- Zonetail (ZONE) has closed the first tranche of a private placement for gross proceeds of $130,000

- Under the first tranche, the company issued a total of 3,250,000 units at $0.04 per unit

- A total of $511,790 was raised under a now-terminated private placement announced on August 26, 2022

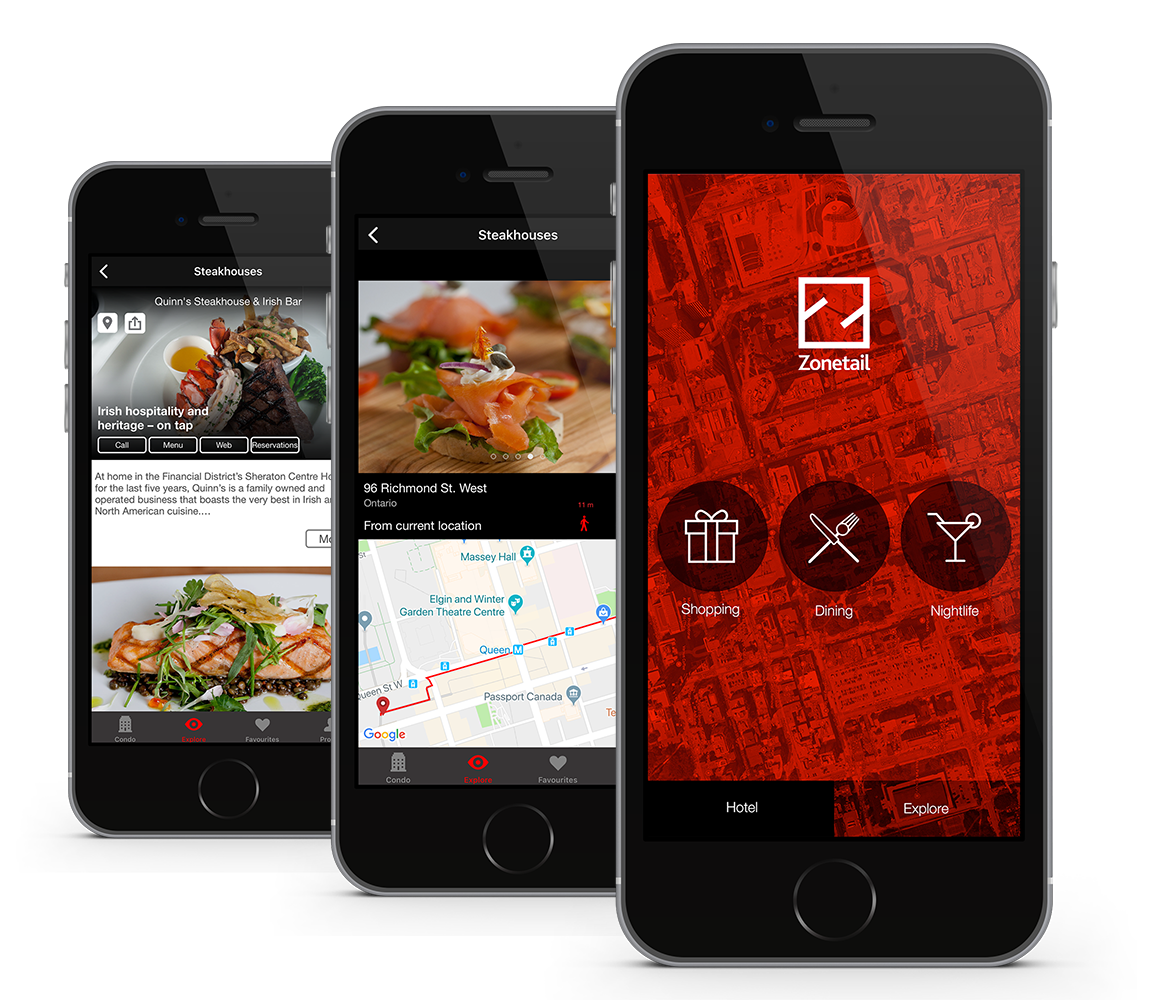

- Zonetail is a mobile platform provider serving residents and guests of high-rise residential buildings

- Zonetail Inc. (ZONE) opened trading at C$0.025

Zonetail (ZONE) has closed the first tranche of its previously announced private placement for gross proceeds of $130,000.

The offering consists of units at a price of $0.04, each consisting of one common share and one common share purchase warrant. Each warrant will entitle the holder to purchase one additional share at an exercise price of $0.06 for a period of thirty-six months from the closing date of the offering.

Under the first tranche, the company issued a total of 3,250,000 units.

The company paid eligible finders fees of approximately $7,800 and has issued a total of 195,000 finders warrants.

All securities are subject to a statutory four-month hold period.

The company is seeking to raise up to $500,000 under the offering and expects to complete the offering prior to January 27, 2023.

The proceeds will be used for general working capital purposes.

The company also announces that the private placement announced on August 26, 2022, has been terminated. A total of $511,790 was raised.

Zonetail is a well-known mobile platform provider serving residents and guests of high-rise residential buildings. The Zonetail platform connects residents to amenities and services through their personal mobile devices.

Zonetail Inc. (ZONE) opened trading at C$0.025.