This article has been edited from its original version.

As Bitcoin continues to gain traction as a global digital asset, the demand for faster, more efficient, internet-powered transaction methods has never been higher.

Enter the Bitcoin Lightning Network, a revolutionary payment and transaction layer that promises to deliver on Bitcoin’s potential by enabling instant, low-cost peer-to-peer transactions at tremendous scale.

At the forefront of this groundbreaking technology is LQWD Technologies (TSXV:LQWD, OTC:LQWDF), a company dedicated to providing the necessary enterprise grade transaction infrastructure to make the Lightning Network a reality for users worldwide.

The Bitcoin Lightning Network explained

The Lightning Network is designed to address Bitcoin’s scalability issues by creating a second layer on top of the Bitcoin blockchain. This layer allows users to create payment channels between any two parties on that extra layer. These channels enable the participants to transact freely without waiting for block confirmations, resulting in near-instantaneous transactions. By leveraging Bitcoin’s secure and decentralized nature, the Lightning Network facilitates rapid microtransactions that were previously impractical because of high fees and slow confirmation times.

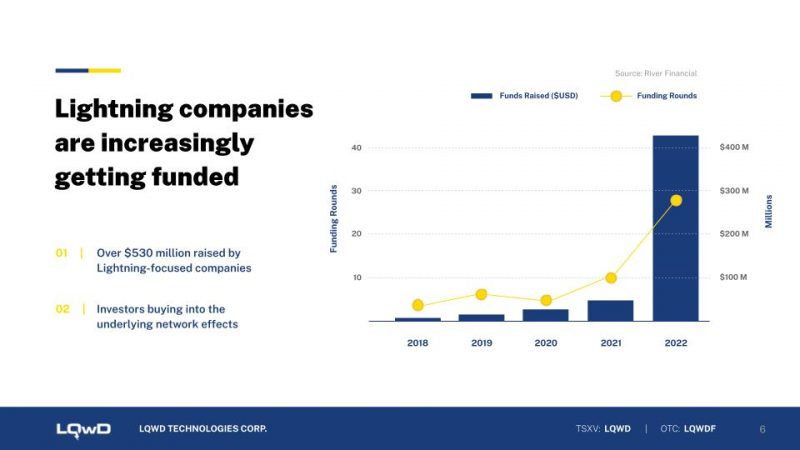

Over the past two years, Lightning Network activity has surged by 1,200 percent, fuelled by influential adopters such as Michael Saylor of MicroStrategy Inc. (NDAQ:MSTR), major cryptocurrency exchanges such as Coinbase, and tech celebrities such as Elon Musk and Jack Dorsey. These high-profile endorsements highlight the network’s growing significance in the cryptocurrency ecosystem and its potential to revolutionize digital payments. The likes of T-Mobile (NDAQ:TMUS) and Deutsche Telekom (OTCQX:DTEGF) entering the Lightning Network can be viewed as further validation of the potential for mass “network effect” adoption.

Liquidity service providers are in high demand, and this is where LQWD comes into play. The Vancouver-based company operates 19 Bitcoin Lightning Network nodes across 18 key countries worldwide and has partnerships with VC-backed companies such as AMBOSS Technologies and the BREEZ wallet. These companies leverage LQWD’s infrastructure to facilitate liquidity and routing within the Bitcoin Lightning Network.

The company connects many other types of node operators and ensures that payments can route across the world and get to where they want to go. For doing so, LQWD takes a fee off every transaction that passes through the part of the network it controls.

LQWD Technologies: A pioneer in Lightning Network infrastructure

LQWD Technologies is a first mover in the Bitcoin Lightning Network space, positioning itself as a key player by offering essential liquidity and routing transaction infrastructure. With nodes deployed globally, LQWD is committed to ensuring the Lightning Network’s seamless operation and scalability.

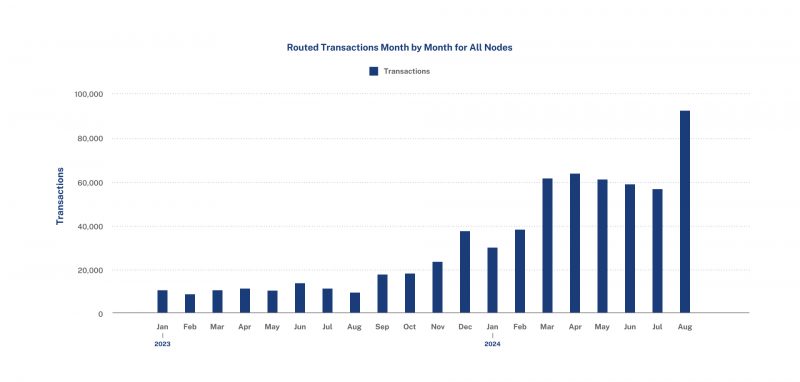

In an exclusive interview with The Market Online, the company’s CEO, Shone Anstey, commented on growth drivers, explaining that with these 18 global nodes connecting 1,100 connected channels, LQWD has achieved a record of more than 90,000 transactions in the month of August.

“We’re seeing a lot more adoption of the Lightning Network and integration to exchanges and wallet providers. Coinbase recently announced the integration of Lightning Network as a form of depositing and withdrawing Bitcoin off of their network.

“We’re seeing other exchanges take it and other wallet providers. So just the sheer growth of the network it has that Metcalfe’s Law written all over it where the network effect is growing extremely fast.

“And our goal as a company is just to simply continue to operate, build, build, build, (a) very Silicon Valley model, and capture as much market share as we can on as many other routes we can, integrate with as many wallets as we can and let the network effect carry us up faster than anything possibly could. And that’s what we’re starting to see.”

Click here to watch the video.

LQWD owns 115 bitcoins, which are used to operate its transaction infrastructure, and provides the company with a Bitcoin-based core asset. LQWD has developed and is operating a scalable revenue model for the Lightning Network that receives routing fees for each transaction on LQWD’s infrastructure.

The company’s infrastructure supports the rapid increase in transactions facilitated by the Lightning Network. Each month, the volume of transactions routed through LQWD’s network continues to rise, demonstrating the growing trust and reliance on its services. This consistent growth is bolstered by the company’s focus on building and maintaining robust partnerships with other industry leaders, further enhancing its role as a premier liquidity service provider.

Operational update

In a report on operational progress from September 2024, the team reported that volume growth had more than quadrupled since the implementation of an AI-driven channel rebalancing system in September 2023. Since the launch of its first node in November 2021, LQWD has facilitated routing for more than 790,000 transactions and 740 bitcoins through its Lightning infrastructure for C$39.7 million in transacted dollar value.

In addition to organic volume growth, LQWD expects increased volume through partnerships with prominent venture capital backed Lightning Network technology companies, AMBOSS and Breez, which are integrating into LQWD’s transaction infrastructure and liquidity services.

Click here to see channel growth and node volume in real time.

The growing opportunity in Bitcoin and the Lightning Network

The Lightning Network represents a transformative opportunity in the world of digital finance. As more businesses and people recognize the advantages of faster, cheaper transactions, the demand for reliable infrastructure providers such as LQWD Technologies will only increase. The company’s ability to provide essential liquidity services and maintain a vast network of nodes places it in an advantageous position to capitalize on this burgeoning market.

LQWD’s Bitcoin holdings act as a safeguard and asset strength moving forward.

Bitcoin is demonstrating its strength as a hedge against inflation and currency depreciation, not to mention the importance and value of the technology itself.

In addition to Bitcoin’s impressive technological capabilities, it serves as a global currency with the highest level of integrity, as its system cannot be bought, coerced, or altered by anyone except the distributed majority and their incentives.

With Bitcoin, fewer risks are associated with corporate management, currency fluctuations, labour issues or competition, as it operates as the largest computer network in the world. Bitcoin is cybernetic, scarce, highly divisible, indestructible, global, instantaneous and incorruptible.

LQWD’s role is further cemented by its partnerships and collaborations. By aligning with influential figures and leading exchanges, the company ensures its infrastructure remains at the cutting edge of technological advancements, meeting the growing demands of the market.

This proactive approach not only enhances the functionality and reliability of the Lightning Network but also drives the adoption of bitcoin as a mainstream payment method.

Why invest in LQWD Technologies?

LQWD Technologies Corp. stands at the nexus of Bitcoin’s future, providing the critical infrastructure needed to support the Lightning Network’s growth. LQWD is asset backed by Bitcoin holdings and is firmly established as the second largest routing node operator on the network. Investing in the company means investing in Bitcoin and the future of digital transactions. As the Lightning Network continues to evolve and expand, LQWD’s pioneering infrastructure and strategic partnerships position it for sustained growth and success. The company’s increasing transaction volumes and global node deployment reflect a deep understanding of market needs and a commitment to innovation.

With the cryptocurrency market in a position for continued expansion and high-profile endorsements driving adoption, LQWD Technologies is uniquely situated to benefit from these trends. For investors looking to capitalize on the rapid advancements in the Bitcoin ecosystem, LQWD offers a compelling opportunity to be part of the next wave of financial innovation.

LQWD’s stock price has continued to increase over the past year, with the company’s pioneering efforts and strategic focus on partnerships and innovation positioning it as a standout investment in the evolving cryptocurrency landscape.

You can find out the latest developments by LQWD Technologies from its website at lqwdtech.com.

Company shares were last trading at $0.53.

Join the discussion: Find out what everybody’s saying about this stock on the LQWD Technologies Corp. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of LQWD Technologies Corp., please see full disclaimer here.

(Top image of LQWD Technologies logo: LQWD Technologies Corp.)