- Ridgeline Minerals (RDG) intercepted high-grade grade minerals from its Chinchilla Zone at the Selena project in Nevada

- SE22-045 returned the single best intercept in the project’s history, 6.1 m grading 1,137.20 g/t AgEq (metal prices $20 Ag, $0.90 Pb, $1.25 Zn, $1800 Au,

- CEO Chad Peters spoke with Coreena Robertson about the results

- The company plans to begin delineating a maiden resource at the Chinchilla zone and start exploration drilling from more favourable drill pad locations at the Juniper and CRD targets

- Ridgeline Minerals Corp. (RDG) opened trading at C$0.315 per share

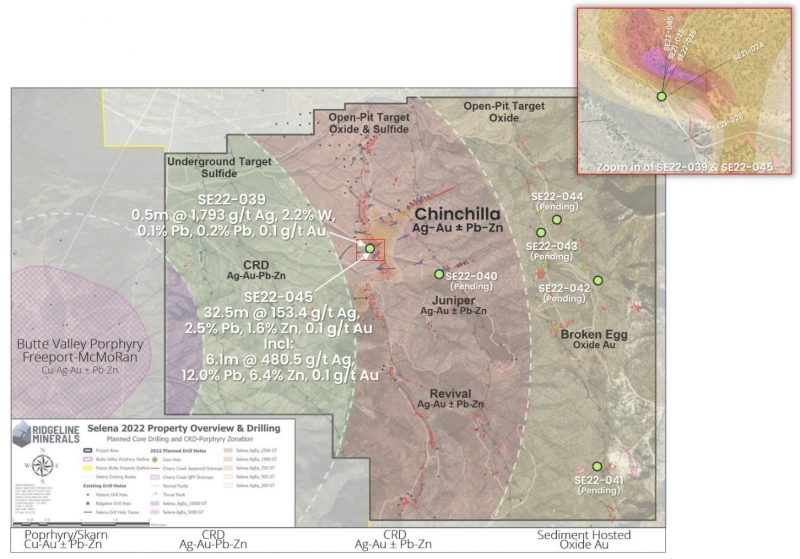

Ridgeline Minerals (RDG) intercepted high-grade grade minerals from its Chinchilla Zone at the Selena project in Nevada.

Silver (Ag), lead (Pb), zinc (Zn), and gold (Au) were intercepted with localized tungsten (W) mineralization across seven core holes. Assays are pending on the remaining five.

Highlights:

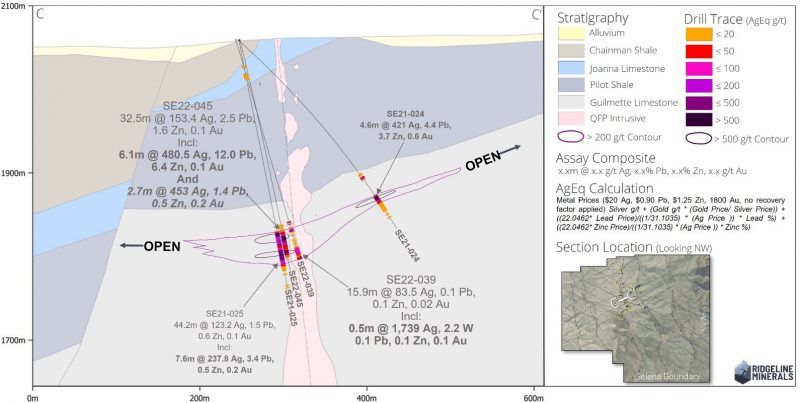

- SE22-045:32.5 metres grading 153.42 g/t Ag, 2.51 per cent Pb, 1.60 per cent Zn,0.09 g/t Au, starting at 235 m true vertical depth (TVD)

- Including 6.1 metres grading 480.52 g/t Ag, 12.0 per cent Pb, and 6.39 per cent Zn, 0.14 g/t Au in SE22-045

- Including 0.7 metres grading 1,347.73 g/t Ag, 28.89 per cent Pb and 12.02 per cent Zn, 0.11 g/t Au

- SE22-039: 15.9 metres grading 83.5 g/t Ag, 0.10 per cent Pb, 0.14 per cent Zn, 0.02 g/t Au, in SE22-039 starting at 230 mTVD;

- Including 0.5 metres grading 1,793 g/t Ag, 2.2 per cent W, 0.08 per cent Pb and 0.15 per cent Zn,0.09 g/t Au

- SE22-045 returned the single best Ag-Au-Pb-Zn CRD drill intercept in the project’s history

- If calculated on a silver equivalent (AgEq) basis, the highlight intercept returned 6.1 mETRES grading 1,137.20 g/t AgEq (metal prices $20 Ag, $0.90 Pb, $1.25 Zn, $1800 Au, no recovery factory applied)

High-grade silver-tungsten mineralization in SE22-039 is hosted within a quartz-feldspar porphyry-infilled fault zone. It is the first instance of tungsten at Selena, with additional infill drilling required to define the potential of this new mineralized zone.

CEO Chad Peters spoke with Coreena Robertson about the results.

Ridgeline’s Vice President of Exploration, Mike Harp, added that Hole 45 represents the single best drill intercept in the project’s history and highlights the company’s need for an aggressive infill program this year to upgrade the Chinchilla Zone to a maiden resource.

“Drilling to date suggests the potential to define both open-pit and underground mining scenarios at Chinchilla, with significant upside remaining along strike and within un-tested and highly prospective carbonate host rocks at depth.”

The company plans to begin delineating a maiden resource at the Chinchilla zone and start exploration drilling from more favourable drill pad locations at the Juniper and CRD targets. This work is expected to begin once permitting from the Bureau of Land Management is approved (by Q2, 2023).

| Chinchilla Zone – Q4 2022 Drill Program | ||||||||||

| Drill hole | Az/Dip | From

(m*) |

To

(m) |

Interval

(m) |

Ag (g/t) | Pb (per cent) | Zn (per cent) | Au (g/t) | TVD

(m)* |

Redox

State |

| SE22-045 | 007/-70 | 246.3 | 278.8 | 32.5 | 153.42 | 2.51 | 1.60 | 0.09 | 235 | Oxide |

| Including | 252.4 | 258.5 | 6.1 | 480.52 | 12.00 | 6.39 | 0.14 | |||

| Including | 253.9 | 254.6 | 0.7 | 1,347.73 | 28.89 | 12.02 | 0.11 | |||

| and | 270.6 | 273.3 | 2.7 | 452.96 | 1.42 | 0.54 | 0.15 | |||

| SE22-039 | 015/-70 | 231.7 | 235.1 | 3.4 | 83.90 | 1.45 | 1.92 | 0.02 | 224 | Sulfide |

| 240.9 | 244.5 | 3.6 | 57.97 | 0.53 | 0.43 | 0.06 | 230 | Oxide | ||

| 263.6 | 279.5 | 15.9 | 83.51 | 0.10 | 0.14 | 0.02 | ||||

| Including | 277.3 | 277.8 | 0.5 | 1,739.00 | 0.08 | 0.16 | 0.09 | |||

| *TVD – True Vertical Depth to the top of the drilled intercept. (To the extents known, true widths estimated at 70-90% of drilled intercept) | ||||||||||

Ridgeline Minerals is a gold-silver explorer with an exploration portfolio of five projects in Nevada and Idaho.

Ridgeline Minerals Corp. (RDG) opened trading at C$0.315 per share.