- Lexston Mining Corp. (CSE:LEXT) is about to begin its inaugural 2024 geological exploration program on its Itza uranium property in Nunavut

- Crews are anticipated to mobilize later this month to begin verifying historical results and ground truthing favourable anomalism in high priority target areas on the property

- This comes as the U.S. government recently banned imports of Russian uranium, which further deepened challenges of supply but also raised the demand for domestic sources.

- Lexston Mining Corp. (CSE:LEXT) last traded at $0.115 per share

Lexston Mining Corp. (CSE:LEXT) is about to begin its inaugural 2024 geological exploration program on its Itza uranium property in Nunavut.

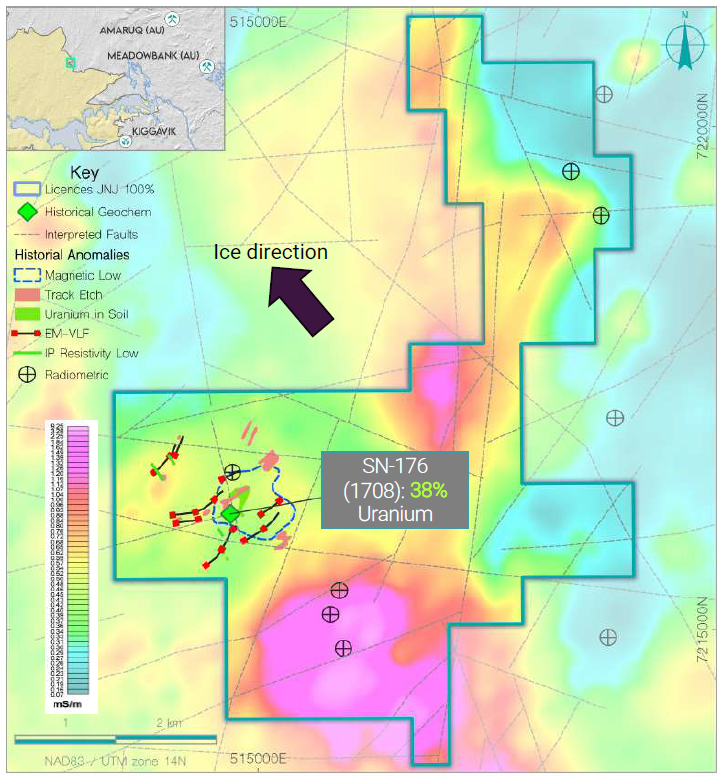

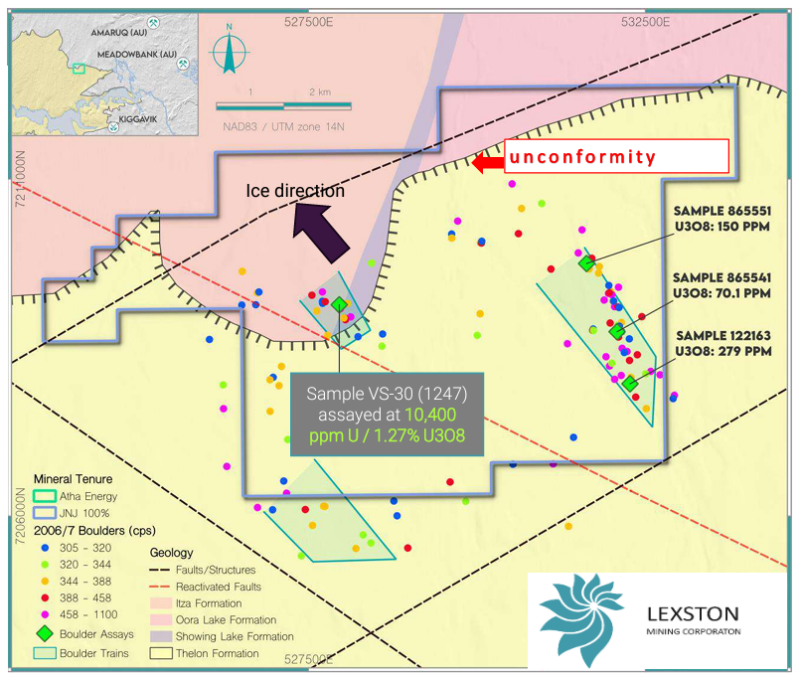

The Vancouver-based miner has engaged Aurora Geosciences Ltd. to prepare for the 2024 field season. Crews are anticipated to mobilize later this month to begin verifying historical results and ground truthing favourable anomalism in high priority target areas on the property, along with the 176 property.

Property highlights:

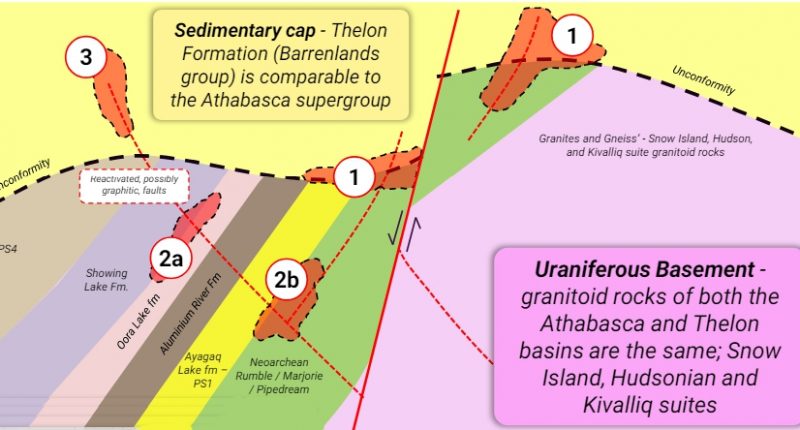

- The Itza and 176 projects are in the Thelon Basin in the Kivalliq Region of Nunavut, occupying a 113.5 square kilometre area

- Extensive historical data is available on the properties to guide exploration planning

- Historical high-grade uranium occurrences: including a historical pebble sample retrieved during boulder prospecting returned 4,000 counts per second (cps) using a scintillometer and assayed 332,000 ppm U (39.15 per cent U3O8)

- Previous exploration programs were terminated without extensive drill testing

- The portfolio covers the process from conceptual exploration targets to near-drill ready targets

The combined properties straddle a mapped unconformity between the Thelon Formation and the underlying lake metasediments that contains numerous reactivated faults identified during previous exploration.

“This field program will initially verify the historical uranium anomalism identified at the property which we intend to follow up with additional ground-based geophysics ahead of a future drilling program,” The company’s CEO, Jag Bal, said in a news release. “This year’s program will mark Lexston’s inaugural field season focusing on the ground truthing uraniferous boulder trains identified at the property. Aurora Geosciences brings over 40 years of remote field exploration expertise and is focused on delivering excellence in northern exploration with the goal of providing mineral discovery.”

This comes as the U.S. government recently banned imports of Russian uranium, which further deepened challenges of supply but also raised the demand for domestic sources.

Lexston Mining Corp. is a mineral exploration company focused on the acquisition and development of mineral projects.

Lexston Mining Corp. (CSE:LEXT) last traded at $0.115 per share.

Join the discussion: Find out what everybody’s saying about this stock on the Lexston Mining Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: Lexston Mining Corp.)