- Ucore Rare Metals (UCU) has upsized its previously-announced private placement

- The company has received subscription agreements for more than $4.2 million

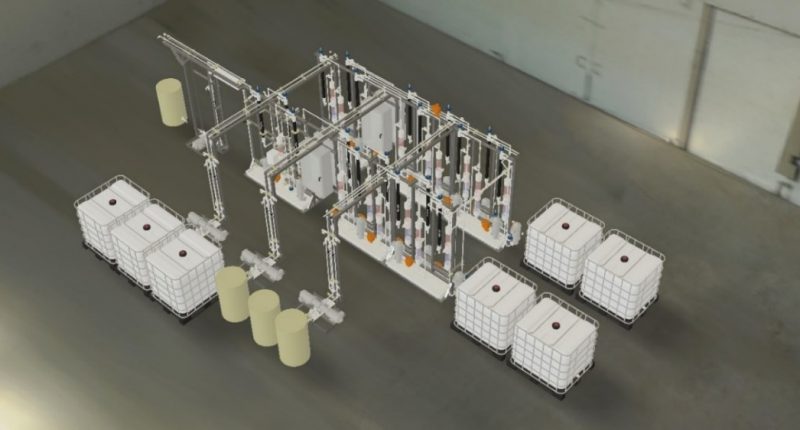

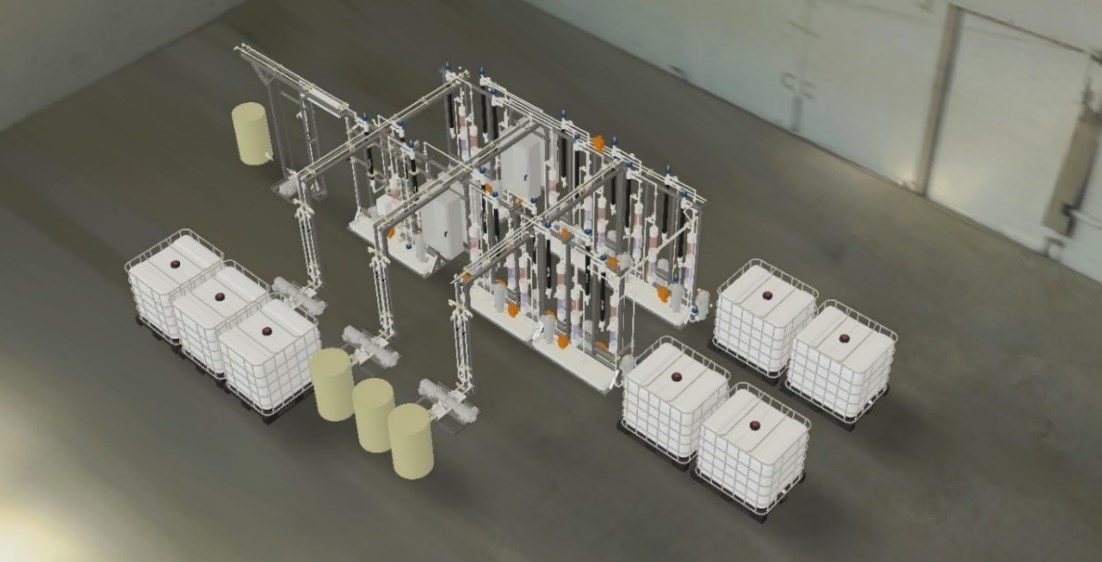

- The company will use the proceeds from the offering towards the commissioning of the company’s planned RapidSX demonstration plant, etc

- Ucore Rare Metals Inc. is focused on rare- and critical-metal resources, extraction, beneficiation, and separation technologies

- Ucore Rare Metals Inc. (UCU) opened trading at C$0.72

Ucore Rare Metals (UCU) has upsized its previously-announced private placement.

The company has received subscription agreements for more than $4.2 million and intends to increase the offering to accept these additional orders.

Each unit, priced at C$0.65, will consist of one common share of the company and one common share purchase warrant. Each warrant will entitle the holder to purchase one common share at a price of $0.85 for a 24-month term.

The company will use the proceeds from the offering towards the commissioning of the company’s planned RapidSX demonstration plant; the processing of initial feedstock through the demonstration plant; finalization of offtake and feedstock agreements; engineering work for the proposed Strategic Metals Complex in Louisiana, USA; and for general working capital purposes

To accommodate the additional orders, the offering is now expected to close on or about December 22, 2022.

Ucore Rare Metals Inc. is focused on rare- and critical-metal resources, extraction, beneficiation, and separation technologies with the potential for production, growth, and scalability.

Ucore Rare Metals Inc. (UCU) opened trading at C$0.72.