced the grade-driven increasing production outlook 2023 increasing to 250 to 275 thousand ounces, 2024 increasing to 275 to 300 thousand ounces leading to lower per-ounce costs

- Received the environmental permit to develop the Pavon Central open pit

- 15 drills completed 62 kilometres of drilling across our operations which has led to new discoveries, resource-building opportunities and the potential for additional grade-driven production growth, including

- Bonanza-grade drill results from Panteon North within the Limon Complex

- 66.03 g/t Au over 5.6 metres Estimated True Width (ETW); 30.33 g/t Au over 5.0 m ETW

- 22.55 g/t Au over 4.9 metres ETW; 17.80 g/t Au over 7.3 m ETW

- New Versatile Time Domain Electromagnetic (VTEM) data outlines multiple kilometres of high-priority discovery and resource-building potential

- High-grade drill results from the Gold Rock Project in Nevada

- 2.94 g/t Au over 18.0 metres; 3.36 g/t Au over 22.9 metres

- 3.10 g/t Au over 18.3 metres; 2.19 g/t Au over 44.2 metres

- Positive metallurgical results demonstrating favourable heap leach recoveries and cycles times.

- Step-out drill results from the Pan Mine in Nevada

- 1.29 g/t Au over 18.3 m; 1.46 g/t Au over 9.1 metres

- 1.01 g/t Au over 9.1 m; 0.95 g/t Au over 15.2 metres

- Demonstrated resource expansion and higher-grade potential.

Darren Hall, President & CEO of Calibre, commented on the results.

“I am very pleased with the company’s second-quarter performance, delivering a record 59,723 ounces, positioning the company well to deliver its full-year guidance of 220,000 to 235,000 ounces. Our demonstrated quarter over quarter delivery and continued robust operating cash flows provide the opportunity to self-fund all growth opportunities and reinvest into exciting exploration across all the assets while maintaining a strong treasury.”

He went on to say:

“We continue to see the benefits of our commitment to exploration with the exciting results across the board, in particular at Limon with bonanza intercepts, in combination with our new VTEM data, demonstrate exciting potential to make new high-grade discoveries across multiple kilometres of strike extent.”

Finally, the company said its Q2 gold production of 59,723 ounces aligns with its original outlook for the year, and with production expected to increase during the second half with continued increasing grades the Company is well-positioned to meet its full-year gold production guidance of 220,000 to 235,000 ounces.

Calibre Mining Corp. (CXB) is up 5.88 per cent trading at $0.90 per share at 2:27 pm EDT.