By Dr. Ryan D. Long, Mining and Metals Research Corp.

Silvercorp Metals Inc. (TSX:SVM) (NYSE:SVM) invited a group of analysts to an informational call on the geology of the Ying Mining District, China, where the company operates a number of mines and recently began pouring gold doré for the first time (Figure 1). This article and video contains a summary of the things I learned from that call.

Over the past three years, Silvercorp has been exploring for gold alongside producing, and exploring for, silver. Since commencing production at Ying way back in 2006, the company has received assay results from areas that were unusually rich in gold and produced gold as a by-product.

But it was not until 2020 that the full potential for gold mineralisation began to be recognized, when the company discovered a series of gently dipping quartz-ankerite-sulphide shear zones, which were crosscut and overprinted by the sub-vertical silver-lead-zinc veins. Sampling of these zones returned high-gold and copper grades and created a new exploration paradigm for the company.

Since this discovery, Silvercorp has increased its exploration activity and has been actively exploring for gold mineralisation with a series of exciting drill results, including these results from the LMW Mine:

W Zone:

- 1.11 metres at grades 18.0 grams per tonne (“g/t”) gold (“Au”), 32 g/t silver (“Ag”), and 8.38 per cent copper (“Cu”) – ZKX1009

Veins LM50 and LM26:

- 1.26 metres at grades of 10.79 g/t Au, 272 g/t Ag, 1.55 per cent Pb, 0.19 per cent zinc (“Zn”) and 0.10 per cent -ZKX0597

- 0.59 metres at grades of 22.79 g/t Au, 31 g/t Ag and 0.13 per cent Pb – ZKX0598

- 1.24 metres at grades of 28.9 g/t Au and 12 g/t Ag – ZKX3822

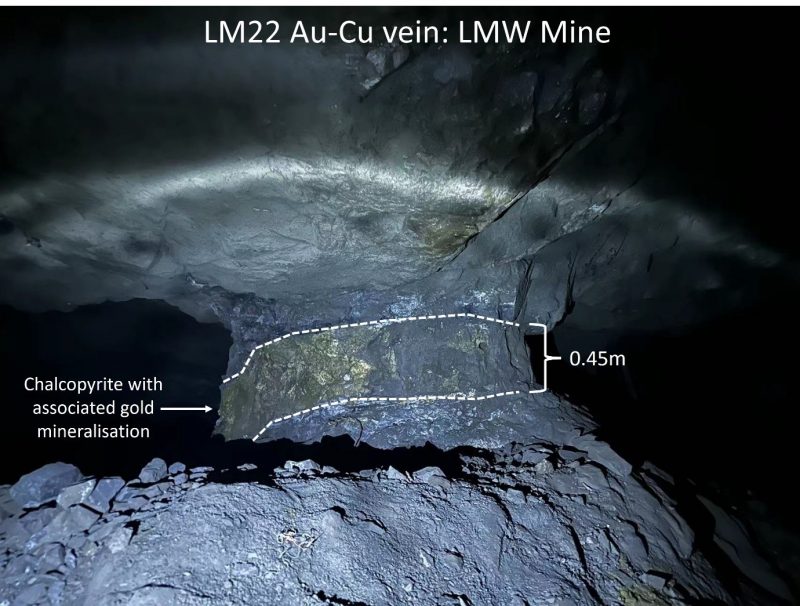

These veins have also begun to be uncovered along different levels of the LMW Mine, revealing two dominant types of gold-bearing veins. The first type is laterally and vertically extensive, north dipping, quartz sulphide veins that appear to have developed along low angle compression related fault planes and are associated with strong chalcopyrite mineralisation (Figure 2).

Figure 2: Photo of a Quartz-Chalcopyrite-Gold Vein

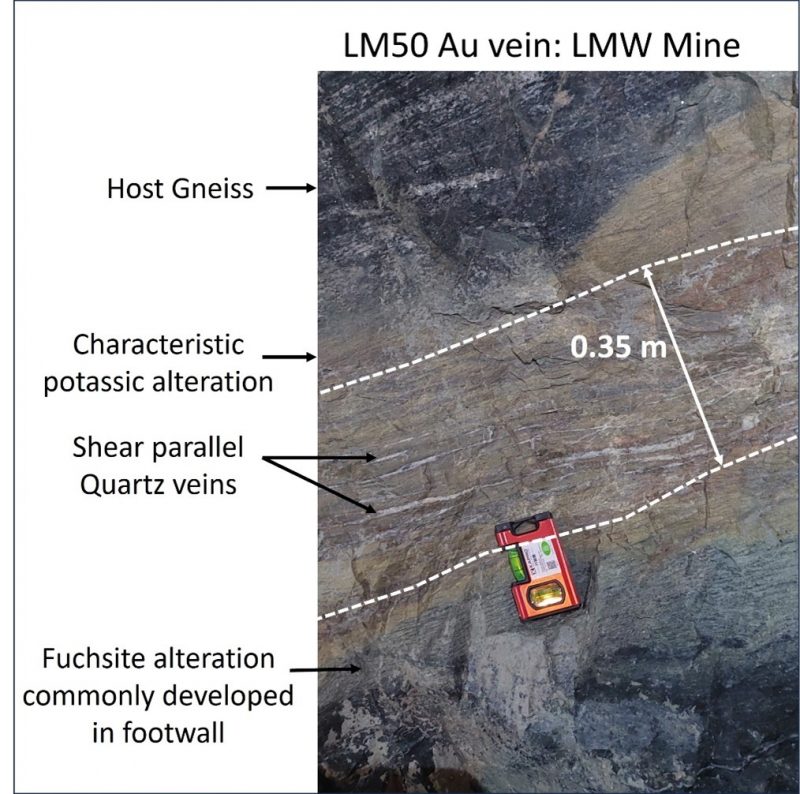

The second type of veins are associated with shear structures, containing prominent alteration of the host gneiss. These south dipping structures contain a series of thin bedding parallel quartz veins with fine disseminated pyrite (Figure 3).

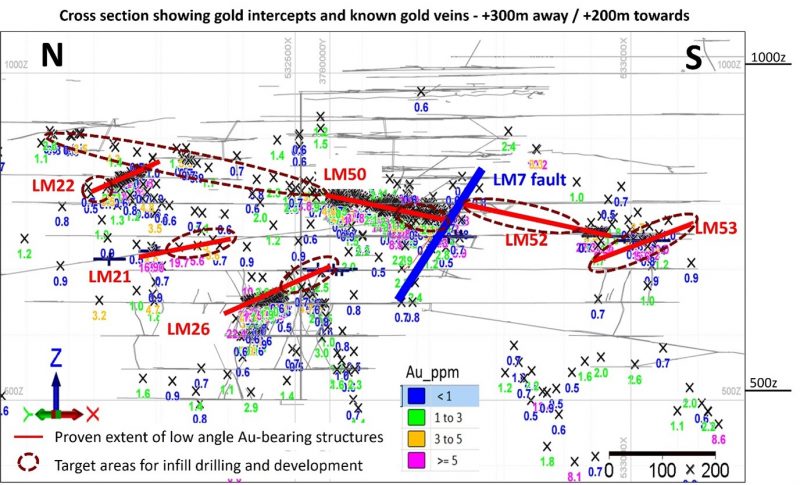

Silvercorp has just commenced gold mining activities that are focused on the LM50 Vein, given its high gold grade and proximity to existing mine development (Figure 4), but the extensive data set gives the company numerous targets for further gold production. Exploration activities are testing the lateral and horizontal extension potential of these gold-bearing veins, where gold mineralisation has already been intermittently intersected, shown as brown ellipses in Figure 4.

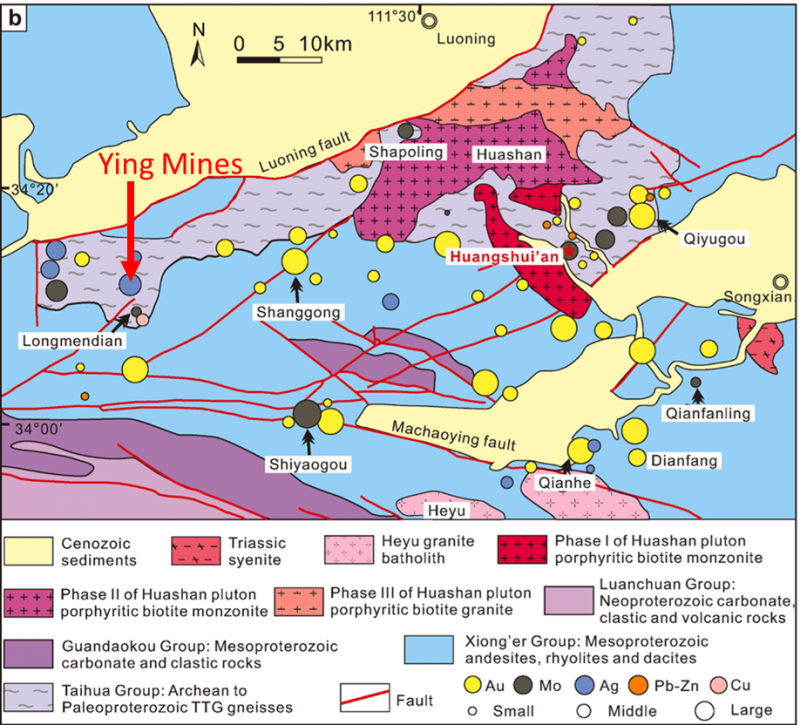

The potential for gold mineralisation is further highlighted by the wider regional geology. The Ying Mining District is within the Qinling Orogenic Belt, a 1,200 km long area of intense tectonic activity caused by the collision of the North and South China Cratons during the Early Mesozoic period. The Qinling Orogenic Belt is well known for its gold endowment, containing more gold deposits than silver deposits (Figure 5).

As Silvercorp began to understand the potential for gold mineralisation within the Ying Mining District, it looked to enhance its gold processing capabilities by further upgrading and optimizing its milling facility, including the addition of a new Knelson gold gravity separation circuit.

Silvercorp has increased its gold production by 105 per cent during its last quarter and plans to continue to increase its gold production into 2024.

As Silvercorp wraps up its exploration in 2023, it is gearing up to release an NI 43-101 report in the first half of 2024. We look forward to reviewing updated mineral resources and reserves estimates, as well as additional details on the growth in gold production.

For more information about Silvercorp’s projects, please visit www.silvercorpmetals.com/welcome.

Disclaimers

This is third-party provided content issued on behalf of Silvercorp Metals Inc., please see full disclaimer here.

The content in this article was originally published by Mining and Metals Research Corp. The information used to compile the article has been collected from publicly available sources and Mining and Metals Research Corp. cannot guarantee the 100 per cent accuracy of those sources. This communication is intended for information purposes only and does not constitute an offer, recommendation or solicitation to make any investments. Nothing in this communication constitutes investment, legal accounting or tax advice or a personal recommendation for any specific investor. Mining and Metals Research Corp. does not accept liability for loss arising from the use of this communication. This communication is not directed to any person in any jurisdiction where, by reason of that person’s nationality, residence or otherwise, such communications are prohibited. Mining and Metals Research Corp. may derive fees from the production of this newsletter.

Join the discussion: Find out what everybody’s saying about this stock on the Silvercorp Metals Inc. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.