- Popular French video game publisher Ubisoft (OTC Pink:UBSFF) saw a significant surge in its stock price after reports of a potential buyout

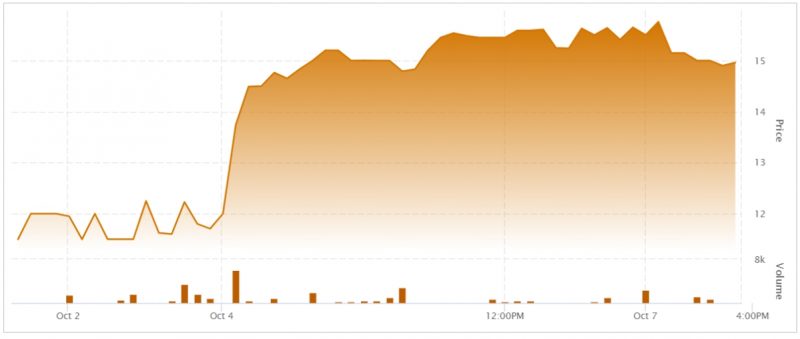

- Speculation of the buyout by Chinese gaming giant Tencent Holdings (OTC Pink:TCEHY) and the Guillemot family drove Ubisoft’s shares up by nearly 30 per cent over the past week, marking one of the most substantial gains for the company in recent years

- This potential buyout is seen as a strategic move to stabilize Ubisoft, which has faced financial challenges and a declining market value over the past year.

- Ubisoft stock last traded at US$14.96

Popular French video game publisher Ubisoft (OTC Pink:UBSFF) saw a significant surge in its stock price after reports of a potential buyout.

Speculation of the buyout by Chinese gaming giant Tencent Holdings (OTC Pink:TCEHY) and the Guillemot family (who founded the company back in 1986) drove Ubisoft’s shares up by nearly 30 per cent over the past week, marking one of the most substantial gains for the company in recent years.

The buyout buzz

The rumours, first reported by Bloomberg, suggest that Tencent and the Guillemot family, who are minority shareholders in Ubisoft, are exploring options to take the company private.

According to London Stock Exchange Group data, the Guillemot family owns 15 per cent of the company, while Tencent owns just under 10 per cent.

This potential buyout is seen as a strategic move to stabilize Ubisoft, which has faced financial challenges and a declining market value over the past year.

Why Ubisoft stock jumped

Investors are paying attention to the buyout rumours because acquisitions can often result in a premium payout for shareholders. When a company is bought out, the acquiring entity typically offers a price higher than the current market value to incentivize shareholders to sell their shares. This premium can provide substantial returns for investors, making buyout stocks highly attractive.

Shareholder sentiment

The prospect of a buyout has led to increased buying activity among shareholders, who are eager to capitalize on the potential premium. This surge in demand has naturally driven up Ubisoft’s stock price, reflecting the market’s optimism about the potential deal.

Ubisoft also faces pressure from activist investor AJ Investments, which called for a CEO change and urged it to go private or be sold and said it has gathered support from 10 per cent of its shareholders.

Ubisoft’s response

In response to the buyout rumours, Ubisoft has remained tight-lipped, declining to comment on the speculation. This silence had only fuelled further interest and speculation among investors, who are closely watching for any official announcements.

In a statement given to Video Game Chronicle published this week, Ubisoft stated it “regularly reviews all its strategic options,” referring to a possible buyout.

“Ubisoft has noted recent press speculation regarding potential interests around the company,” a spokesperson said to VGC. “It regularly reviews all its strategic options in the interest of stakeholders and will inform the market if and when appropriate.”

Market context

The potential buyout comes at a time when Ubisoft’s stock has been trading at decade lows, partly because of weaker demand for its recent game releases and increased competition in the gaming industry. The company’s recent decision to delay the release of its upcoming “Assassin’s Creed Shadows” game has also contributed to investor concerns. The plea from investors to go private had emerged as Ubisoft’s stock had recently fallen to depths not seen in a decade.

You can save your game, but not your stock value

As the situation develops, investors will be tracking Ubisoft stock closely for any updates regarding the potential buyout. The possibility of a premium payout makes Ubisoft’s stock an attractive option, and the market’s reaction underscores the significant impact that acquisition rumours can have on stock prices.

For now, the gaming world and investors are left to speculate on the future of Ubisoft and the potential strategic moves by Tencent and the Guillemot family.

About Ubisoft

Ubisoft Entertainment Inc. develops, publishes and distributes video games for consoles, PCs, smartphones and tablets in physical and digital formats. It owns several popular brands and a diversified portfolio of franchises, including Assassin’s Creed, The Crew, Far Cry and Tom Clancy’s Ghost Recon.

Ubisoft stock (OTC Pink:UBSFF) has lost more than 40 per cent this year in France, down more than 42 per cent since the year began on the OTC, where it last traded at US$14.96.

Join the discussion: Find out what everybody’s saying about this stock on the Ubisoft Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: Ubisoft Entertainment)