- Joint venture partners CGX Energy (OYL) and Frontera Energy (FEC) amended their joint operating agreement, effectively farming into the Corentyne and securing funding for Wei-1 exploration

- CGX will transfer 29.73 per cent of its participating interest in the Corentyne block and Frontera will fund the costs associated with Wei-1 exploration for US$130 million

- CGX will have a 32 per cent participating interest and Frontera will have a 68 per cent participating interest in the Corentyne block

- Final preparations are underway in advance of spudding Wei-1, the second exploration well, in October 2022

- The Wei-1 exploration well will be drilled in water depth of 583 metres and to an anticipated total depth of 6,248 metres

- CGX Energy (OYL) was down 10.40 per cent trading at $1.12 per share as of 9:40 am ET

JV partners CGX Energy (OYL) and Frontera Energy (FEC) have amended their joint operating agreement, securing funding for Wei-1 exploration.

CGX will transfer 29.73 per cent of its participating interest in the Corentyne block to Frontera in exchange for Frontera funding the joint venture’s costs associated with the Wei-1 exploration well for up to US$130 million and up to an additional US$29 million of certain Kawa-1 exploration well, Wei-1 pre-drill, and other costs.

CGX will have a 32 per cent participating interest and Frontera will have a 68 per cent participating interest in the Corentyne block.

Final preparations are underway in advance of spudding Wei-1, the second exploration well, in October 2022.

The Wei-1 exploration well will be drilled in water depth of 583 metres and to an anticipated total depth of 6,248 metres.

CGX’s Executive Co-Chairman, Suresh Narine stated that this farm-in agreement will enables the company to strengthen its balance sheet.

“Our continued partnership with Frontera reflects the significant value we have created on the Corentyne license, and the opportunity set that is now before us following the discovery of hydrocarbons at the Kawa-1 exploration well. We are focused now on the transformational potential of the Corentyne block ahead of spudding the Wei-1 exploration well in October 2022, pending rig release from the current operator.”

The agreement was originally signed back in January 2019.

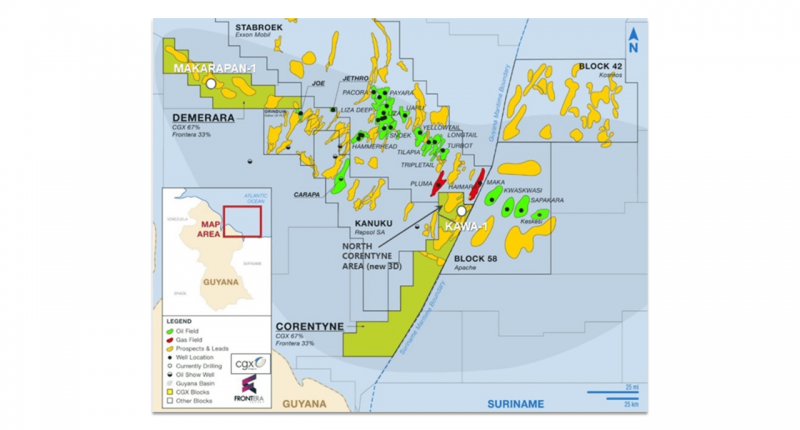

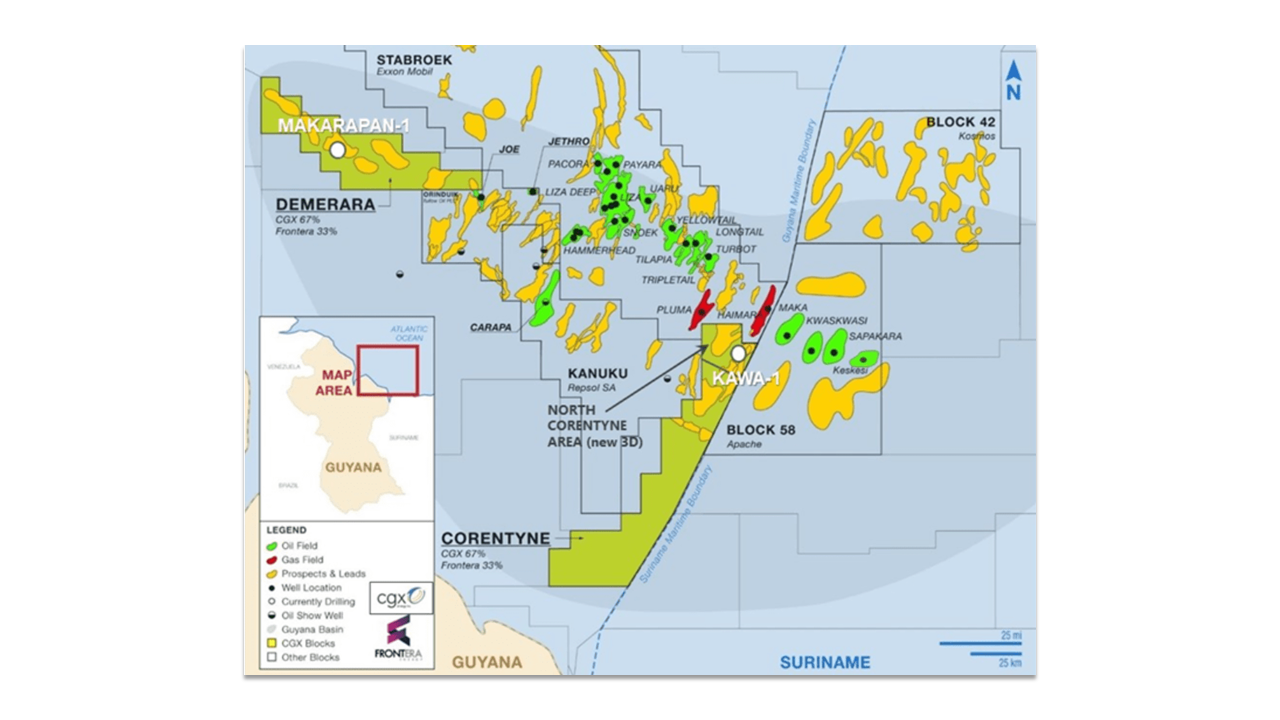

CGX is focused on oil exploration in the Guyana-Suriname Basin and the development of a deep-water port in Berbice, Guyana.

CGX Energy (OYL) was down 10.40 per cent trading at $1.12 per share as of 9:40 am ET.