- Delta Resources (DLTA) reports visible gold in two step-out drill holes at its Delta-1 project in Thunder Bay, Ontario

- Follow up of previous drill hole at Eureka Gold Zone

- The gold mineralization consists of a network of multiple generations of quartz-carbonate-pyrite veinlet

- Delta Resources (DLTA) is a Canadian mineral exploration company focused on the exploration of 2 gold and base-metal projects in Quebec and Ontario

- Delta Resources (DLTA) is trading at C$0.12 as of 3:15 pm ET

Delta Resources (DLTA) reports visible gold in 2 step-out drill holes at its Delta-1 project in Thunder Bay, Ontario.

Preliminary visual observations on the 2 drill holes were completed last month. This is a follow-up to the intersection of 11.9 metres of 14.8 g/t gold within a broader interval of 31.0 metres of 5.92 g/t gold in drill hole D1-22-18 at the Eureka Gold Zone.

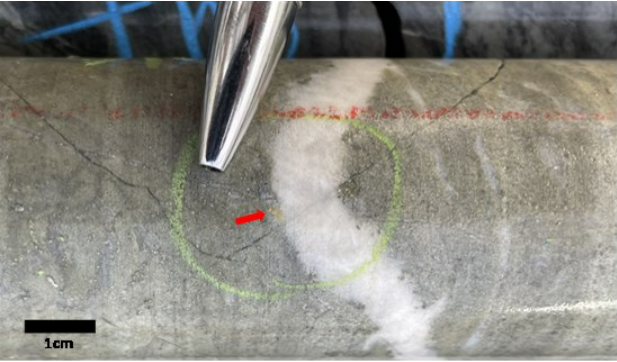

The 2 drill holes, D1-22-24 and D1-22-25, are for testing the eastern extension of the mineralization intersected in drill hole D1-22-18. The results are visible in the image below.

Plan View Map of 2 Drill Holes

Plan view map showing locations of the new drill holes (D1-22-24 and D1-22-25). The geology has been projected up-dip to the surface with step-outs of 50 metres and 100 metres, respectively. Drill hole D1-22-18 was also extended by 93 metres as results indicated it had ended in a mineralized interval.

The mineralized zone was intersected in drill holes D1-22-24 and D1-22-25, with visible gold observed in both holes. In drill hole D1-22-24, the mineralized zone is observed from 308 metres to 366 metres, with visible gold observed.

Both holes were drilled towards the south and inclined at -45 degrees, and therefore, the intersections are believed to represent close to true widths. Favourable host rock and alteration were also observed in the extension of D1-22-18.

These observations suggest the mineralized zone is now defined over a strike length of nearly 950 metres and a vertical depth of approximately 220 metres. The zone remains open in all directions and at depth.

The gold mineralization consists of a network of multiple generations of quartz-carbonate-pyrite veinlets ranging in widths between 1 mm to 10 cm within a zone of intense, texture-destructive carbonate, sericite and silica alteration. Visible gold is locally observed within the veinlets. Host rocks are believed to be sandstones, intermediate volcanics and amphibole-feldspar-phyric intermediate dikes.

The mineralized zone trends roughly 100° azimuth, dips 50° towards the north and has now been intersected over a strike length of approximately 950 m and a vertical depth exceeding 200 m.

The core from the drill holes was described and sampled at Delta’s core logging facilities in Chibougamau, Quebec. A total of 575 samples were collected and shipped on November 8th, 2022, to SGS Canada Minerals Laboratories in Sudbury, Ontario, for sample preparation and analysis. All assays are pending.

Delta Resources (DLTA) is a Canadian mineral exploration company focused on the exploration of 2 gold and base-metal projects in Quebec and Ontario.

Delta Resources (DLTA) is trading at C$0.12 as of 3:15 pm ET.