- Silver Bullet (SBMI) continues to yield high-grade gold and PGM assays

- Last month, the company unveiled significant levels of palladium, platinum, rhodium, osmium and gold in its concentrate

- To locate the source of these metals, it recently took samples around its mill site and the Buckeye Silver Mine

- Peter Clausi, Silver Bullet’s VP Capital Markets, spoke with Daniella Atkinson about the highly prospective assay results

- Silver Bullet Mines is focused on the discovery and development of mineral deposits in the U.S.

- Silver Bullet Mines (SBMI) opened with a gain of 8.82 per cent trading at $0.185 per share

Silver Bullet (SBMI) continues to yield high-grade gold and PGM assays.

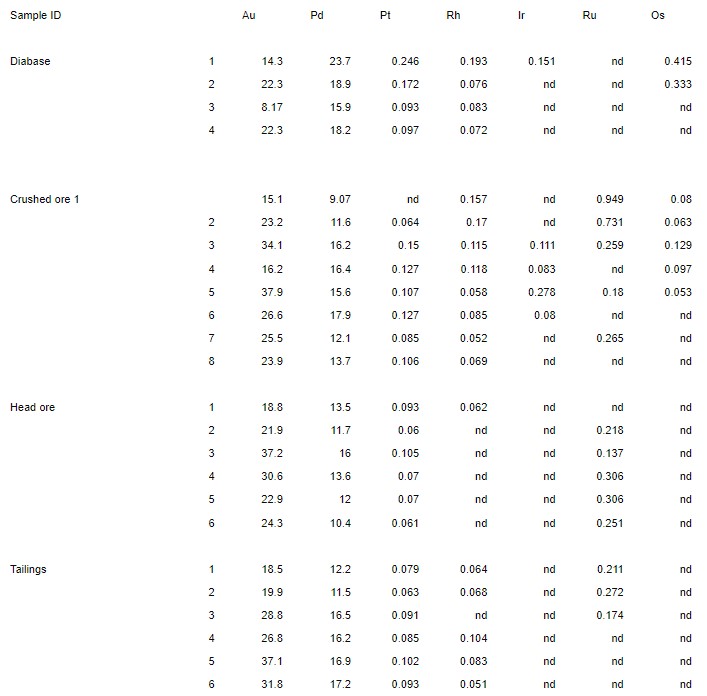

Last month, the company unveiled significant levels of palladium, platinum, rhodium, osmium and gold in its concentrate.

To locate the source of these metals, it recently took samples around its mill site and the Buckeye Silver Mine, including from crushed material, directly from the vein, from diabase samples from the wall rock and from tailings from the run of lower-grade material.

Management believes the results serve as strong evidence for Buckeye hosting economic amounts of the aforementioned metals.

The company has engaged third-party engineers, metallurgists and geologists to assist in creating a process flow sheet and determining the nature of Buckeye’s mineralized material. It has also had positive preliminary discussions with potential financiers for the funding of such work.

Peter Clausi, Silver Bullet’s VP Capital Markets, spoke with Daniella Atkinson about the results.

Assay results (g/t)

Silver Bullet Mines is focused on the discovery and development of mineral deposits in the U.S.

Silver Bullet Mines (SBMI) opened with a gain of 8.82 per cent trading at $0.185 per share.