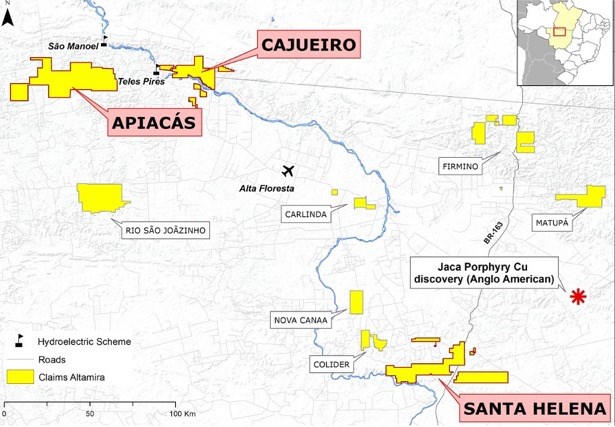

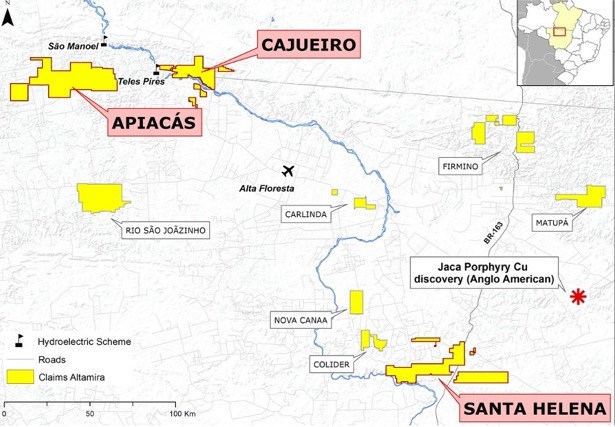

- Altamira Gold (ALTA) has identified a second significant copper anomaly at its Santa Helena Project in Mato Grosso State, Brazil

- Additional soil sampling in the project has also confirmed consistent copper values in the original soil anomaly. Both are being prepared for drill testing

- These anomalies measure 500 by 500 metres and 800 by 600 metres respectively and have consistent soil values above 46ppm with a peak of 448ppm

- There is no history of copper production in the Santa Helena area and previous artisanal mining activity has focused on high-grade gold, hosted in vein structures

- Altamira Gold is unchanged, trading at C$0.14 at 11:50 am ET

Altamira Gold (ALTA) has identified a second significant copper anomaly at its Santa Helena Project in Mato Grosso State, Brazil.

Additional soil sampling in the project has also confirmed consistent copper values in the original soil anomaly. Both are being prepared for drill testing

These anomalies measure 500 by 500 metres and 800 by 600 metres respectively and have consistent soil values above 46ppm with a peak of 448ppm.

There is no history of copper production in the Santa Helena area and previous artisanal mining activity has focused on high-grade gold, hosted in vein structures.

Drill core from hole STH0023 showing reactivation of vein structures. A: intensive potassic alteration of syenite with a chlorite (black) vein reactivated and filled by i) sericite (light grey) and ii) quartz/carbonate. B: chlorite/magnetite vein reactivated and filled by quartz/carbonate.

Altamira Gold’s President and CEO, Michael Bennett, commented that the definition of a second significant copper-in-soil anomaly adjacent to existing gold targets, and in association with porphyry-style alteration in drill core, is an exciting development and suggests that there is significant copper potential within our licenses at Santa Helena.

“The preservation of the upper and generally higher-grade parts of such alteration systems is rare in rocks of this age. However, the thick volcanics and sedimentary cover sequences that we believe formerly covered the area, appear to have contributed to the preservation of the prospective structural level where porphyry mineralization can be found. We look forward to drill testing these targets in a cost effective and speedy manner whilst we wait for drill results on a number of the peripheral gold targets.”

Altamira Gold Corp is a junior natural resource company engaged in the acquisition, exploration, development, and mining of mineral properties in Canada and Brazil.

Altamira Gold is unchanged, trading at C$0.14 at 11:50 am ET.