- Pacton Gold (PAC) will offer a C$2.5 million non-brokered private placement

- It intends to issue up to 10 million common shares priced at $0.25

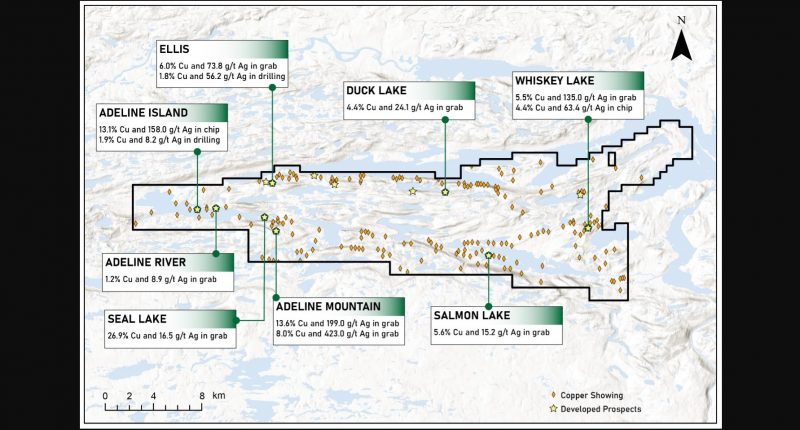

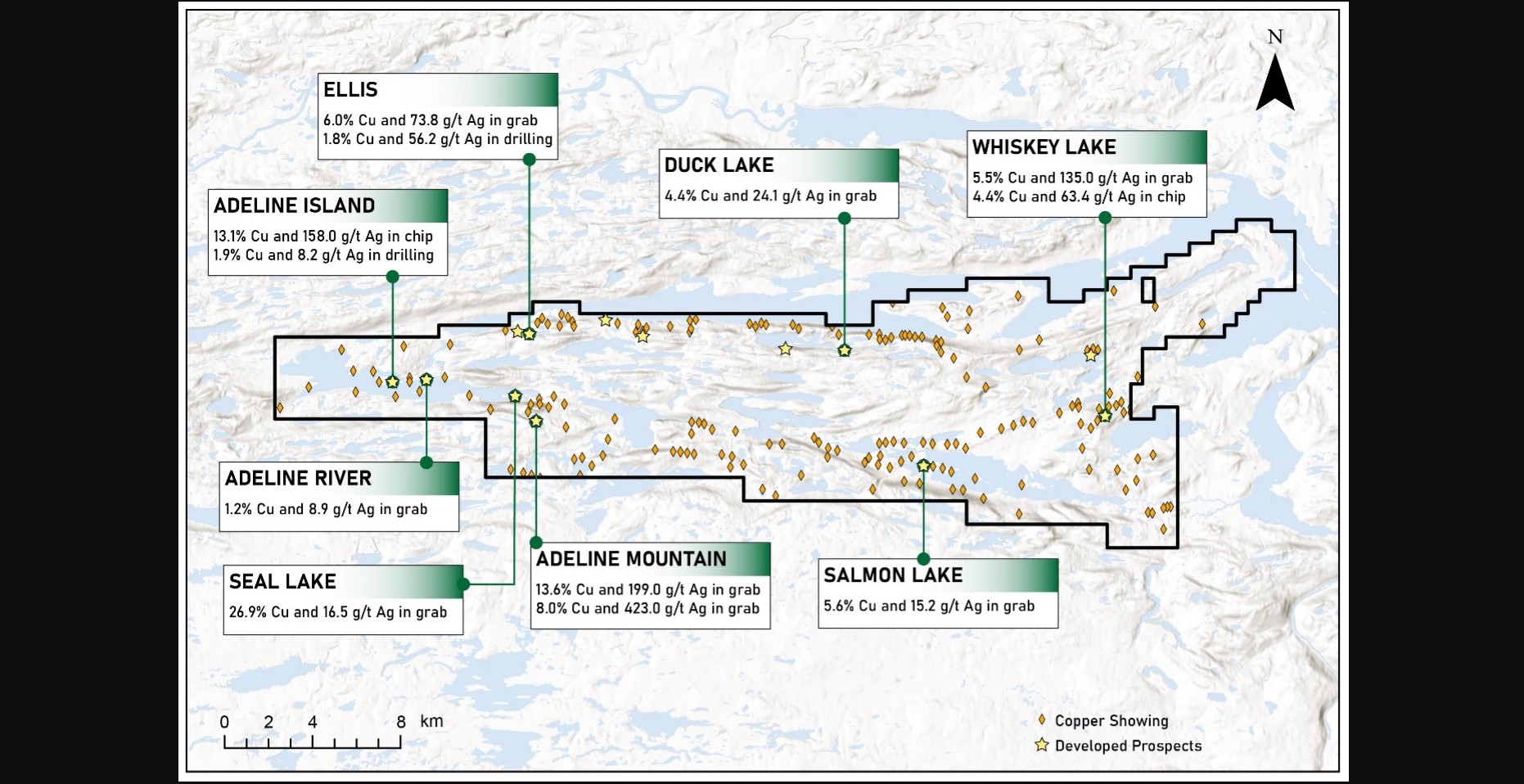

- The company will use the proceeds to complete its acquisition of and commence exploration and development on the high-grade Adeline Copper Project in Labrador

- Pacton Gold is focused on the exploration and development of high-grade mineral resource properties, primarily in Ontario, Canada

- Pacton Gold (PAC) opened unchanged, trading at $0.285 per share

Pacton Gold (PAC) will offer a C$2.5 million non-brokered private placement.

It intends to issue up to 10 million common shares priced at $0.25.

The company will use the proceeds to complete its acquisition of the high-grade Adeline Copper Project in Labrador, to commence exploration and development on the project, as well as for general working capital.

Adeline offers hundreds of significant copper targets, demonstrated ore grades and geology that suggests district-scale potential.

Closing of the offering is subject to customary conditions, including TSXV approval.

Red Cloud Securities is acting as a finder for the offering on behalf of the company.

Pacton Gold is focused on the exploration and development of high-grade mineral resource properties, primarily in Ontario, Canada. The company also owns a strategic portfolio of prospective projects in Western Australia.

Pacton Gold (PAC) opened unchanged, trading at $0.285 per share.