- Patriot Battery Metals (PMET) has closed a private placement for gross proceeds of $20,000,145.90

- The company issued 1,507,170 charity flow-through common shares at a price of $13.27 per share

- The gross proceeds received will be used for exploration expenses on the company’s Corvette Property in the James Bay area of Quebec

- Patriot Battery Metals Inc. is a mineral exploration company focused on the acquisition and development of mineral properties containing battery, base, and precious metals

- Patriot Battery Metals Inc. (PMET) opened trading at C$6.50

Patriot Battery Metals (PMET) has closed its previously-announced private placement for gross proceeds of $20,000,145.90.

The company issued 1,507,170 charity flow-through common shares at a price of $13.27 per share.

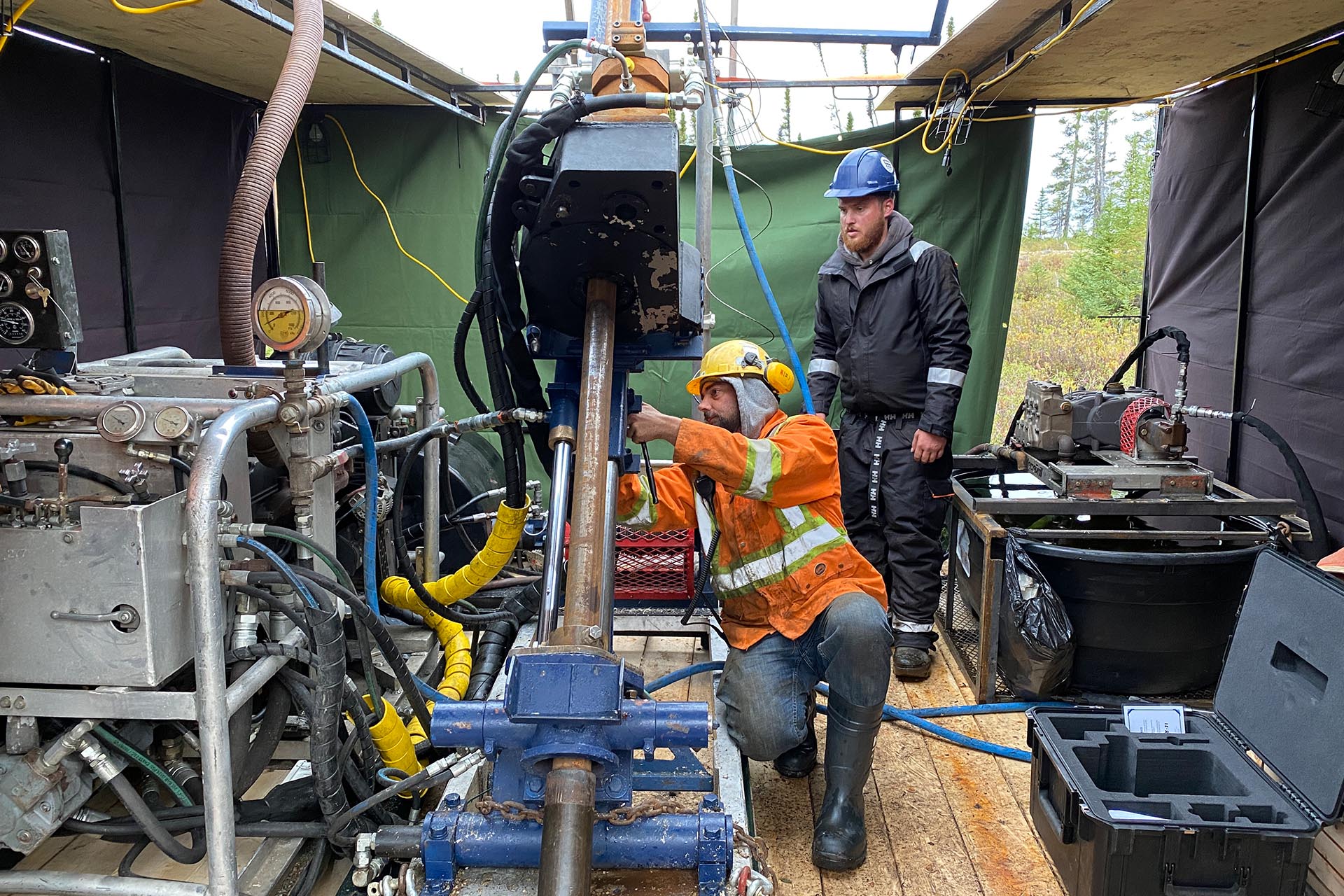

The gross proceeds received will be used to incur exploration expenses on the company’s Corvette Property in the James Bay area of Quebec.

Blair Way, President and CEO, commented on the capital raise.

“I am very pleased to be completing this significant financing for the Company at such a great premium. Our war chest is topped up again, and we are fully funded to undertake our winter and spring drill program for the Corvette project. We will continue to drill out the CV5 corridor and explore the other lithium pegmatite outcrop clusters identified on the property.”

The FT shares are subject to a statutory hold period of four months.

The company paid a commission of $454,216.77; and issued 71,530 broker warrants to eligible finders.

Patriot Battery Metals Inc. is a mineral exploration company focused on the acquisition and development of mineral properties containing battery, base, and precious metals. The company’s flagship asset is the 100 per cent owned Corvette Property, located in the James Bay Region of Québec.

Patriot Battery Metals Inc. (PMET) opened trading at C$6.50.