- Aton Resources Inc. (AAN) gave an update on progress at its Hamama West gold-silver project in the Eastern Desert of Egypt

- The program was completed with a total of 6,620 metres drilled, including five holes at the West Garida prospect

- The Hamama West project has an indicated resource of 137,000 ounces of gold equivalent and an inferred resource of 341,000 ounces AuEq

- Aton Resources Inc. (AAN) is trading steady at C$0.25 per share at 9:30 am ET

Aton Resources Inc. (AAN) gave an update on progress at its Hamama West gold-silver project in the Eastern Desert of Egypt.

The program was completed on August 24, 2022, with a total of 6,620 metres drilled, including five holes at the West Garida prospect. Assay results have been received for the first 35 holes, HAP-101 to HAP-135, to date.

Significant intersections:

- 2.90 g/t Au, 68.9 g/t Ag and 3.71 g/t AuEq over a 37-metre interval from surface (drill hole HAP-115),

- 2.87 g/t Au, 54.3 g/t Ag and 3.51 AuEq over a 22-metre interval from 1 metre depth (hole HAP-110),

- 1.43 g/t Au, 24.1 g/t Ag and 1.72 g/t AuEq over a 32-metre interval from 3 metres depth (hole HAP-115)

The Hamama West project has an indicated resource of 137,000 ounces of gold equivalent, and an inferred resource of 341,000 ounces AuEq.

The program was designed by Aton, in conjunction with its mineral resource consultants, Cube Consulting, based out of Perth, Western Australia, to test the oxide and transitional portion of the Hamama West mineral resource estimate.

A total of 6,620 metres was drilled, mainly at the Hamama West zone. Three holes were completed, for 297 metres, at the Western Carbonate zone, and five holes, for 390 metres, at the West Garida prospect approximately 3 km east of Hamama West, with the remaining 5,933 metres drilled at Hamama West.

Aton’s Interim CEO, Tonno Vahk, explained that the program was completed on schedule, and the team is pleased with the results so far.

“The results are in line with our expectations, and again confirm that the Hamama West oxide gold cap will be an easily mineable body of oxide mineralisation outcropping at surface, and which metallurgical testing has shown to be eminently treatable using heap leach processing technology. As soon as all the results have been received they will be forwarded on to our consultants Cube Consulting, who will commence work on revising the Hamama West mineral resource estimate. The development of the Hamama West starter open pit and heap leach project on the outcropping oxides, as only the second commercial gold mining operation in Egypt, will be a huge step forwards for the mining and mineral exploration sector in Egypt, the Egyptian Mineral Resources Authority, and of course for Aton, and for all our stakeholders.”

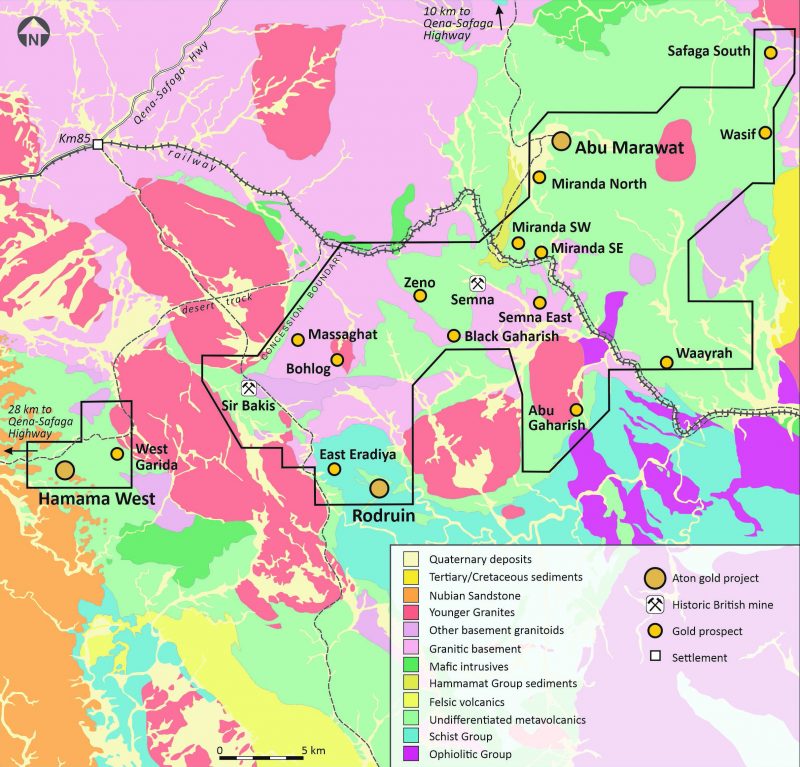

Aton Resources is an exploration company focused on its 100 per cent owned Abu Marawat Concession in Egypt’s Arabian-Nubian Shield. Aton has identified numerous gold and base metal exploration targets at Abu Marawat. Aton has also identified several distinct geological trends within Abu Marawat, which display potential for developing various styles of precious and base metal mineralization.

Aton Resources Inc. (AAN) is trading steady at C$0.25 per share at 9:30 am ET.