- Turquoise Hill Resources Ltd. (TRQ) has signed a term sheet with Rio Tinto International Holdings Ltd.

- Under the proposal, Turquoise Hill would sell all its outstanding common shares to Rio Tinto for $43 per share

- Rio Tinto previously offered to take ownership of Turquoise Hill Resources for $40.00 per share

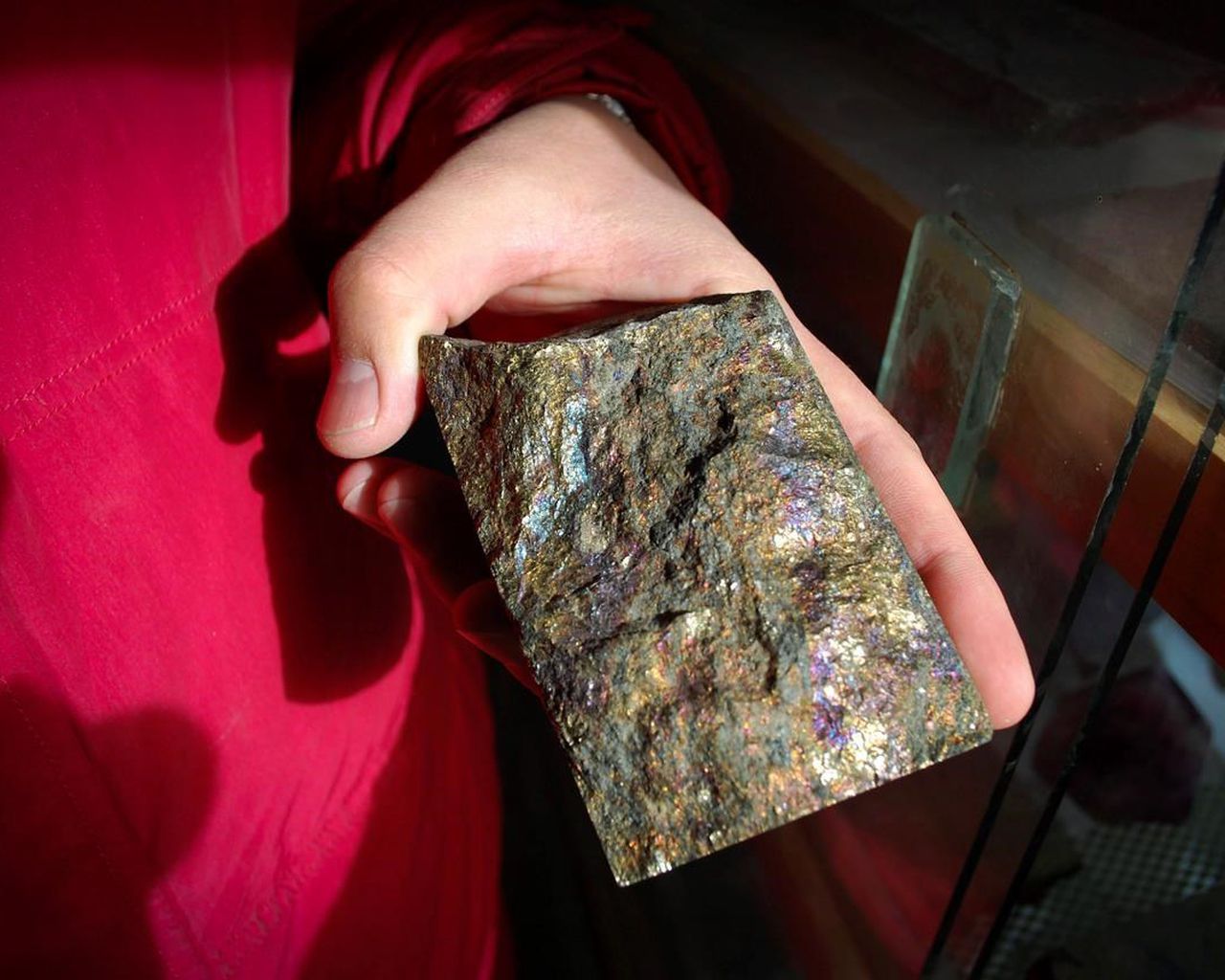

- Turquoise Hill is a mining company focused on the Oyu Tolgoi copper-gold mine

- Turquoise Hill Resources Ltd. (TRQ) opened trading at C$36.12

Turquoise Hill Resources (TRQ) has signed a term sheet with Rio Tinto International Holdings Ltd.

Turquoise Hill is an international mining company focused on the operation and continued development of the Oyu Tolgoi copper-gold mine in Mongolia, which is its only material mineral resource property. The new proposal is conditional on Turquoise Hill not raising additional equity capital.

Previously, Rio Tinto offered to acquire the company for $40.00 per share, but Turquoise Hill did not believe that amount accurately reflected its capital value.

TD Securities Inc. set the fair market value of the company’s common shares to be in the range of C$42 to C$58 per common share.

Turquoise Hill has been focused on raising at least US$650 million in new equity by year-end as required under its previously announced funding agreement with Rio Tinto.

Maryse Saint-Laurent, Chair of the Special Committee commented on the proposed transaction.

“Our discussions with Rio Tinto resulted in material increases from the price first offered by Rio Tinto to the minority shareholders of Turquoise Hill while also ensuring Turquoise Hill’s additional funding needs will be met pending the consideration by shareholders of the proposed Transaction. The Special Committee has diligently considered these and a wide variety of other factors in reaching its determination to unanimously approve entering into the agreement in principle.”

Turquoise Hill Resources Ltd. (TRQ) opened trading at C$36.12.