- Undervalued junior miner American Pacific Mining (CSE:USGD) intersected impressive gold, copper and silver grades at its Madison project in Montana

- Phase-two drilling is scheduled for Q1 2025 with numerous porphyry targets

- American Pacific Mining is a precious and base metals explorer and developer active in the Western United States

- American Pacific Mining stock last traded at C$0.25 per share

Undervalued junior miner American Pacific Mining (CSE:USGD) intersected impressive gold, copper and silver grades at its Madison project in Montana.

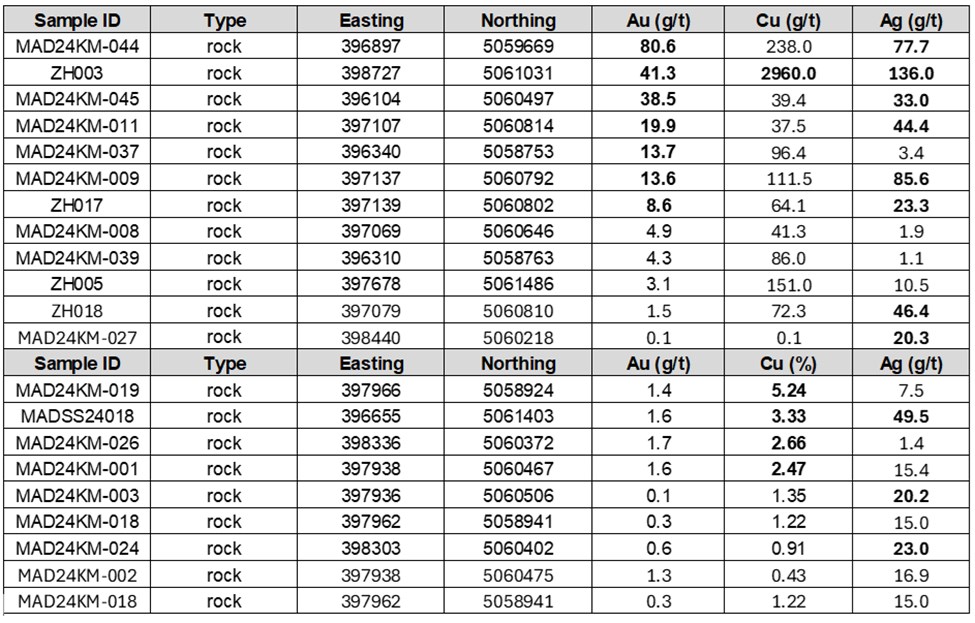

Gold grades reached up to 80.6 grams per ton (g/t) in surface rock samples, while copper grades registered up to 5.2 per cent and silver grades touched up to 136 g/t.

The results represent the final assays from 88 rock samples and 141 soil samples collected during the 2024 field season.

Notable gold, copper and silver rock samples

A 3,000-metre phase-two drilling program is slated to begin in Q1 2025 guided by radiometric survey data indicating thorium, potassium and uranium, all of which are potential porphyry system indicators.

The junior miner acquired the Madison project in 2020 based on its past-production of 2.7 million pounds of copper between 2008-2012, drilling in 2017 including 30.18 metres of 24.50 g/t gold and 0.39 per cent copper, as well as the property’s proximity (48 kilometres) and analogous nature to the Butte mine, which yielded 21 billion pounds of copper, 715 million ounces of silver and 2.9 million ounces of gold.

While noteworthy, Madison is but one driver in American Pacific’s portfolio. Here’s a quick primer on the exposure you stand to gain from an investment:

- The Ziggurat project in Nevada, acquired in 2023, whose broad kilometre-scale alteration footprint and strong pathfinder elements point to the property earning its place beside neighbors Kinross and Newmont.

- The Palmer project in Alaska, acquired in 2024, a preliminary economic assessment-stage property with a net present value (7 per cent ) of US$266 million.

- The Tuscarora District in Nevada, acquired in 2023, where the company took bonanza-grade samples in 2021 as high as 21,032 g/t gold and 38,820 g/t silver.

- The Red Hill project in Nevada, acquired in 2021, which yielded 8.11 g/t gold over 13.7 metres in historical drilling and is only 12 km from Barrick’s multi-million ounce Goldrush discovery along the Cortez trend.

- The Gooseberry project in Nevada, where a high-grade epithermal vein system features similar geology and resides just 15 miles from Comstock Lode and its 8.6 million ounces of gold and 270 million ounces of silver.

Despite multiple data-driven catalysts for shareholder value creation, investors in American Pacific Mining are sitting on a 10.71 per cent loss since 2019, offering a contrarian entry point to build a position and wait for a re-rating as gold, copper and silver hover around all-time or generational highs.

Leadership insights

“We are encouraged by the field work results that followed up on our 2024 drilling program. The field mapping and rock sampling have extended the mineralized footprint 2.5 kilometres southeast and 2 kilometres west. The data collected presents us with 5 additional target areas that have not historically been drill tested but have now been included in the fully-funded phase-two drill program beginning Q1 2025,” Eric Saderholm, American Pacific Mining’s managing director of exploration, said in a statement. “The higher-grade silver values were unexpected and clearly add to the potential value of the Madison property. Our use of radiometric surveys is somewhat unique in exploring for porphyry systems and will help us pinpoint drill targets in 2025. Further refinement of the magnetic data will be completed in December to maximize the potential for new property-wide discoveries.”

About American Pacific Mining

American Pacific Mining is a precious and base metals explorer and developer active in the Western United States.

American Pacific Mining stock (CSE:USGD) last traded at C$0.25 per share.

Join the discussion: Find out what everybody’s saying about this undervalued junior gold, copper and silver miner on the American Pacific Mining Corp. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of American Pacific Mining’s Madison project in Montana: American Pacific Mining)