- A new report by DesRosiers Automotive Consultants revealed that vehicle sales across Canada saw a substantial uptick in March 2024.

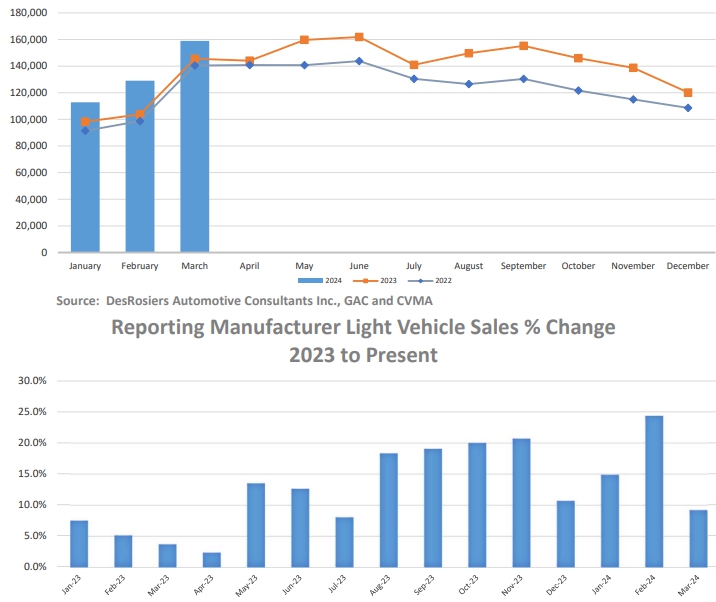

- 159,000 motor vehicles were sold throughout the country in March, marking a notable 9.2 per cent increase from the previous year

- The surge in vehicle sales across Canada presents lucrative opportunities for investors looking to capitalize on the automotive sector’s growth

- Ford Motor Co.’s ambitious foray into electric vehicle manufacturing underscores the industry’s shift towards sustainable mobility solutions, while Tesla’s recent challenges highlight the importance of prudent investment decisions amidst market volatility

In a new report by DesRosiers Automotive Consultants, it was revealed that vehicle sales across Canada saw a substantial uptick in March 2024. According to the data, a staggering 159,000 motor vehicles were sold throughout the country in March, marking a notable 9.2 per cent increase from the previous year. This surge in sales signifies a promising trend for the automotive industry in Canada, indicating robust consumer demand and economic resilience.

Reporting manufacturer light vehicle sales – 2022 to present

Investors keen on tapping into this burgeoning market should take note of significant developments within the automotive sector.

One such noteworthy development is Ford Motor Co.’s (NYSE:F) ambitious endeavor to transform its Oakville, Ontario, auto assembly plant into a “high-volume” electric vehicle manufacturing hub. With a substantial investment of $1.8 billion, although the start of production has been delayed until 2027, Ford aims to capitalize on the growing demand for electric vehicles (EVs) and position itself as a key player in the rapidly evolving automotive landscape.

General Motors Co. (NYSE:GM) has made headlines with its foray into the EV market. A recent test of Chevrolet’s electric pickup beat its already class-leading range figure and travelled more than 740 km on a single charge.

Both automotive stocks took a hit on Thursday after the DesRosiers report was released, but the two have performed well in the past month, with GM up 6.56 per cent and Ford up 3.43 in the past 30 days.

Performance on the investment highway

However, amidst the backdrop of soaring vehicle sales and Ford’s electrification initiative, Tesla Inc. (NASDAQ:TSLA) has encountered some challenges. The tech giant, renowned for its innovative electric vehicles, has faced an 11.12 per cent downturn in performance over the past month. Investors closely monitoring Tesla’s trajectory should exercise caution and assess the company’s strategies amidst increasing competition and market dynamics.

In the realm of Canadian stocks, two prominent players worth considering are manufacturing companies Linamar Corp. (TSX:LNR) and Magna International Inc. (TSX:MG).

Linamar Corp., despite also experiencing a dip in its stock value on Thursday, has exhibited significant growth over the past month up nearly 7 per cent, showcasing its resilience and potential for long-term investment. On the other hand, Magna International, while also witnessing a decline in stock performance on Thursday, has demonstrated consistent growth and stability to climb 0.78 per cent higher over the past year. Magna has positioned itself as a reliable investment option within the automotive industry.

Shift into gear

The surge in vehicle sales across Canada presents lucrative opportunities for investors looking to capitalize on the automotive sector’s growth. Ford’s ambitious foray into electric vehicle manufacturing underscores the industry’s shift towards sustainable mobility solutions, while Tesla’s recent challenges highlight the importance of prudent investment decisions amidst market volatility.

For investors eyeing Canadian stocks, Linamar Corp. and Magna International Inc. emerge as compelling options, each offering unique value propositions and growth potential. With careful consideration of industry trends, company strategies, and market dynamics, investors can strategically position themselves to reap the rewards of Canada’s thriving automotive market.

Join the discussion: Find out what everybody’s saying about automakers and other hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.